Australia's Energy Commodity Resources 2024 Carbon capture and storage

Page last updated:15 July 2024

Carbon Capture and Storage

Carbon Capture and Storage statistics.

|

TDR 403 Mt1 |

|

Storage Projects 16 announced - 1 operational - 1 under construction - 14 in feasibility and under development |

|

Stored 9 Mt2 |

Abbreviations:

TDR = Total demonstrated resources (storage capacity and contingent resources); Mt = million tonnes.

Notes:

1carbon dioxide (CO2) geological storage reserves and resources; 2cumulative CO2 stored geologically.

Key messages

Key messages

- The scientific consensus is that it will be almost impossible to reach net-zero emissions by 2050 without a significant global scale up of CCS (IEA, 2020, 2021; IPCC, 2022).

- As of December 2023, the Gorgon CCS project, Australia’s only operating commercial CCS facility, had stored more than 9 million tonnes of CO2 in the Dupuy Formation, beneath Barrow Island.

- The CCS project landscape is continually evolving. As of June 2024, there are 15 CO2 storage projects in development, including the Moomba CCS project in South Australia that is scheduled to commence injecting CO2 in 2024.

- In 2023, 10 offshore areas were released for bidding under the Commonwealth Offshore Greenhouse Gas Storage Acreage Release process and the award of assessment exploration permits for these greenhouse gas storage areas is pending. The areas are located in the Bonaparte, Browse, Northern Carnarvon, Perth, Otway, Bass and Gippsland basins.

- Regulatory frameworks enabling greenhouse gas storage are now in place in South Australia, Victoria, Queensland, Western Australia as well as for the offshore Commonwealth jurisdiction.

- In November 2023, the Amendment (Using New Technologies to Fight Climate Change) to the Environment Protection (Sea Dumping) Act 1981 came into force. The amendment gives effect to Australia’s international obligations under the 2009 amendment to the London Protocol to enable the transboundary movement of CO2 for the purpose of sub-seabed geological storage.

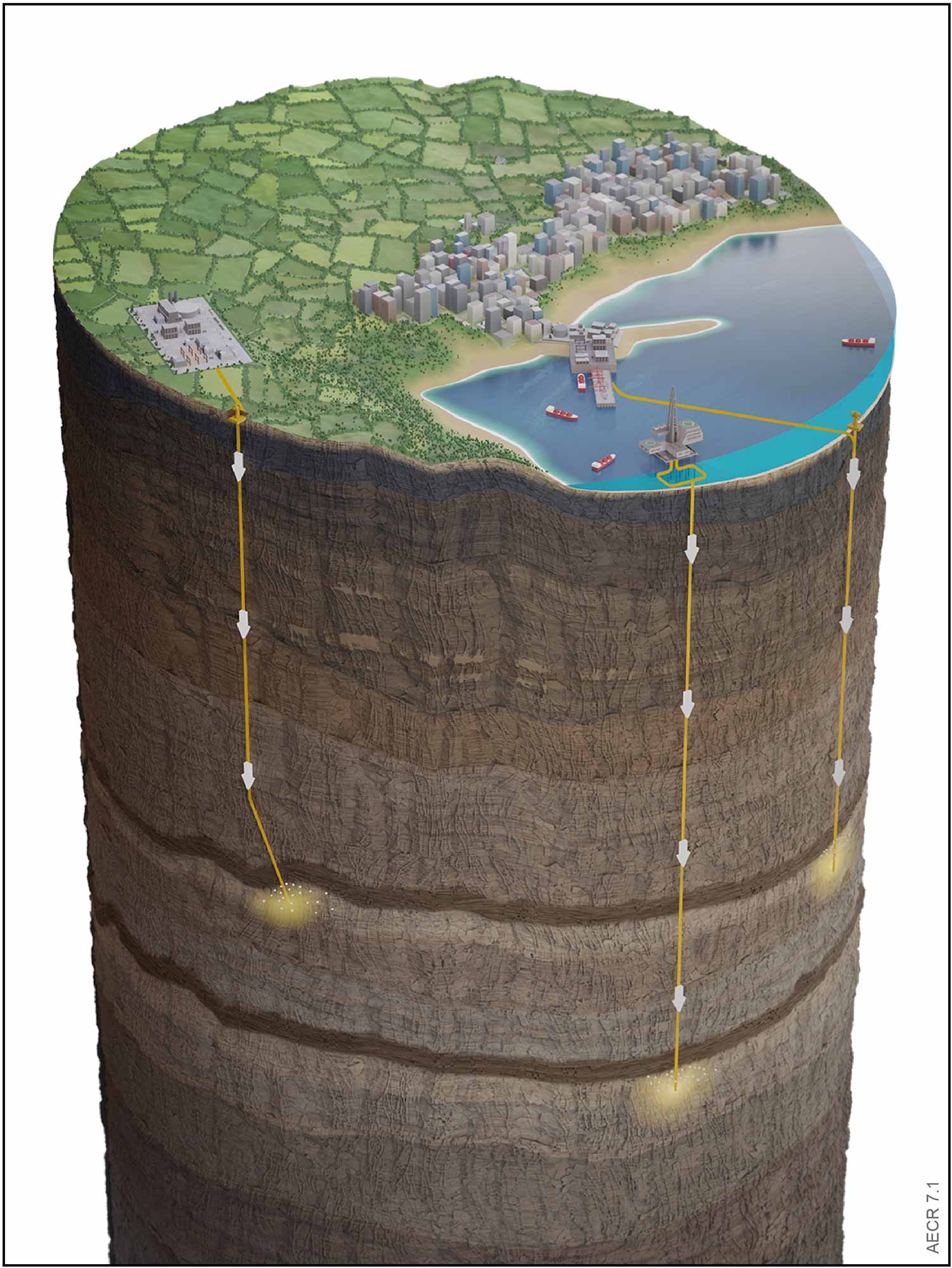

Carbon Capture and Storage (CCS) or carbon capture, utilisation and storage (CCUS) is a decarbonisation tool that can be applied to prevent the release of CO2 from stationary greenhouse gas emission sources and to remove CO2 emissions directly from the atmosphere. The CCS value chain includes capturing, transporting, compressing, and injecting CO2 into deep underground geological formations where it is permanently trapped (Figure 7.1).

The scientific consensus is that it will be almost impossible to reach net-zero emissions by 2050 without a significant global scale up of CCS (IEA, 2020, 2021; IPCC, 2022). Globally, around 41 (GCCSI, 2023) to 45 (IEA, 2024a) commercial-scale CCS projects capture around 50 million tonnes (Mt) of CO2 per year (IEA, 2024a). Of these, some 10-12 have dedicated geological storage for carbon abatement, while the remainder are utilisation projects that largely store CO2 through enhanced oil recovery operations. Around 230 Mt of CO2 are used annually for fertiliser production (130 million tonnes per annum [Mtpa]) and enhanced oil recovery (80 Mtpa) (IEA 2024b). According to the Global CCS Institute (2023), there are 26 CCS facilities under construction and a further 325 in development, noting that these numbers fluctuate regularly. In the IEA’s updated net zero emissions scenario, this needs to increase to 1.2 Gt of CO2 per year by 2030 and 6.2 Gt CO2 per year by 2050 (IEA, 2022a).

The IEA scenarios conclude that even with full electrification, CCS will be required to abate emissions from industrial sectors, which cannot be fully electrified at this point in time, and/or have no alternative feedstock to natural gas or coal, or for those sectors where CO2 is a by-product of the manufacturing process (e.g. cement production).

CCS is one of the few solutions available for reducing emissions from heavy industries such as iron and aluminium, steel, cement, fertiliser and chemical manufacturing, as well as from natural gas processing and blue (fossil fuel plus CCS) hydrogen production. CCS also underpins direct removal and permanent geological sequestration of CO2 from the atmosphere through direct air capture and storage (or DACS), which is expected to play an increasingly important role in meeting the global carbon budget well into the future (IEA, 2022b). At 0.5 Mtpa of CO2—and with potential to scale to 1 Mtpa CO2—Oxy and 1PointFive’s STRATOS project in the United States is the largest DACS facility currently in the development pipeline and is due to commence operating in mid-2025 (Oxy, 2023, 2024; 1PointFive, 2024). Nearly 30 small scale DACS projects have been commissioned across the world (IEA, 2024c).

CCS in Australia

CCS in Australia

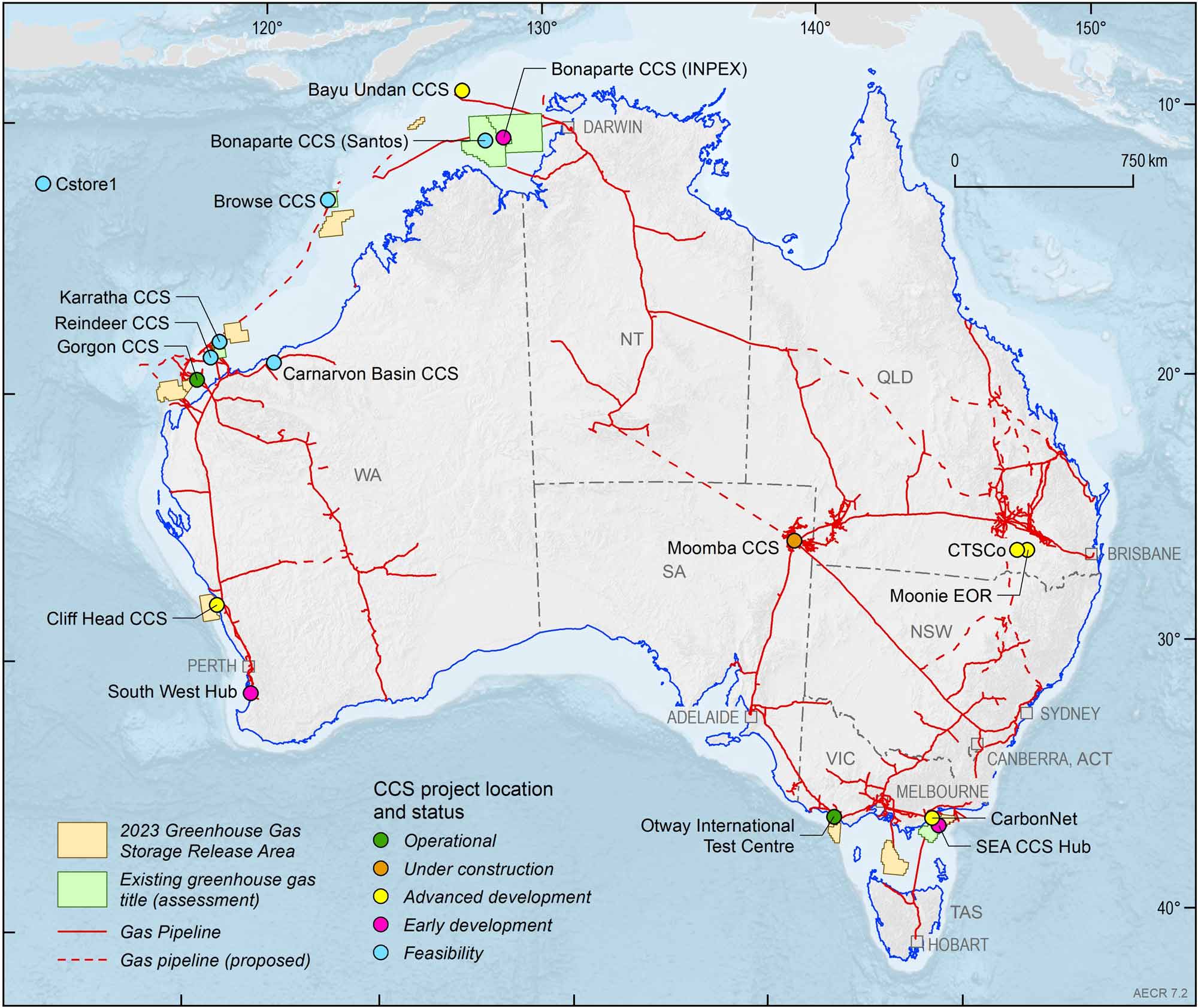

Australia currently has one operating commercial-scale full-chain capture and storage project (Gorgon CCS), one operational research and demonstration project (Otway International Test Centre), and a growing number of commercial-scale projects at various stages of development, both onshore and offshore (Figure 7.2; Table 7.1).

Figure 7.2. Location of Australian CCS Projects to June 2024 Note that only projects with a geological storage component are included. The planned CStore floating injection platform is expected to be located offshore WA/NT.

Table 7.1. CO2 storage projects announced for Australia (to June, 2024).

| Project | Basin | Operators and partners | Storage Type | Status | Estimated scale | Start date |

|---|---|---|---|---|---|---|

| Bayu Undan | Bonaparte | Santos, SK E&S, INPEX, ENI, JERA, Tokyo Gas | Depleted Field |

Advanced development |

2.3 Mtpa (up to 10 Mtpa) | 2028 |

| Bonaparte CCS (INPEX) | Bonaparte | INPEX Browse E&P, Total Energies CCS Australia, Woodside Energy | Saline aquifer |

Early development |

2 Mtpa (up to 7 Mtpa) | 2030 |

| Bonaparte CCS (Santos) | Bonaparte | Santos, Chevron Australia, SK E&S | Saline aquifer | Feasibility | ||

| Browse CCS | Browse | Woodside Energy, Shell, BP, MIMI, PetroChina |

Depleted field, saline aquifer | Feasibility | 4 Mtpa | |

| CarbonNet | Gippsland | Victorian Government, Australian Government | Saline aquifer |

Advanced development |

up to 6 Mtpa (168 Mt at Pelican) | 2030 |

| Carnarvon Basin CCS | Carnarvon | Buru Energy, Energy Resources | Saline aquifer | Feasibility | ||

|

Cliff Head CCS (Mid West Clean Energy Project) | Perth | Pilot Energy | Depleted Field |

Advanced development |

> 1 Mtpa (50 Mt) | 2026 |

| Cstore1 | tbc | deepCStore, ABL Group, CSIRO, JX Nippon Oil and Gas Exploration, Kyushu Electric Power, Mitsui O.S.K Lines, Osaka Gas, Technip Energies, Toho Gas | tbc |

Early development | 1.5 - 7.5 Mtpa | |

| CTSCo | Surat | CTSCo (Glencore), Australian Government, LETA, ANLEC R&D, Marubeni, J Power | Saline aquifer |

Advanced development |

Demonstration: 0.11 Mtpa (0.33 Mt) | |

| Gorgon CCS | Carnarvon | Chevron, ExxonMobil, Shell, Osaka Gas, Tokyo Gas, JERA | Saline aquifer | Operating |

>100 Mt (>9 Mt stored to date) | 2019 |

| Karratha CCS (Angel CCS) | Carnarvon | Woodside Energy, BP, MIMI, Shell, Chevron | Depleted field | Feasibility | Up to 5 Mtpa (est) | |

| Moomba CCS | Cooper | Santos, Beach Energy | Depleted Field |

Under construction |

1.7 Mtpa (up to 20 Mtpa) | 2024 |

| Moonie CO2-EOR | Surat | New Hope (Bridgeport Energy) | Depleted Field |

Advanced development |

0.12 Mtpa (0.8-1 Mt) | |

| Otway International Test Centre | Otway | CO2CRC |

Saline aquifer, depleted field | Operating |

Research (>95 kt stored) | 2008 |

| Reindeer CCS (Western Australia CCS) | Carnarvon | Santos, Chevron Australia |

Depleted field, saline aquifer | Feasibility | 5 Mtpa | 2028 |

| SEA CCS | Gippsland | Esso Australia (ExxonMobil), BHP Petroleum (Woodside Energy) | Depleted Field |

Early development | 2 Mtpa | 2025 |

| South West Hub | Perth | Western Australian Government, Verve Energy, Griffin Energy, Wesfarmers Premier Coal, Alcoa Australia, Perdaman Chemicals & Fertilisers | Saline aquifer |

Early development | 0.8 Mtpa |

Abbreviations

Mt = Mega tonnes.

Notes

Only projects directly undertaking geological storage projects are included here.

Enabling regulatory framework

Over the past two years, there has been considerable activity with respect to the legislative and regulatory frameworks that govern CCS in Australia.

Offshore CCS projects in Commonwealth waters are conducted under the Offshore Petroleum and Greenhouse Gas Storage (OPGGS) Act 2006, the Environment Protection (Sea Dumping) Act 1981 and the Environment Protection and Biodiversity Conservation Act 1999 (the regulatory frameworks and approvals governing offshore CCS projects are described in Australian Government 2023 guidance document). An Australian Government review of the Offshore Petroleum and Greenhouse Gas Storage Act 2006 and the Offshore Petroleum and Greenhouse Gas Storage (Environment) Regulations 2023, led by the Department of Industry, Science and Resources (DISR), is currently underway to examine and recommend improvements to the offshore environmental management regime.

Under the OPGGS Act, project proponents are able to nominate and bid for greenhouse gas acreage, which enables exploration for suitable geological storage formations and can ultimately lead to the granting of CO2 injection licences.

Under the 2021 Offshore Greenhouse Gas Storage Acreage Release, five permits were awarded for greenhouse gas storage exploration offshore the Northern Territory (Bonaparte Basin) and Western Australia (Browse and Northern Carnarvon Basins; DISR, 2022; King, 2022; Figure 7.2). Indicative exploration expenditure associated with the work programs for these five areas totals A$399.3 million (NOPTA, 2024a).

In 2023, a further 10 areas were released for bidding to explore for greenhouse gas storage opportunities in the Bonaparte, Browse, Northern Carnarvon, Perth, Otway, Bass and Gippsland basins located offshore Western Australia, Victoria, and Tasmania (Figure 7.2; DISR, 2023). As of June 2024, a decision on these greenhouse gas storage exploration permits is pending.

A Sea Dumping Permit is required for offshore injection and geological storage of CO2 (Department of Climate Change, Energy, the Environment and Water [DCCEEW], 2024)

Onshore projects are governed under equivalent state or territory legislation. South Australia, Victoria, and Queensland have had enabling legislative frameworks in place for a number of years, while in May 2024, the Western Australian Parliament passed the Petroleum Legislation Amendment Bill 2023 that enables the transport and storage of greenhouse gases as well as exploration for naturally-occurring hydrogen.

In November 2023, the Amendment (Using New Technologies to Fight Climate Change) to the Environment Protection (Sea Dumping) Act 1981 came into force, providing a framework that enables the transboundary movement (international import or export) of CO2 for the purpose of sub-seabed geological storage. The Act gives effect to Australia’s international obligations under the 2009 amendment to the London Protocol (1996 Protocol to the Convention on the Prevention of Marine Pollution by Dumping of Wastes and Other Matter).

In May 2024 the Australian Government released the Future Gas Strategy, which recognises the need for natural gas beyond 2050 in Australia (DISR, 2024). The strategy also underlines the increasing role for CCS in Australia with respect to decarbonising natural gas operations and the hard-to-abate industrial sector.

CCS Projects

There are currently 16 geological storage projects in various stages of development across Australia, mostly located in the Commonwealth jurisdiction (Table 7.1, Figure 7.2), offshore Northern Territory, Western Australia and Victoria, and onshore in South Australian and Queensland. Both saline aquifers and depleted fields are targeted for storage.

The majority of Australia’s currently announced CO2 storage projects are associated with the production of natural gas/LNG. Natural gas can contain significant (>10%) concentrations of CO2. Common practice has been to separate the CO2 from the natural gas stream and vent it to the atmosphere. However, venting practices are becoming less acceptable, due to concerns about increasing CO2 emissions to the atmosphere, and as emission reduction requirements under legislation such as the Safeguard Mechanism come into effect (DCCEEW, 2023). Australian CO2 storage projects in development also include those linked with hydrogen and ammonia production, industrial emission sources, enhanced oil recovery, and direct air capture.

The Gorgon CCS project on Barrow Island, Western Australia, is Australia’s first, and currently only, operating commercial-scale CCS project. The CO2 associated with natural gas from the Gorgon and Jansz-Io fields is captured and stored in the Upper Jurassic Dupuy Formation in the Barrow Sub-basin, around 2,000 m beneath Barrow Island. The project has stored in excess of 9 Mt of CO2 between the commencement of injection in August 2019 and December 2023, and is expected to store more than 100 Mt of CO2 during its 40-year plus lifetime (Chevron, 2024). Other projects are advancing across the country. Construction at Santos’ Moomba CCS facility in the Cooper Basin, South Australia, is 80% complete (as of February 2024) with injection expected to begin in 2024 (Santos, 2024a, 2024b). A number of other projects are progressing through the relevant regulatory approvals processes.

There is an increasing focus on the development of CCS hubs based on or in addition to CO2 storage projects associated with LNG production that will enable geological storage of emissions from hydrogen and ammonia production as well as from industrial and hard-to-abate facilities. Examples of these are the Northern Territory Low Emissions Hub, Pilot Energy’s Mid West Clean Development Hub, and the CarbonNet CCS hub in Victoria. DeepC Store are developing Australia’s first multi-user floating CO2 injection and storage hub, which will be located offshore in northern and western Australia and store between 1.5–7.5 Mt CO2 per year (DeepC Store, 2023). The passage of the 2023 amendment to the Environment Protection (Sea Dumping) Act (1981) to enable transboundary movement of CO2 for the purpose of sub-seabed storage is also generating interest from both potentially CO2-exporting countries and developers of Australian geological storage facilities. For example, Santos have put in place agreements with international energy companies to investigate the feasibility of storing third party CO2 via the Moomba CCS Project (Santos, 2023a, 2024b).

Direct removal of CO2 from the atmosphere is of growing interest to abate historical CO2 emissions and those emissions that cannot be captured or easily abated (e.g. from agricultural use or dispersed transport emissions). AspiraDAC is an example of a demonstration direct air capture and storage project that will use renewable energy to power modular direct air capture units to capture 1 tCO2 per day for at least one year (AspiraDAC, 2023). The captured CO2 will be stored at a nearby CCS storage site in the Cooper Basin. This is a first-of-a-kind demonstration of direct air capture with CO2 storage for Australia.

In addition to CO2 storage, a number of projects are seeking to capture CO2 from manufacturing or industrial processes, either for permanent storage or for use in creating new products such as low carbon cement and synthetic fuels.

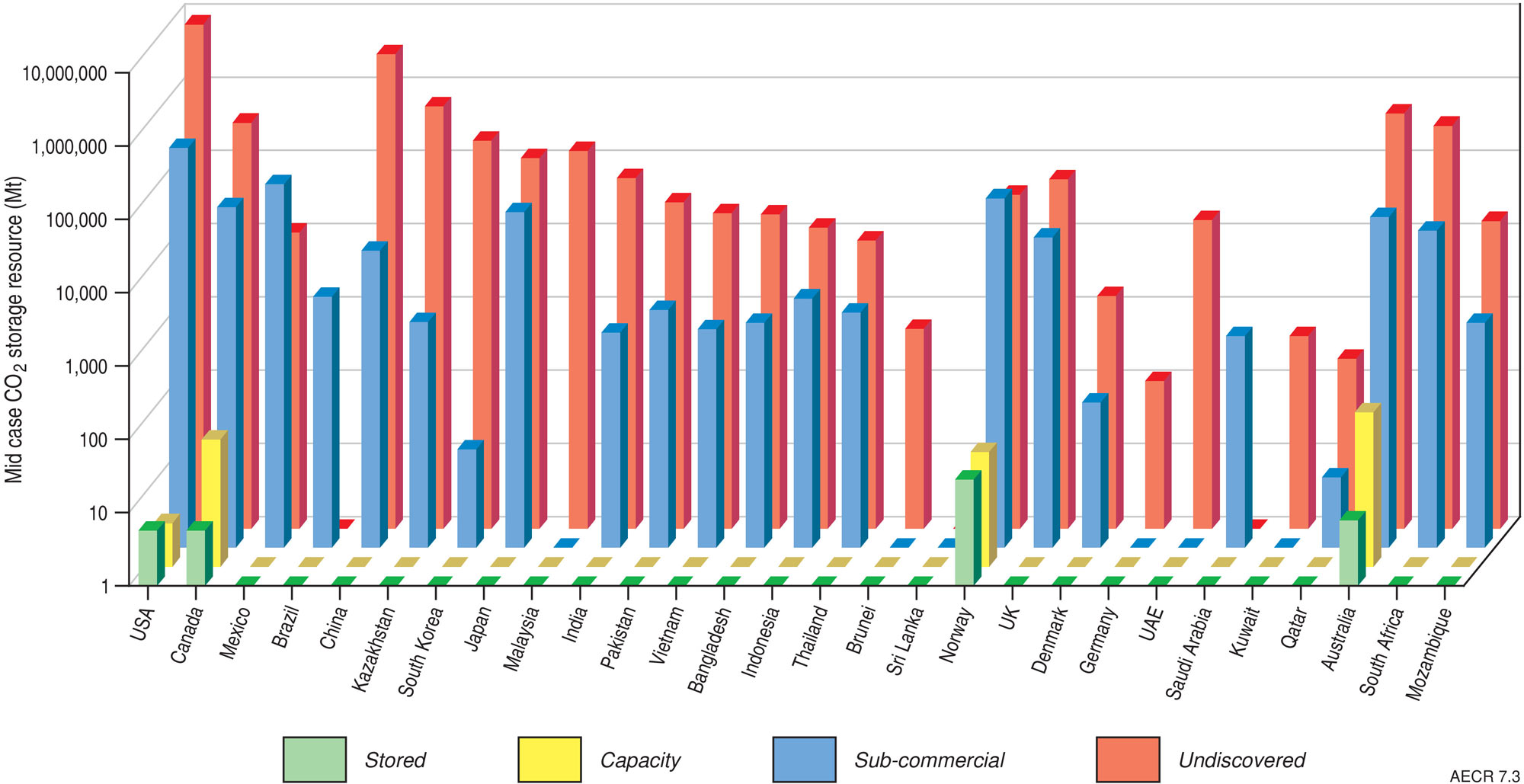

Australia’s geological storage resources

Australia has an enormous theoretical capacity for geological storage of CO2 in saline aquifers and depleted fields. The Oil and Gas Climate initiative (2022) applied the technically-based CO2 Storage Management System (the SRMS; SPE, 2017) to produce a catalogue of global CO2 storage resources and their maturity (Figure 7.3), which estimates that Australia has approximately 31 Gt of sub-commercial storage capacity and 470 Gt in undiscovered storage resources. Much of this storage resource is found in the sedimentary basins offshore Victoria (Gippsland Basin), Western Australia (Browse, Perth, Northern Carnarvon basins) and Northern Territory (Bonaparte Basin), and onshore in South Australia (Cooper-Eromanga Basin) and Queensland (Surat Basin).

Figure 7.3. Plot of CO2 storage resources by country and CO2 Storage Resources Management System (SRMS) maturity (modified from Oil and Gas Climate Initiative (2022) Fig. 1-2, with updated Stored and Capacity estimates for Australia).

To date, the Moomba CCS, Cliff Head CCS, WA-481-P CCS and South Erregulla projects have publicly announced their 2P storage capacity (reserves) and/or 2C storage resources (Table 7.2; Beach Energy Limited, 2023; Santos Limited, 2023b; Triangle Energy, 2022; Pilot Energy 2023; Strike Energy, 2023). Additionally, the Gorgon CCS Project (Chevron, 2024) and CarbonNet Project (Victoria State Government, 2024) have publicly announced storage resources estimates, deemed to be the equivalent to a 2P storage capacity and 2C storage resource, respectively.

Table 7.2. Australia's carbon dioxide geological storage reserves and resources in 2022.

| Basin | Project | Storage Type | Carbon dioxide geological storage | Owners | |

|---|---|---|---|---|---|

| 2P Capacity (Mt) | 2C Resources (Mt) | ||||

| Barrow Sub‑basin | Gorgon CCS | Saline aquifer | 100 | Chevron Australia; ExxonMobil; Shell; Osaka Gas; Tokyo Gas; JERA | |

| Gippsland Basin | CarbonNet | Saline aquifer | 168 |

Victorian Government; Australian Government | |

| Cooper Basin | Moomba CCS | Depleted field | 13 | 103 |

Beach Energy Limited; Santos Limited |

| Perth Basin | Cliff Head CCS | Depleted field | -- | 10 |

Triangle Energy (Global) Limited; Pilot Energy Limited |

| Perth Basin | WA-481-P CCS | -- | -- | 4 | Pilot Energy Limited |

| Perth Basin | South Erregulla | -- | -- | 5 | Strike Energy Limited |

| Total | 113 | 290 | |||

Abbreviations

Mt = Mega tonnes.

Notes

Identified storage resources, for the purposes of this report, are the equivalent of discovered 2P storage capacity and 2C contingent storage resources in the SPE-CO2 storage resources management system (SRMS; SPE, 2017).Sources: Beach Energy (2023); Chevron (2024); Pilot Energy (2023); Santos Limited (2023b); Strike Energy (2023); Triangle Energy (2022); Victoria State Government (2024).

Australia has excellent potential for the application of CCS, with many onshore and offshore basins hosting suitable formations for injection and storage of CO2. There are hydrocarbon fields in many basins that are at mature stages of development and often provide early opportunities for CCS in their depleted reservoirs. The associated geological knowledge and data from decades of exploration and development is also underpinning exploration and appraisal of potentially larger saline aquifer storage projects as the CCS industry scales up. Natural gas production is currently at relatively less mature stages of development in parts of offshore northern and western Australia. These will provide potential new CCS opportunities in the future as hydrocarbon fields are developed and depleted and saline aquifer storage opportunities are realised, adding to Australia’s inventory of potential storage sites.

References

References

1PointFive, 2024. Direct Air Capture (Last accessed June 2024).

AspiraDAC 2023. AspiraDAC (Last accessed March 2024).

Australian Government 2023. Guidance Fact Sheet: Offshore Carbon Capture and Storage Regulatory Approvals, Commonwealth of Australia/ (Last accessed June 2024)

Bridgeport Energy (a New Hope Group company) 2021. Moonie Oil Field CO2 EOR Project Initial Injection Plan (Last accessed June 2024)

Chevron Australia, 2024. Gorgon carbon capture and storage fact sheet (Last accessed May 2024).

CO2CRC 2024. The Otway International Test Centre (Last accessed June 2024)

CSIRO 2022. A business case for a low-emissions CCUS hub in the Northern Territory (Last accessed June 2024)

CTSCo 2022. Environmental Impact Statement - Surat Basin Carbon Capture and Storage Project (Executive Summary).

DeepC Store 2024. CStore1 (Last accessed June 2024).

DCCEEW (Department of Climate Change, Energy, the Environment and Water) 2023. Safeguard Mechanism. (last accessed June 2024).

DCCEEW (Department of Climate Change, Energy, the Environment and Water) 2024. Offshore carbon capture and sequestration (Last accessed June 2024)

DISR (Department of Industry, Science and Resources) 2022. 2021 Offshore Greenhouse Gas Storage Acreage Release (Last accessed 30 May 2024).

DISR (Department of Industry, Science and Resources) 2023. 2023 Offshore Greenhouse Gas Storage Acreage Release (Last accessed 30 May 2024).

DISR (Department of Industry, Science and Resources) 2024. Future Gas Strategy. Canberra, Australia. (Last accessed June 2024)

Flett, M., Brantjes, J., Gurton, R., McKenna, J., Tankersley, T., Trupp, M. Subsurface development of CO2 disposal for the Gorgon Project. Energy Procedia 1, pp 3031-3038.

GCSI (Global CCS Institute) 2023. Global Status of CCS: 2023. Australia (Last accessed 30 May 2024).

Government of Western Australia Department of Mines, Industry Regulation and Safety 2019. South West Hub Project (Last accessed June 2024)

INPEX 2024. Bonaparte Carbon Capture and Storage (Last accessed June 2024)

IEA (International Energy Agency) 2020. Energy Technology Perspectives 2020: Special report on carbon capture utilisation and storage. IEA, Paris. (Last accessed June 2024)

IEA (International Energy Agency) 2022a. World Energy Outlook 2022d: An updated roadmap to Net Zero Emissions by 2050. IEA, Paris (Last accessed June 2024).

IEA (International Energy Agency) 2022b. Direct Air Capture: a key technology for net zero. IEA, Paris. (Last accessed June 2024)

IEA (International Energy Agency) 2024a. CCUS Projects Database. IEA, Paris. (Last accessed June 2024)

IEA (International Energy Agency) 2024b. CO2 Capture and Utilisation. IEA, Paris. (Last accessed June 2024)

IEA (International Energy Agency) 2024c. CO2 Capture and Utilisation: Direct Air Capture. IEA, Paris. (Last accessed June 2024)

IPCC (Intergovernmental Panel on Climate Change) 2022. Climate Change 2022: Mitigation of Climate Change (Last accessed June 2024).

King, M. 2022. New offshore greenhouse gas storage acreage to help lower emissions. Press release, 24 August 2022. (Last accessed June 2024)

NOPTA (National Offshore Petroleum and Titles Administrator), 2024a. National Electronic Approvals Tracking System (NEATS), Department of Industry, Science and Resources (Last accessed May 2024).

Oil and Gas Climate Initiative 2022. CO2 storage resource catalogue, cycle 3 report (Last accessed June 2024).

Oxy, 2023. Occidental and BlackRock form joint venture to develop STRATOS, the world’s largest direct air capture plant. Media release 7 Nov 2023. (Last accessed May 2024).

Oxy, 2024. 1PointFive and AT&T Announce Direct Air Capture Carbon Removal Agreement. Media release 13 Mar 2024. (Last accessed May 2024).

Pilot Energy 2024. Mid West Clean Energy Project (Last accessed June 2024).

Santos 2022. Santos awarded CO2 storage permits for more CCS opportunities (Last accessed May 2024)

Santos 2023a. Santos, JX and ENEOS to collaborate on carbon capture and storage to support Moomba CCS phase 2 and help Japan decarbonise. Media release 18 Dec 2023 (Last accessed May 2024)

Santos 2023b. Climate Change Report. (Last accessed June 2024)

Santos 2024a. Decarbonisation in action (Last accessed June 2024)

Santos 2024b. Santos secures Moomba carbon capture and storage finance to drive decarbonisation. Media release 26 Feb 2024.

SPE (Society of Petroleum Engineers), 2017. CO2 Storage Resources Management System (Version 1.02, revised July 2022). ISBN 978-1-61399-955-4. (last accessed 20 March 2024).

Victoria State Government Department of Jobs, Skills, Industry and Regions, 2024. CarbonNet Project (last accessed June 2024).

Woodside 2022. Woodside-led Joint Venture awarded greenhouse gas assessment permit in WA (Last accessed June 2024)

Woodside 2023. Climate Report 2023 (Last accessed June 2024)

Woodside 2024. Browse Carbon Capture and Storage (Last accessed June 2024).

References for carbon dioxide storage capacity and resources

Beach Energy Limited, 2023. Annual Report 2023 (Last accessed 07 June 2024)

Chevron Australia, 2024. Gorgon carbon capture and storage fact sheet (Last accessed 11 June 2024).

Pilot Energy, 2023. Annual Report 2023. (Last accessed 07 June 2024)

Santos Limited, 2023. Annual Report 2022 (Last accessed 07 June 2024)

Strike Energy Limited, 2023. Annual Report 2023 (Last accessed 07 June 2024)

Triangle Energy (Global) Limited 2022. Cliff Head Joint Venture, Significant Upgrade to WA 31-L CO2 Storage Contingent Resource and Submission to NOPTA for Initial CCS Regulatory Approval (Last accessed June 2024).

Victoria State Government Department of Jobs, Skills, Industry and Regions, 2024. About the CarbonNet Project (Last accessed June 2024).

Data download

Data download

Australia's Energy Commodity Resources Data Tables - 2022 reporting period