Australia's Energy Commodity Resources 2024 Appendices

Page last updated:15 July 2024

Appendix 1: Glossary

Appendix 1: Glossary

Accumulation (petroleum)

An individual body of naturally occurring petroleum in a reservoir or a group of reservoirs that are related to a localised geological structural feature and/or stratigraphic condition (trap).

Basin

A geological depression filled with sedimentary rocks.

Basin centred gas

A type of tight gas that occurs in distributed basin centred gas accumulations, where gas is hosted in low permeability reservoirs which are commonly abnormally overpressured, lack a down dip water contact and are continuously saturated with gas.

Black coal

A coal of either sub-bituminous, bituminous or anthracite rank.

Brown coal

A coal intermediate between peat and bituminous coal; lignite.

Coal oil

The crude oil obtained by the destructive distillation of bituminous coal.

Coal recovery factor

Coal recovery factors are applied to coal resource estimates to calculate the recoverable coal resource. Coal recovery factors are dependent on mine type. A recovery factor of 90% is applied to open cut coal mines, and 50–75% is applied to underground coal mines.

Coal reserve

A coal reserve is reported at a higher level of confidence than a coal resource and includes diluting materials, and allowances for losses which may occur during mining. Geoscience Australia does not apply recovery factors to coal reserves.

Coal seam gas (CSG)

A form of natural gas (generally 95% to 97% pure methane, CH4) contained in coal deposits and extracted from coal seams, typically at depths of 300 to 1000 m.

Completion (petroleum)

The process by which a finished well (borehole) is either sealed off or prepared for production.

Compressed natural gas (CNG)

Natural gas compressed to a pressure at or above 200-248 bar (2900-3600 pounds per square inch) and stored in high-pressure containers. It is used as a fuel for natural gas-powered vehicles.

Condensate

A portion of natural gas of such composition that exists in the gaseous phase at the temperature and pressure of the reservoirs, but that, when produced, are in the liquid phase at surface pressure and temperature conditions.

Conventional resources (petroleum)

Petroleum resources within discrete accumulations related to localised geological structural features or stratigraphic conditions, that are recoverable through wells (boreholes) and typically require minimal processing prior to sale. For natural gas, the term generally refers to methane held in a porous rock reservoir frequently in combination with heavier hydrocarbons.

Crude oil

The portion of petroleum that exists in the liquid phase in natural underground reservoirs and remains liquid at atmospheric conditions of pressure and temperature. It does not include liquids obtained from the processing of natural gas.

Development

Petroleum: phase in which a proven oil or gas field is brought into production by drilling and completing production wells.

Minerals: phase in which the mineral deposit is brought into production through development of a mine.

Discovered accumulation (petroleum)

A petroleum accumulation where one or several exploratory wells through testing, sampling, and/or logging have demonstrated the existence of a significant quantity of potentially recoverable hydrocarbons and thus have established a known accumulation.

Discovered petroleum initially-in-place

Quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production.

Discovery

Petroleum: first well (borehole) in a new field from which any measurable amount of oil or gas has been recovered. A well that makes a discovery is classified as a new field discovery (NFD).

Minerals: first drill intersection of economic grade mineralisation at a new site.

Enhanced oil recovery

The extraction of additional petroleum, beyond primary recovery, from naturally occurring reservoirs by supplementing the natural forces in the reservoir. It includes water flooding and gas injection for pressure maintenance (secondary processes) and any other means of supplementing natural reservoir recovery processes, including thermal and chemical processes to improve the in-situ mobility of viscous forms of petroleum (tertiary processes).

Exploration

Phase in which a company or organisation searches for petroleum or mineral resources by carrying out detailed geological and geophysical surveys, followed up where appropriate by drilling and other evaluation of the most prospective sites.

Extension/appraisal wells (petroleum)

Wells (boreholes) drilled to determine the physical extent, reserves and likely production rate of a petroleum field.

Feedstock

Raw material to feed an industrial process.

Field (petroleum)

An area consisting of a single reservoir or multiple reservoirs grouped on, or related to, the same individual geological structural feature and/or stratigraphic condition.

Fossil fuels

Combustible materials derived from the long-term decomposition of organic matter in geological formations. Fossil fuels include crude oil, coal and natural gas.

Gas-to-liquids

Technologies that use specialised processing (e.g. Fischer-Tropsch synthesis) to convert natural gas into liquid petroleum products.

Heavy oil

Crude oil that has a low API gravity or Baumé gravity.

Hydrocarbons

Chemical compounds consisting wholly of hydrogen and carbon molecules.

In-place (petroleum)

Petroleum-in-Place is the total quantity of petroleum that is estimated to exist originally in naturally occurring reservoirs. Oil-in-place, gas-in-place and bitumen-in-place are defined in the same manner.

In-situ gasification

A process by which a gas is made in the subsurface from coal or other solid hydrocarbons.

JORC Code

The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, prepared by the Joint Ore Reserves Committee. It is a principles-based code which sets out recommended minimum standards and guidelines on classification and public reporting in Australasia. Companies listed on the Australian Securities Exchange are required to report exploration outcomes, resources and reserves in accordance with the JORC Code standards and guidelines.

Liquid fuels

All liquid hydrocarbons, including crude oil, condensate, liquefied petroleum gas and other refined petroleum products.

Liquefied natural gas (LNG)

Natural gas (primarily methane) that has been liquefied by reducing its temperature at atmospheric pressure.

Liquefied petroleum gas (LPG)

A group of hydrocarbon gases, primarily propane, normal butane and isobutane, derived from crude oil refining or natural gas processing. They can be liquefied through pressurization (without requiring cryogenic refrigeration) for convenience of transportation or storage. Excludes ethane and olefins.

Natural gas

The portion of petroleum that exists either in the gaseous phase or is in solution in crude oil in natural underground reservoirs, and which is gaseous at atmospheric conditions of pressure and temperature.

Natural gas liquids (NGL)

Those portions of natural gas which are recovered as liquids in separators, field facilities or gas processing plants. Natural Gas Liquids include but are not limited to ethane, propane, butanes, pentanes, and natural gasoline.

Non-renewable resources

Resources such as fossil fuels (crude oil, natural gas, coal) and uranium that are depleted by extraction.

Oil sands

Sand and sandstone rock material which contains crude bitumen, and requires extraction using either mining and processing if near the surface, or from a well if deeply buried.

Oil shale

A kerogen-bearing finely laminated sedimentary rock that will yield hydrocarbons on distillation.

Petajoule

1015 joules, the standard form of reporting energy aggregates. One petajoule is equivalent to 278 gigawatt-hours.

Petroleum

A naturally occurring mixture consisting predominantly of hydrocarbons in the gaseous, liquid or solid phase.

Play (geological)

A model that can be used to direct petroleum exploration. It is a group of fields or prospects in the same region and controlled by the same set of geological parameters.

Primary energy

Energy found in nature that has not been subjected to any conversion or transformation process.

Primary fuels

The forms of energy sources obtained directly from nature. They include non-renewable fuels such as black coal, brown coal, uranium, crude oil and condensate, natural gas, and renewable fuels such as biomass, hydro, wind, solar, ocean and geothermal.

Primary recovery

The extraction of petroleum from reservoirs utilising the natural energy available in the reservoirs to move fluids/gases through the reservoir rock to points of recovery.

Production

Petroleum: the phase of bringing well fluids to the surface, separating them and storing, gauging and otherwise preparing them for transport.

Minerals: the phase at which operations produce mined product.

Prospect (geological)

A potential accumulation of petroleum or minerals that is sufficiently well defined to represent a viable drilling target.

Recoverable

Petroleum: the quantity of hydrocarbons which is estimated to be producible from an accumulation, either discovered or undiscovered.

Minerals: the quantity of material of interest that is able to be extracted during mining.

Recovery factor

The proportion of a total resource in place which is recoverable, normally expressed as a percentage. Geoscience Australia applies recovery factors to resource estimates in order to improve understanding of Australia’s resource potential.

Resources (natural)

Materials or conditions occurring in nature that can be economically exploited.

Shale gas

Gas stored in shale formations, usually trapped and sealed in unconnected fractures and pores of impermeable shale rocks. The shale acts as both the source and the reservoir for the gas.

Shale oil

Oil stored in impermeable sedimentary rocks, usually in shale formations, which is extracted by fracturing the host formation. The shale acts as both the source and the reservoir for the oil.

Tight gas

Gas stored in low permeability sedimentary rocks that require hydraulic fracturing for extraction.

Tight oil

Oil stored in low permeability sedimentary rocks that require hydraulic fracturing for extraction.

Trap (geological)

Any barrier to the upward movement of oil or gas, allowing either or both to accumulate. The barrier can be a stratigraphic trap, an overlying impermeable rock formation or a structural trap as result of faulting or folding.

Unconventional resources (petroleum)

Resources within petroleum accumulations that are pervasive throughout a large area and that are not significantly affected by hydrodynamic influences. Typically, such accumulations require specialised extraction technology. Examples include coal seam gas (CSG), tight gas, shale gas, gas hydrates, natural bitumen and shale oil.

Undiscovered accumulation (petroleum)

Petroleum accumulations that are inferred to exist, on the basis of indirect evidence, but which have not been confirmed by drilling.

Wildcat well

A petroleum exploration well drilled on a structural or stratigraphic trap that has not previously been shown to contain petroleum.

Yield

Usually refers to the amount of saleable coal that remains after washing or processing.

Appendix 2: Energy resource ownership and infrastructure

Appendix 2: Energy resource ownership and infrastructure

Ownership and administration of energy resources

The Australian Constitution specifies that mineral and petroleum resources are owned either by the Australian Government, or the state and territory governments. Exploration and development of these resources are undertaken by companies operating under licences and permits granted by the government. The Australian, state and territory governments actively encourage investment in Australia’s energy resources.

Petroleum exploration and production activities beyond three nautical miles from the territorial sea baseline and within Australia’s Exclusive Economic Zone (‘Commonwealth Waters’) are the responsibility of the Australian Government. These resources are governed under the Offshore Petroleum and Greenhouse Gas Storage Act 2006 and by maritime boundary treaties with neighbouring countries. The Joint Authorities (comprising the Commonwealth and state and territory governments), the National Offshore Petroleum Titles Administrator and the National Offshore Petroleum Safety and Environmental Management Authority grant, administer and regulate petroleum titles to ensure that exploration and development activities are compliant with the relevant regulatory frameworks.

Regulating the exploration for, and development of, non-renewable resources onshore and within three nautical miles offshore is the responsibility of state and territory governments. They are administered under the applicable state or territory legislation relating to minerals and petroleum. The legislation varies between jurisdictions but is similar in content and administration across the jurisdictions and is based on a two-stage award of exploration permit and production licence. An overview is provided in Australia's Energy and Mineral Resources Investor Guide, and more information is available from the relevant state and territory resources agencies.

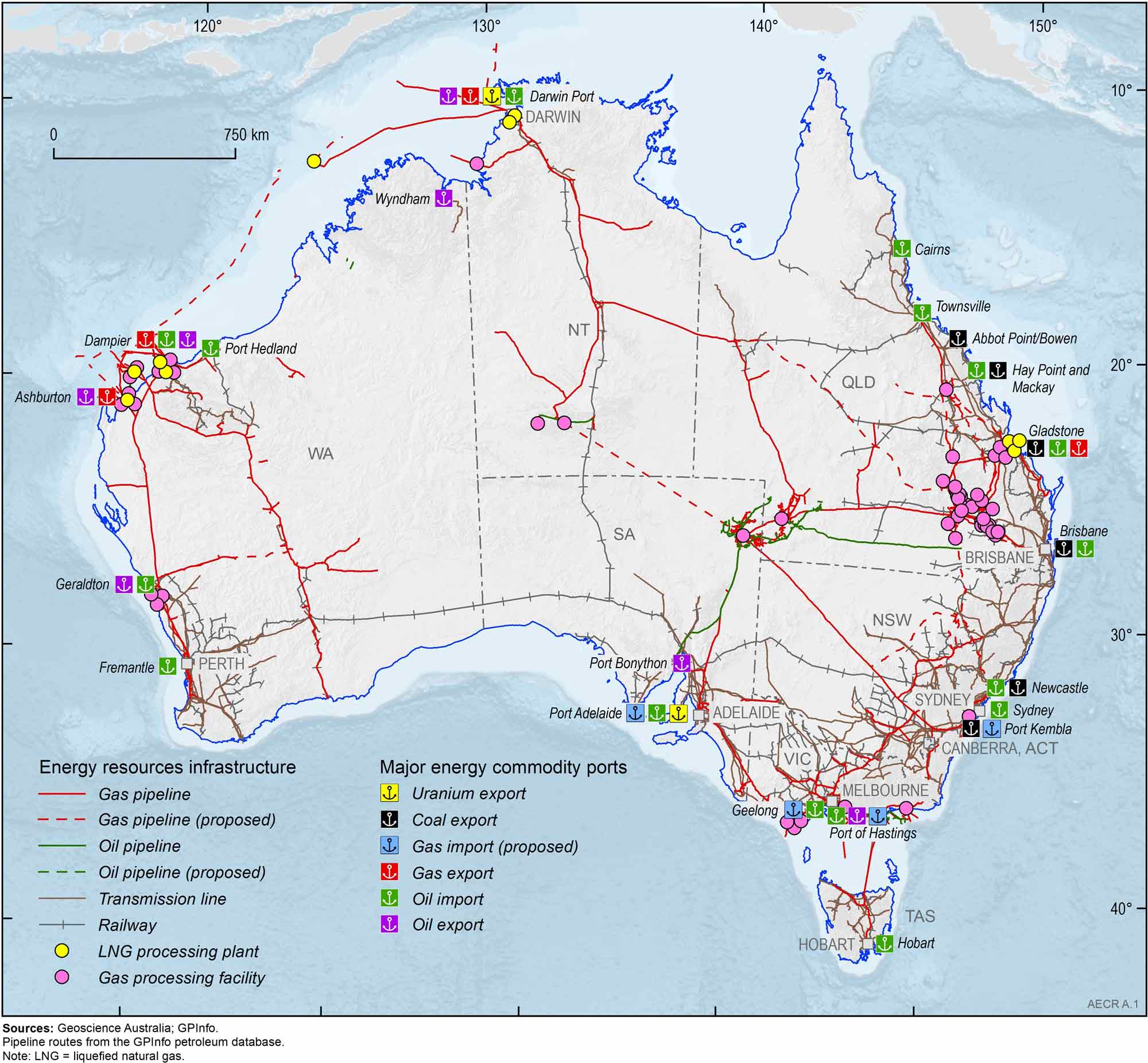

Energy production and distribution infrastructure

Utilisation of Australia’s abundant non-renewable energy resources requires investment in reliable energy supply infrastructure, including gas pipelines, gas processing and storage facilities, ports, and rail networks (Figure A.1). Gas is distributed across a series of transmission pipelines from areas of extraction and processing plants to either ports for export as LNG, or to power stations, large industrial and commercial plants, mines, and local consumers via gas retailers for domestic consumption. Shipping is the main transport mode used to export Australia’s energy resources, including coal (six ports), petroleum liquids (nine ports and one floating facility), LNG (five ports and one floating facility), and uranium (two ports). Australia’s first hydrogen shipment was exported from Victoria’s Port Hastings in January 2022. Further details on Australia’s shipping trade are available from the Bureau of Infrastructure and Transport Research Economics (BITRE, 2023) and Ports Australia. Australia has a dedicated network of railway infrastructure for the transportation of coal and uranium resources from their extraction points to a number of major ports for export (Figure A.1).

Gas pipelines

Gas pipelines in Australia consist of a series of major long-haul transmission pipelines, which deliver gas from production and processing facilities to domestic markets and export terminals (Figure A.1). These pipelines typically have wide diameters and operate under high pressure to optimise transmission capacity.

An interconnected gas pipeline network, including sixteen major transmission pipelines, links gas fields in the Northern Territory, Queensland, South Australia and Victoria with industrial and domestic demand centres across eastern and southern Australia (AEMO, 2024). This interconnected gas transmission network has become increasingly important in recent years to ensure peak gas demand in southern states during winter is supplied by gas producing basins in northern Australia (AEMO, 2024). Five additional gas transmission pipelines have also been proposed to connect potential new gas projects in the Beetaloo Sub-basin, Galilee Basin, Gunnedah Basin and northern Bowen Basin (ACCC, 2023). The Western Australian gas market is serviced by eleven major pipelines, which link gas fields in the Perth Basin and the North West Shelf to the mining sector and domestic markets (AEMO, 2023). Recent additions to the networks include: the commencement of operation of the Northern Goldfields Interconnect, enabling gas from the Perth Basin to meet demand in the Kalgoorlie region; commencement of operation of Victoria’s Western Outer Ring Main (WORM) pipeline and second compressor at Winchelsea, increasing peak supply capacity to Melbourne; and commissioning of the East Coast Grid Expansion Stage 1, increasing north to south transmission capacity (AEMO, 2024).

Gas storage facilities

Gas storage facilities provide flexible capacity to meet domestic consumption requirements by storing surplus gas produced during low demand periods in summer to meet increased demand during winter. In 2024, gas storage facilities include two depleted gas fields in Western Australia (Mondarra and Tubridgi; AEMO, 2023), four facilities using depleted gas fields in eastern Australia (Roma, Moomba, Silver Springs and Iona), and two LNG storage facilities in eastern Australia (Newcastle and Dandenong; AEMO, 2024). An upgrade to the Iona Underground Storage facility was recently completed, with further upgrades proposed. There are plans to develop a new underground gas storage facility in the Gippsland Basin (Golden Beach Energy Storage Project) to help manage the forecast gas supply shortfalls in southern states during very high demand conditions (AEMO, 2024).

Proposed LNG import terminals

LNG import terminals are being considered as an alternative to the supply of gas for consumers in eastern Australia. Four LNG import terminals have been proposed as of October 2023 (AIE Port Kembla, Venice Outer Harbour, Viva Geelong, Vopak Avalon; DISR, 2023) to help offset declining production from gas fields in southern Australia, thereby securing seasonal and peak supply requirements. These terminals could source gas from both international and domestic markets, potentially providing a virtual pipeline from Australia’s northern gas fields to southern demand centres. The Port Kembla Energy Terminal is currently the only committed project with expected completion of onshore infrastructure in December 2024, and operations possibly commencing in early 2026 (AEMO,2024). The Venice Outer Harbour project is moving closer to a final investment decision (FID) with Stage 1 enabling works completed in 2023 (DISR, 2023)

References

Australian Competition and Consumer Commission (ACCC) 2023. Gas Inquiry 2017-2025 Interim Report - January 2023 (Last accessed 21 March 2024)

Australian Energy Market Operator (AEMO) 2023. 2023 Western Australia gas statement of opportunities, December 2023 (last accessed 21 March 2024).

Australian Energy Market Operator (AEMO) 2024. Gas statement of opportunities, March 2024, for eastern and southeastern Australia (last accessed 21 March 2024).

Bureau of Infrastructure and Transport Research Economics (BITRE) 2023. Australian sea freight 2020–21, Canberra, ACT. (last accessed 21 March 2024)

Department of Industry, Science and Resources (DISR), Commonwealth of Australia. Resources and Energy Major Projects 2023. (last accessed 21 March 2024)

Appendix 3: Resource classification

Appendix 3: Resource classification

Development of new energy sources requires reliable estimates of how much energy is available at potential development sites. Reporting systems have been developed for the different resource types. Adherence to standards and common frameworks makes it possible for investors to evaluate risk and potential returns, and for governments to set policy and regulations and make decisions on infrastructure development.

Schemes currently commonly used for classifying minerals, petroleum and geothermal energy utilise two axes, one to describe geological certainty, and another to describe investment or commercial readiness. These schemes are based on the McKelvey classification published in 1972 and 1976. Each of the resource estimation and reporting schemes utilised in Australia for oil and gas, coal, thorium and uranium are discussed briefly below. A three-axis classification scheme, incorporating an economic and social viability axis, field project and feasibility axis, and geological knowledge axis, has been developed by the United Nations Economic Commission for Europe (United Nations Economic Commission for Europe 2009) but is not currently applied in Australia.

Petroleum resource classification

The petroleum industry in Australia uses the Petroleum Resources Management System (PRMS) for classification of oil and gas resources. The description ahead is a summary of the foundation principles contained in the 2007 PRMS and the relevant updates in the revised 2018 PRMS (SPE, 2018).

Oil and gas reserves and resources denote volumes that may be commercially recovered in the future. Resources are physically located in reservoirs deep underground and cannot be visually inspected or counted, but the amount of oil and gas present can be estimated by evaluating geological data. All estimates involve some degree of uncertainty due to limitations in the existence and reliability of required data.

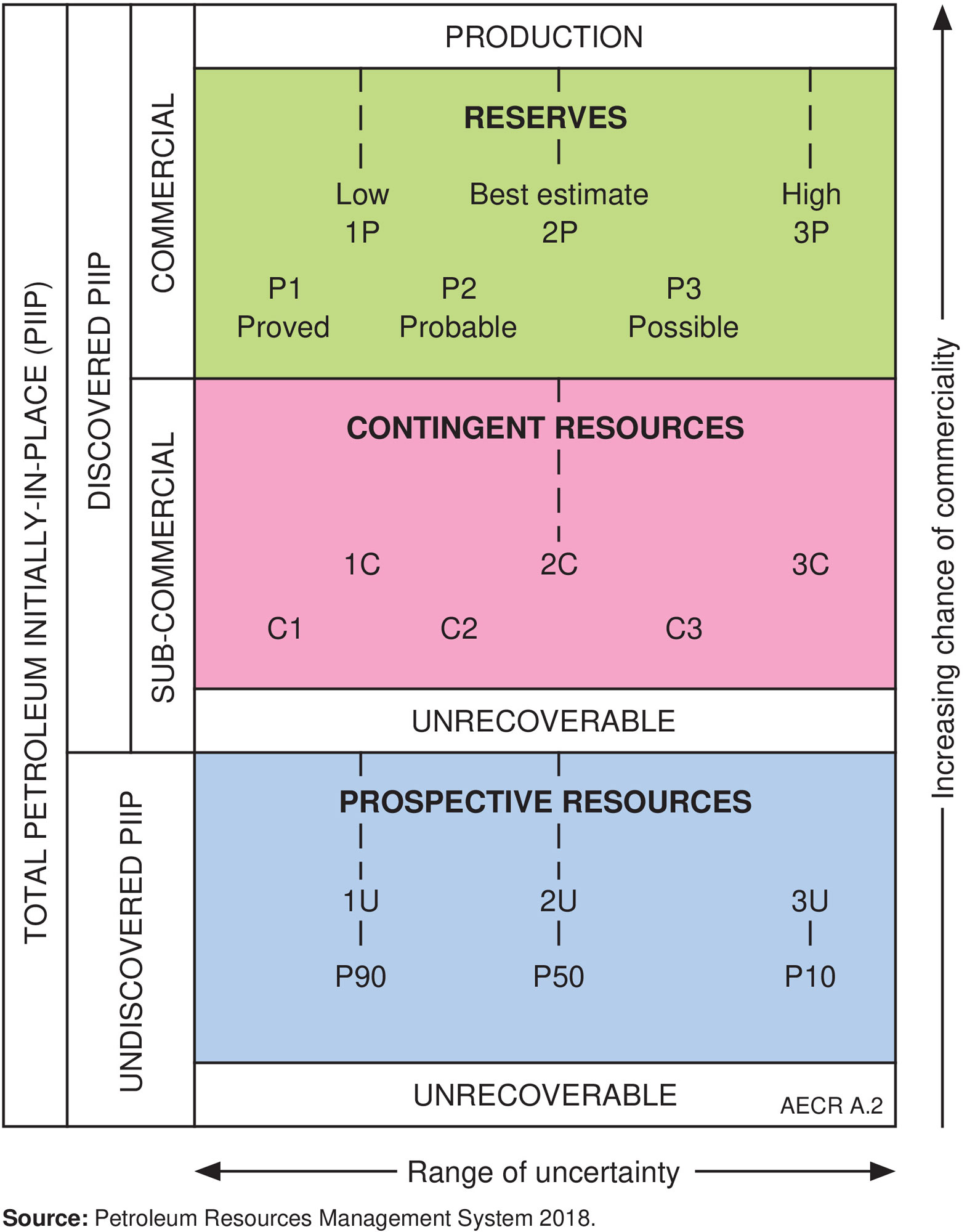

The PRMS incorporates a central framework that categorises reserves and resources according to the level of certainty associated with their potentially recoverable volumes (horizontal axis in Figure A.2) and classifies them according to the chance of reaching commercial producing status (vertical axis).

Chance of commerciality classes (vertical axis)

The four major recoverable resources classes defined by the PRMS are production, reserves, contingent resources, and prospective resources. There is also a distinct class for unrecoverable petroleum. These classes are shown on the vertical axis of the PRMS framework.

Production is the quantity of oil and natural gas that has been recovered already (by a specified date). This is primarily output from operations for use by consumers.

Reserves represent that part of resources which are anticipated to be commercially recoverable and have been justified for development. They are quantities of petroleum from a known accumulation that can be recovered as part of a development project under defined conditions from a given date forward.

Contingent resources are less certain than reserves. These are resources that are potentially recoverable but not yet considered mature enough for commercial development due to technological or business hurdles. For contingent resources to move into the reserves category, the key conditions, or contingencies, that prevented commercial development must be resolved. Approvals of development and environmental plans are examples of contingencies to be resolved. For contingent resources at the 'development pending' project stage, there must be evidence of firm intention by a company's management to proceed with development within a reasonable time frame (typically five years, though it could be longer).

Prospective resources are estimated volumes associated with undiscovered accumulations. These represent quantities of petroleum which are estimated, as of a given date, to be potentially recoverable from oil and gas deposits which have not been drilled but have been identified on the basis of indirect evidence. This class represents a higher risk than contingent resources since the risk of discovery is also added. For prospective resources to become classified as contingent resources, hydrocarbons must be discovered, the accumulations must be further evaluated and an estimate of quantities that would be recoverable under appropriate development projects prepared.

Some petroleum will be classified as "unrecoverable" at this point in time, not being producible by any projects that the company may plan or foresee. While a portion of these quantities may become recoverable in the future as commercial circumstances change or technological developments occur, some of the remaining portion may never be recovered due to physical or chemical constraints in the reservoir. The volumes classified using the system represent the analysis of the day, and should be regularly reviewed and updated, as necessary, to reflect changing conditions.

A project may have recoverable quantities in several resource classes simultaneously. As barriers to development are removed, some resources may move to a higher classification. One of the primary distinctions between resources and reserves is that while resources are technically recoverable, they may not be commercially viable. Reserves are always commercially viable and there is intent to develop them.

Range of uncertainty categories (horizontal axis)

The range of uncertainty in resource estimates is captured by categories that represent the likelihood of given quantities being recovered. These can be either cumulative low, best and high forecasts, or incremental proved, probable and possible estimates, for the resource classes shown in Figure A.2.

The category with a high degree of certainty in the reserves class, in which quantities are reasonably certain to be recoverable from known reservoirs under defined commercial and other conditions, is proved reserves (P1, and equal to 1P, in Figure A.1). Proved reserves are the low estimate of reserves. The best estimate of reserves (2P) is the sum of proved (P1) plus probable (P2) reserves, which has an added degree of uncertainty in the estimate of recoverable quantities. The optimistic, or high estimate (3P), of reserves is the sum of proved (P1) plus probable (P2) plus possible (P3) reserves. There is a low probability that the actual quantities recovered will equal or exceed the high estimate, as possible reserves are assessed from geoscience and engineering data to have a low likelihood of recovery.

The uncertainty range of contingent resources is categorised on a similar cumulative (1C, 2C, 3C) or incremental (C1, C2, C3) basis. Undiscovered prospective resources are categorised on a cumulative basis only, in which the unrisked low, best and high estimates are given as 1U, 2U and 3U to denote uncertainty in potentially recoverable quantities.

The best estimate of recovery from committed projects is generally considered to be the 2P sum of proved and probable reserves. The total value of any resource base must include an assessment of the contingent and prospective resources as well as reserves.

Mineral resource classification

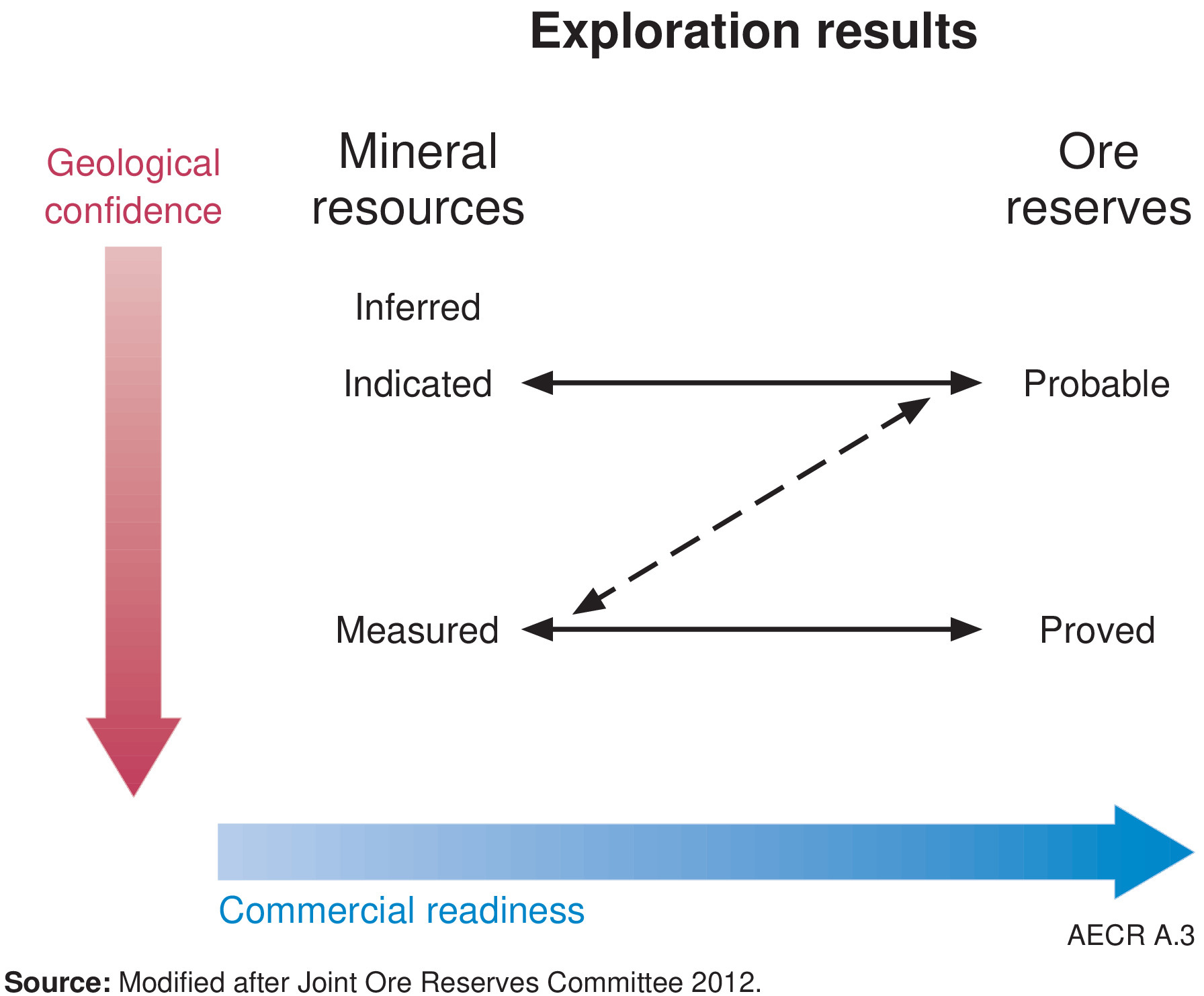

Minerals companies listed on the Australian Securities Exchange report resource information according to the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, also called the 'JORC Code' (Joint Ore Reserves Committee [JORC] 2012). The Joint Ore Reserves Committee was established in 1971 and published several reports containing recommendations on the classification and Public Reporting of Ore Reserves prior to the release of the first edition of the JORC Code in 1989. The JORC Code utilises axes of geological uncertainty and commercial readiness (Figure A.3). The summary below paraphrases the JORC Code (2012).

A 'Mineral Resource' is a concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade (or quality), and quantity that there are reasonable prospects for eventual economic extraction (i.e. more likely than not), regardless of the classification of the resource. The location, quantity, grade (or quality), continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

An 'Inferred Mineral Resource' is that part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade (or quality) continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to an Ore Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

An 'Indicated Mineral Resource' is that part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Ore Reserve.

A 'Measured Mineral Resource' is that part of a Mineral Resource for which quantity, grade (or quality), densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proved Ore Reserve or under certain circumstances to a Probable Ore Reserve.

'Modifying Factors' are considerations used to convert Mineral Resources to Ore Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. Consideration of the confidence level of the Modifying Factors is important in conversion of Mineral Resources to Ore Reserves.

An 'Ore Reserve' is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at Pre-Feasibility or Feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified.

A 'Probable Ore Reserve' is the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Ore Reserve is lower than that applying to a Proved Ore Reserve. A Probable Ore Reserve has a lower level of confidence than a Proved Ore Reserve but is of sufficient quality to serve as the basis for a decision on the development of the deposit.

A 'Proved Ore Reserve' is the economically mineable part of a Measured Mineral Resource. A Proved Ore Reserve implies a high degree of confidence in the Modifying Factors.

National Classification System for Identified Mineral Resources

The following terminology and definitions are used in Australia's National Classification System for Identified Mineral Resources.

Resource: A concentration of naturally occurring solid, liquid, or gaseous materials in or on the Earth’s crust and in such form that its economic extraction is presently or potentially (within a 20–25 year timeframe) feasible.

Identified Resource: A specific body of mineral-bearing material whose location, quantity and quality are known from specific measurements or estimates from geological evidence for which economic extraction is presently or potentially (within a 20–25 year timeframe) feasible.

To reflect degrees of geological assurance, Identified Resources can be divided into Measured Resources, Indicated Resources and Inferred Resources where Measured Resources have the most geological confidence and Inferred Resources the least. The National Classification System’s definitions for Measured, Indicated and Inferred Resources are consistent with those of the JORC Code.

Under the JORC Code, with the application of Modifying Factors and mine planning, Measured Resources can be converted into Proved Ore Reserves or Probable Ore Reserves and Indicated Resources can be converted into Probable Ore Reserves.

Demonstrated Resource: A collective term for the sum of Measured and Indicated Resources, including Proved and Probable Ore Reserves.

Economic: This term implies that, at the time of determination, profitable extraction or production under defined investment assumptions has been established, analytically demonstrated, or assumed with reasonable certainty.

Economic Demonstrated Resource (EDR): A Demonstrated Resource that is regarded as economic under the definition above. The EDR category provides a long-term view of what is likely to be available for mining (potential supply). It is inclusive of Ore Reserves, which can be considered separately for shorter-term, commercial viewpoints of the economic category. It does not include Inferred Resources as these do not have enough geological confidence to support mine planning.

Subeconomic: This term refers to those resources that are geologically demonstrated but which do not meet the criteria of Economic at the time of determination. Subeconomic Resources include paramarginal and submarginal categories:

Paramarginal: That part of Subeconomic Resources which, at the time of determination, could be produced given postulated limited increases in commodity prices or cost-reducing advances in technology. The main characteristics of this category are economic uncertainty and/or failure (albeit just) to meet the criteria of economic.

Submarginal: That part of Subeconomic Resources that would require a substantially higher commodity price or major cost-reducing advance in technology to render them economic.

Accessible Economic Demonstrated Resource (AEDR): Some resources have enough geological confidence to be considered a Demonstrated Resource and, in normal circumstances, would also be regarded as economic but they are not currently available for development because of legal and/or land-use restrictions. They are included in EDR but not in AEDR.

Uranium resource classification

Geoscience Australia prepares estimates of Australia's uranium resources within categories defined by the Organisation for Economic Co-operation and Development Nuclear Energy Agency and International Atomic Energy Agency (OECD NEA and IAEA 2018). The following is summarised from that publication.

Uranium resources are classified by a scheme (based on geological certainty and costs of production) developed to combine resource estimates from a number of different countries into harmonised global figures. Identified resources (which include Reasonably Assured Resources (RAR), and Inferred Resources) refer to uranium deposits delineated by sufficient direct measurement to conduct pre-feasibility and sometimes feasibility studies. For RAR, high confidence in estimates of grade and tonnage are generally compatible with mining decision-making standards. Inferred resources are not defined with such a high degree of confidence and generally require further direct measurement prior to making a decision to mine. Undiscovered resources (prognosticated and speculative) refer to resources that are expected to exist based on geological knowledge of previously discovered deposits and regional geological mapping.

Resource estimates are divided into separate categories reflecting different levels of confidence in the quantities reported. The resources are further separated into categories based on the cost of production.

Reasonably Assured Resources refers to uranium that occurs in known mineral deposits of delineated size, grade and configuration such that the quantities which could be recovered within the given production cost ranges with currently proven mining and processing technology, can be specified. Estimates of tonnage and grade are based on specific sample data and measurements of the deposits and on knowledge of deposit characteristics. Reasonably assured resources have a high assurance of existence. Unless otherwise noted, RAR are expressed in terms of quantities of uranium recoverable from mineable ore (see recoverable resources).

Inferred resources refers to uranium, in addition to RAR, that is inferred to occur based on direct geological evidence, in extensions of well-explored deposits, or in deposits in which geological continuity has been established but where specific data, including measurements of the deposits, and knowledge of the deposit's characteristics, are considered to be inadequate to classify the resource as RAR. Estimates of tonnage, grade and cost of further delineation and recovery are based on such sampling as is available and on knowledge of the deposit characteristics as determined in the best known parts of the deposit or in similar deposits. Less reliance can be placed on the estimates in this category than on those for RAR. Unless otherwise noted, inferred resources are expressed in terms of quantities of uranium recoverable from mineable ore.

Cost categories

The OECD NEA and IAEA (2018) uses cost categories, in United States dollars (USD), defined as: <USD 40/kgU, <USD 80/kgU, <USD 130/kgU and <USD 260/kgU. All resource categories are defined in terms of costs of uranium recovered at the ore processing plant.

Reasonably Assured Resource and Inferred Resource estimates are expressed in terms of recoverable tonnes of uranium (i.e. quantities of uranium recoverable from mineable ore), as opposed to quantities contained in mineable ore, or quantities in situ (i.e. not taking into account mining and milling losses).

References

Geoscience Australia, 2024. Australia's Identified Mineral Resources 2023, Appendices (last accessed 20 March 2024).

Joint Ore Reserves Committee. 2012. Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. The JORC Code. (last accessed 20 March 2024).

OECD NEA and IEA (Organisation for Economic Co-operation and Development Nuclear Energy Agency and International Atomic Energy Agency), 2018. Uranium 2018. Resources, Production and Demand. (last accessed 20 March 2024).

SPE (Society of Petroleum Engineers), 2018. Petroleum Resources Management System Version 1.01 (revised June 2018). (last accessed 20 March 2024).

United Nations Economic Commission for Europe, 2009. United Nations Framework Classification for Fossil Energy and Mineral Reserves and Resources 2009 incorporating Specifications for its Applications. (last accessed 20 March 2024).

Appendix 4: Prospective resource estimates

Appendix 4: Prospective resource estimates

This appendix provides a bibliography of all published prospective oil and gas resource estimates for the 2022 reporting year accessed by Geoscience Australia.

Undiscovered resources can be assessed and classified using thePetroleum Resources Management System (PRMS; SPE, 2018). These are defined as Prospective Resources as they estimate potentially recoverable quantities of hydrocarbons from undiscovered accumulations, referred to as prospects, assuming that a discovery is made and developed.

Individual prospects are defined by a range of possible resource outcomes and carry both a geological risk of discovering oil and gas, as well as a risk of developing any resources in the event of a discovery. Estimating prospective resources is therefore subject to a range of uncertainties regarding the potential recoverable quantities of hydrocarbons. The PRMS provides requirements for determining low, best and high case estimates of prospective resources. However, the methodologies used to assess prospective resources vary across basins, reservoir types, trap types and available sources of data. As such, each reporting entity has the flexibility to calculate resource estimates based on internal best practices.

Prospective resource estimates need to be evaluated in the context of the assessment areas for which they have been generated, the resource type assessed (conventional or unconventional), the assumptions and methodologies used in the assessments, and with an understanding of the risk associated with these resources being realised. There were a number of examples of this in the past year, including the Trigg prospect. While drilling the Trigg 1 well (EP 320, Perth Basin) in June 2023, gas shows were identified in the primary target, but could not be recovered with wireline testing, so the well was plugged and abandoned (Beach Energy Ltd, 2023). Similarly, the Lockyer 2 well in EP 368 (Perth Basin) was drilled in April 2023 as an appraisal of the Lockyer Deep discovery in September 2021, but found no hydrocarbons (Mineral Resources Limited, 2023). As a final example, the Kanga prospect in WA-412-P (Northern Carnarvon Basin) had gross mean recoverable resource estimates of 170 MMbbl of oil with a 36% chance of success prior to drilling (Finder Energy, 2022a). However, after the drilling of the Kanga 1 well in May 2022, it was subsequently found to contain no commercial hydrocarbons (Finder Energy, 2022b). The implications of such ‘well failures’ for related exploration and development targets, and prospective resource estimates need to be evaluated through post-drill analysis to determine if failure occurred due to local prospect factors, such as trap integrity, or more regional factors, such as lack of hydrocarbon charge or reservoir presence.

Due to their risk and uncertain nature, as well as their position in the exploration life cycle, only a limited set of prospective resource estimates are published each year by energy companies and other reporting entities.Consequently, it is not possible to provide an accurate aggregation of all prospective oil and gas resources in Australia using published prospective resource estimates. This bibliography covers all published prospective resource estimates for the 2022 reporting year accessed by Geoscience Australia. This is provided for reference and for access to the available prospective resource data in each hydrocarbon-bearing basin.

References

Beach Energy Ltd, 2023. Trigg 1 well results. (Last accessed 29 May 2024)

Finder Energy 2022a. Update – Kanga 1 Well. (Last accessed 10 May 2023)

Finder Energy 2022b. Kanga 1 Well Result (Last accessed 10 May 2023)

Mineral Resources Limited, 2023. Lockyer 2 gas appraisal well results. (Last accessed 29 May 2024)

SPE (Society of Petroleum Engineers), 2018. Petroleum Resources Management System (PRMS). (Last accessed 14 March 2024)

Gas prospective resource estimates (2022 reporting year)

Amadeus Basin

Central Petroleum Limited 2023. 2023 Annual Report (Last accessed 14 March 2024)

Central Petroleum Limited 2023. Resource Estimates for Three Sub-salt Exploration Wells (Last accessed 14 March 2024)

Georgina Energy Plc 2023. Helium and Hydrogen: First Class Opportunity (Last accessed 14 March 2024)

Mosman Oil and Gas Limited 2023. 2023 Annual Report. (Last accessed 14 March 2024)

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Shale Gas and Liquids Factsheet (Last accessed 14 March 2024)

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Conventional Oil and Gas Factsheet (Last accessed 14 March 2024)

Bamaga Basin

Fisher, W.S. 2021. The Bamaga Basin: a frontier play in a non-frontier location. The APPEA Journal 2021, 61, 192–204

Bonaparte Basin

Melbana Energy 2021. Bonaparte Gulf - Beehive (Last accessed 14 March 2024)

Melbana Energy 2023. Bonaparte Gulf – Hudson Carbonate (Last accessed 14 March 2024)

Bowen and Surat basins

Elixir Energy 2023. Annual Report 2023 (Last accessed 19 March 2024)

Omega Oil and Gas Limited 2022. Prospectus (Last accessed 19 March 2024)

Pure Hydrogen Corporation Limited 2023. Annual Report 2023 (Last accessed 14 March 2024)

State Gas Limited 2023. Annual Report 2023 (Last accessed 05 June 2023)

Canning Basin

Black Mountain Energy 2021. Prospectus (Last accessed 14 March 2024)

Buru Energy Limited 2018. Independent Assessment of Resources at the Yulleroo Field 18 January 2018 (Last accessed 14 March 2024)

Buru Energy Limited 2022. Rafael resources report confirms major gas potential (Last accessed 14 March 2024)

Cooper-Eromanga Basin

Bengal Energy 2022. Bengal Energy Announces Independent Oil and Natural Gas Resource Report (Last accessed 14 March 2024)

Gidgee Energy Limited 2022. PEL 678 Cooper Basin, South Australia (Last accessed 14 March 2024)

Icon Energy Limited 2022. 2022 Annual Report (Last accessed 14 March 2024)

Gippsland Basin

3D Oil Limited 2021.Update to VIC/P74 Prospective Resource Estimates (Last accessed 14 March 2024)

Cooper Energy 2023. Gippsland Basin Prospective Resource Update (Last accessed 14 March 2024)

Emperor Energy 2021. Positive Initial Results of AVO Analysis 3D Seismic Data (Last accessed 14 March 2024)

Emperor Energy 2022. Presentation for PESA Deal Day, Brisbane (Last accessed 14 March 2024)

Geological Survey of Victoria 2021. Conventional gas prospectivity assessment and resource estimation, Onshore Gippsland Basin, Victoria (Last accessed 14 March 2024)

Lakes Blue Energy NL 2023. Annual Report 2023 (Last accessed 14 March 2024)

McArthur Basin (including Beetaloo Sub-basin)

Armour Energy Limited 2022. Annual Report 2022 (Last accessed 14 March 2024)

Empire Energy Group Limited 2023. Major EP187 Contingent Resources Upgrade (Last accessed 18 March 2024)

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Shale Gas and Liquids Factsheet (Last accessed 14 March 2024)

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Conventional Oil and Gas Factsheet (Last accessed 14 March 2024)

Tamboran Resources Limited 2022. 2022 Annual Report (Last accessed 18 March 2024)

Northern Carnarvon Basin

Bounty Oil and Gas NL 2021. Cerberus Farmin Agreement, Carnarvon Basin, Western Australia and Placement to Raise $2.74 Million (Last accessed 18 March 2024)

Finder Energy 2023. Corporate Presentation, 7 September 2023 (Last accessed 18 March 2024)

Tamaska Oil & Gas Limited 2021. Napoleon Prospect Technical Report (Last accessed 18 March 2024)

Officer Basin

Georgina Energy Plc 2023. Helium & Hydrogen: First Class Opportunity (Last accessed 18 March 2024)

Otway Basin

3D Oil Limited 2017. Annual Report 2017 (Last accessed 18 March 2024)

3D Oil Limited 2023. VIC/P79 Prospective Resource Update (Last accessed 18 March 2024)

3D Oil Limited 2023. Investor Presentation, August 2023 (Last accessed 18 March 2024)

Armour Energy 2022. Enterprise North – Project Update (Last accessed 18 March 2024)

Cooper Energy 2022. Otway Basin Exploration Prospective Resources Announcement (Last accessed 18 March 2024)

Geological Survey of Victoria 2021. Conventional gas prospectivity assessment and resource estimation, Onshore Otway Basin, Victoria (Last accessed 18 March 2024)

Lakes Blue Energy NL 2023. Annual Report 2023 (Last accessed 14 March 2024)

Perth Basin

Pilot Energy Limited 2023. Material Gas Fairway Identified in WA-481-P (Last accessed 14 March 2024)

Strike Energy Limited 2022. Independent certification of Walyering reserves (Last accessed 14 March 2024)

Strike Energy Limited 2022. West Erregulla Reserves upgraded by 41% (last accessed 14 March 2024)

Strike Energy Limited 2022. Strike to test Southwest Erregulla and Erregulla Deep Prospective Resource (Last accessed 14 March 2024)

Talon Energy Ltd 2023. Preliminary prospective resource estimate complete on L7 Perth Basin permit (Last accessed 14 March 2024)

Triangle Energy (Global) Limited 2023. 3D Seismic Interpretation Delivers High-Grade Prospects (Last accessed 14 March 2024)

Roebuck Basin

Carnarvon Energy Ltd 2023. Annual Report 2023 (Last accessed 14 March 2024)

Carnarvon Energy Ltd 2023. Corporate presentation Good Oil and Gas Energy Conference 2023 (Last accessed 14 March 2024)

South Nicholson Basin

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Shale Gas and Liquids Factsheet (Last accessed 14 March 2024)

Oil prospective resource estimates (2022 reporting year)

Amadeus Basin

Central Petroleum Limited 2023. 2023 Annual Report (Last accessed 14 March 2024)

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Shale Gas and Liquids Factsheet (Last accessed 14 March 2024)

Bonaparte Basin

Finder Energy 2023. Corporate Presentation, 7 September 2023 (Last accessed 14 March 2024)

Melbana Energy 2021. Bonaparte Gulf - Beehive (Last accessed 14 March 2024)

Melbana Energy 2023. Bonaparte Gulf – Hudson Carbonate (Last accessed 14 March 2024)

Browse Basin

IPB Petroleum Limited 2022. Investor Presentation (Last accessed 19 March 2024)

Bowen and Surat basins

Elixir Energy 2023. Annual Report 2023 (Last accessed 19 March 2024)

Omega Oil and Gas Limited 2022. Prospectus (Last accessed 19 March 2024)

Canning Basin

Black Mountain Energy 2021. Prospectus (Last accessed 14 March 2024)

Buru Energy Limited 2018. Independent Assessment of Resources at the Yulleroo Field (Last accessed 14 March 2024)

Buru Energy Limited 2022. Rafael resources report confirms major gas potential (Last accessed 14 March 2024)

Cooper-Eromanga Basin

Bengal Energy 2022. Bengal Energy Announces Independent Oil and Natural Gas Resource Report (Last accessed 19 March 2024)

Georgina Basin

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Shale Gas and Liquids Factsheet (Last accessed 14 March 2024)

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Conventional Oil and Gas Factsheet (Last accessed 14 March 2024)

Gippsland Basin

3D Oil Limited 2023. Investor Presentation, August 2023 (Last accessed 18 March 2024)

Cooper Energy 2023. Gippsland Basin Prospective Resource Update (Last accessed 18 March 2024)

McArthur Basin (Beetaloo Sub-basin)

Empire Energy Group Limited 2023. Major EP187 Contingent Resources Upgrade (Last accessed 18 March 2024)

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Shale Gas and Liquids Factsheet (Last accessed 14 March 2024)

Northern Territory Geological Survey (NTGS) 2023. Resourcing The Territory: Conventional Oil and Gas Factsheet (Last accessed 14 March 2024)

Tamboran Resources Limited 2022. 2022 Annual Report (Last accessed 18 March 2024)

Northern Carnarvon Basin

Bounty Oil and Gas NL 2021. Cerberus Farmin Agreement, Carnarvon Basin, Western Australia and Placement to Raise $2.74 Million (Last accessed 18 March 2024)

FAR Limited 2021. Annual Report 2020 (Last accessed 18 March 2024)

Finder Energy 2023. Corporate Presentation, 7 September 2023 (Last accessed 14 March 2024)

Tamaska Oil and Gas Limited 2021. Napoleon Prospect Technical Report (Last accessed 14 March 2024)

Otway Basin

3D Oil Limited 2023. Investor Presentation, August 2023 (Last accessed 18 March 2024)

Armour Energy 2022. Enterprise North – Project Update (Last accessed 18 March 2024)

Lakes Blue Energy NL 2023. Annual Report 2023 (Last accessed 14 March 2024)

Perth Basin

Pilot Energy Limited 2023. Material Gas Fairway Identified in WA-481-P (Last accessed 14 March 2024)

Strike Energy Limited 2022. Independent certification of Walyering reserves (Last accessed 14 March 2024)

Triangle Energy (Global) Limited 2023. 3D Seismic Interpretation Delivers High-Grade Prospects (Last accessed 14 March 2024)

Roebuck Basin

3D Oil Limited 2023. Northwest Shelf Project Update: WA-527-P (Last accessed 18 March 2024)

Carnarvon Energy Ltd 2023. Annual Report 2023 (Last accessed 14 March 2024)

Carnarvon Energy Ltd 2023. Corporate presentation Good Oil and Gas Energy Conference 2023 (Last accessed 14 March 2024)

Hydrogen and CCUS prospective resource estimates (2022 reporting year)

Amadeus Basin

Central Petroleum Limited 2023. Resource Estimates for Three Sub-salt Exploration Wells (Last accessed 14 March 2024)

Georgina Energy Plc 2023. Helium and Hydrogen: First Class Opportunity (Last accessed 14 March 2024)

Mosman Oil and Gas Limited 2023. 2023 Annual Report. (Last accessed 14 March 2024)

Cooper-Eromanga Basin

Gidgee Energy Limited 2022. PEL 678 Cooper Basin, South Australia (Last accessed 14 March 2024)

Delamerian Orogen

Buru Energy Limited 2023. 2H Resources – Natural Hydrogen Business Update (Last accessed 20 March 2024)

Officer Basin

Georgina Energy Plc 2023. Helium & Hydrogen: First Class Opportunity (Last accessed 18 March 2024)

Perth Basin

Pilot Energy Limited 2023. Annual Report 2023 (Last accessed 19 March 2024)

Stansbury Basin

Gold Hydrogen Limited 2023. Ramsay Project Update (Last accessed 18 March 2024)

Appendix 5: Energy measurement

Appendix 5: Energy measurement

Energy is the ability to do work. The International System of Units (SI) unit of energy across all energy types is the Joule (J). It is defined as the amount of work done by a force of one newton exerted over a distance of one metre.

Power is the rate at which work is delivered. The SI unit of power is the watt (W). One watt is equal to one joule per second (1 W = 1 J/sec). Watt is the common unit for electrical power (sometimes expressed as We), although it may also be used for thermal power (Wth).

Table A.1. Units.

| Abbreviation | Unit of measurement |

|---|---|

| GJ | Gigajoule - billion - 109 joules |

| Gt | Gigatonne - billion - 109 tonnes |

| GW | Gigawatt - billion - 109 watts |

| GWh | Gigawatt-hour - 109 watt-hours |

| kt | Kilotonne - thousand -103 tonnes |

| kW | Kilowatt - thousand -103 watts |

| kWh | Kilowatt-hour - 103 watt-hours |

| ML | Megalitre - million -106 litres |

| MJ | Megajoule - million - 106 joules |

| MMbbl | Million -106 barrels |

| Mt | Million -106 tonnes |

| MW | Megawatt - million - 106 watts |

| MWe | Megawatt electrical |

| MWh | Megawatt-hour - 106 watt-hours |

| MWth | Megawatt thermal |

| PJ | Petajoule - quadrillion - 1015 joules |

| Tcf | Trillion - 1012 cubic feet |

| TJ | Terajoule - trillion - 1012 joules |

| TWh | Terawatt-hour - 1012 watt-hours |

Consumption of electric energy is measured in kilowatt-hours (kWh), which is equal to the power in kilowatts (kW) times the time period (hours (h)):

energy (kWh) = power (kW) x time (h)

The average annual energy production or consumption can be expressed in kilowatt-hours per year (kWh/year). For example, a power plant with a capacity of one MW produces 1,000 kWh when the plant runs consistently for one hour. If the power plant runs consistently with no downtime for a year (8,760 hours), the generator produces 8,760,000 kWh (8,760 MWh) in a year. Both Joules and Watts are more commonly recorded in multiples.

Table A.2. Decimal numbering system.

| Multiple | Scientific exp. | Term | Abbreviation |

|---|---|---|---|

| Thousand | 103 | Kilo | k |

| Million | 106 | Mega | M |

| Billion | 109 | Giga | G |

| Trillion | 1012 | Tera | T |

| Quadrillion | 1015 | Peta | P |

| Quintillion | 1018 | Exa | E |

Table A.3. Energy resource units of measurement.

| Energy resource | Measure | Abbreviation |

|---|---|---|

| Oil and condensate | Production, reserves: Litres (usually millions or billions) or barrels (usually thousands or millions) | L, ML, GL, bbl, kbbl, MMbbl |

| Refinery throughput/capacity: Litres (usually thousands or millions) or barrels per day (usually thousands or millions) | GL per day, bpd, kbpd, MMbpd | |

| Natural gas | Cubic feet (usually billions or trillions) or cubic metres (usually millions or billions of cubic metres) | Bcf, Tcf, m3, Mm3, Bcm |

| LNG | Tonnes (usually millions) | t, Mt |

| Production rate: Million tonnes per year | Mtpa | |

| LPG | Litres (usually megalitres) or barrels (usually millions) | L, ML, bbl, MMbbl |

| Coal | Tonnes (usually millions or billions) | Mt, Gt |

| Uranium | Tonnes (usually kilotonnes) of uranium or of uranium oxide | t U; kt U; t U3O8; kt U3O8 |

Table A.4. Fuel-specific to standard unit conversion factors.

| Energy resource | Unit | Conversion factor |

|---|---|---|

| Oil and condensate | 1 barrel | 158.987 litres |

| Oil and condensate | 1 gigalitre (GL) | 6.2898 million barrels |

| Oil and condensate | 1 tonne (t) | 1,250 litres (indigenous) 1,160 litres (imported) |

| Ethanol | 1 tonne | 1,266 litres |

| Methanol | 1 tonne | 1,263 litres |

| LPG: average | 1 tonne | 1,760 - 1,960 litres |

| LPG: naturally occurring | 1 tonne | 1,866 litres |

| Natural gas | 1 cubic metre (m3) | 35.315 cubic feet (cf) |

| Liquefied natural gas | 1 tonne | 2,174 litres |

Energy content conversion factors

The energy content of individual resources may vary according to factors such as the quality of the resource, impurities content, extent of pre-processing and technologies used. The following tables provide a range of measured energy contents and, where appropriate, the accepted average conversion factor.

Table A.5. Gaseous fuels.

| Fuel | Category | PJ/Bcf | MJ/m3 |

|---|---|---|---|

| Natural gas | Victoria | 1.0987 | 38.8 |

| Queensland | 1.1185 | 39.5 | |

| Western Australia | 1.1751 | 41.5 | |

| South Australia, New South Wales | 1.0845 | 38.3 | |

| Northern Territory | 1.1468 | 40.5 | |

| Average | 1.1247 | 39.7 | |

| Ethane | Average | 1.6282 | 57.5 |

| Town gas | Synthetic natural gas | 1.1043 | 39 |

| Other town gas | 0.7079 | 25 | |

| Coke oven gas | 0.5125 | 18.1 | |

| Blast furnace gas | 0.1133 | 4 |

Table A.6. Liquid fuels.

| PJ/MMbbl | By volume MJ/L | By weight GJ/t | |

|---|---|---|---|

| Crude oil and condensate | |||

| indigenous (average) | 5.88 | 37 | 46.3 |

| imports (average) | 6.15 | 38.7 | 44.9 |

| LPG | |||

| propane | 4.05 | 25.5 | 49.6 |

| butane | 4.47 | 28.1 | 49.1 |

| mixture | 4.09 | 25.7 | 49.6 |

| naturally occurring (average) | 4.21 | 26.5 | 49.4 |

| Other | |||

| Liquefied natural gas (North West Shelf) | 3.97 | 25 | 54.4 |

| Naphtha | 4.99 | 31.4 | 48.1 |

| Ethanol | 3.72 | 23.4 | 29.6 |

| Methanol | 2.48 | 15.6 | 19.7 |

Appendix 6: Abbreviations

Appendix 6: Abbreviations

| Acronym | Phrase |

|---|---|

| ACT | Australian Capital Territory |

| BREE | Bureau of Resources and Energy Economics |

| CAGR | Compound annual growth rate |

| CCS | Carbon capture and storage |

| CNG | Compressed natural gas |

| COAG | Council of Australian Governments |

| CSG | Coal seam gas |

| CSIRO | Commonwealth Scientific and Industrial Research Organisation |

| EDR | Economic Demonstrated Resource(s) |

| EIA | US Energy Information Administration |

| EUR | Estimated Ultimate Recovery |

| GA | Geoscience Australia |

| GDP | Gross domestic product |

| HMS | Heavy mineral sands |

| IAEA | International Atomic Energy Agency |

| IEA | International Energy Agency |

| JORC | Joint Ore Reserves Committee |

| JPDA | Timor Sea Joint Petroleum Development Area |

| LNG | Liquefied natural gas |

| LPG | Liquefied petroleum gas |

| NGL | Natural gas liquids |

| NOPTA | National Offshore Petroleum Titles Administrator |

| NSW | New South Wales |

| NT | Northern Territory |

| OECD | Organisation for Economic Co-operation and Development |

| OECD NEA | Organisation for Economic Co-operation and Development Nuclear Energy Agency |

| OPEC | Organisation of the Petroleum Exporting Countries |

| pa | per annum |

| PRMS | Petroleum Resource Management System |

| QLD | Queensland |

| RAR | Reasonably Assured Resource(s) |

| SA | South Australia |

| SDR | Subeconomic Demonstrated Resource(s) |

| SPE | Society of Petroleum Engineers |

| TAS | Tasmania |

| USGS | United States Geological Survey |

| WA | Western Australia |