Australia's Energy Commodity Resources 2024 Hydrogen

Page last updated:15 July 2024

Hydrogen

Hydrogen statistics.

|

TDR 8 PJ1 | |

|

Clean hydrogen production capacity 459 t/yr (operational) |

|

Major Projects 76 announced - 3 under construction - 73 in feasibility and under development |

|

Production Currently in the pilot and demonstration phase, with major projects under construction. |

Abbreviations:

TDR = Total demonstrated resources (reserves and contingent resources); t/yr= tonnes per year.

Notes:

1natural hydrogen resources; 2operating or under construction, from electrolysis, biomass and fossil fuel conversion with carbon capture and storage.

Key messages

Key messages

- Australia has extensive world-class renewable and non-renewable energy resources that can form the foundation of a new clean hydrogen industry.

- Clean hydrogen as an energy source is gaining momentum in Australia, moving from small pilot and research projects to final investment decision on major projects.

- There is significant interest in Australia’s future hydrogen production with over $200 billion in the investment pipeline for hydrogen and various derivatives.

- The number of major hydrogen projects under consideration in Australia increased from 48 in 2022 to 76 in 2023.

- A major review of Australia’s National Hydrogen Strategy was undertaken during 2023, with a greater focus on prioritising hard-to-abate domestic sectors and supporting development of large-scale ‘green’ export industries like ammonia, iron and alumina.

The utilisation of hydrogen is a key pathway for decarbonising Australia’s economy, particularly for hard-to-abate sectors like iron, steel, alumina, fertilizers, heavy road freight and long-haul transport (e.g. aviation and shipping). These industries are currently, heavily reliant on fossil fuels and cannot be easily electrified. In addition, for industries fossil fuels are an integral part of the manufacturing process (e.g. iron production). Today, entire new production processes using hydrogen are being developed to meet future emission standards.

In February 2023, the Energy and Climate Change Ministerial Council agreed to a Review of the 2019 National Hydrogen Strategy (Commonwealth of Australia, 2019) to ensure it positions Australia on a path to be a global hydrogen leader by 2030 on both an export basis and for the decarbonisation of Australian industries. The revised National Hydrogen Strategy will be released in 2024.

While hydrogen produced from renewable energy appears to have cost advantages in the long-term (IEA, 2023a), the production of hydrogen using fossil fuels with substantial carbon capture could be lower cost in the near-term. There are a small number of hydrogen projects using fossil fuels with CCS under development in Australia and these projects can provide additional assurance to buyers prioritising energy security in the near-term.

Box 6.1 Methods for producing clean hydrogen

There are two primary methods currently available for producing clean hydrogen:

- using renewable energy sources such as solar and wind power to split hydrogen from water using a process known as electrolysis; and,

- through a thermochemical reaction using water and fossil fuel feedstocks such as coal (coal gasification) or natural gas (steam methane reforming), with the CO2 emissions created as a by-product captured and stored in deep subsurface geological formations.

In 2022, global hydrogen usage continued to grow, reaching 95 Mt (IEA, 2023b). The majority of all hydrogen produced globally is derived from fossil fuels, without carbon capture and storage, and is responsible for the emission of at least 920 Mt of CO2 per year (IEA, 2023b). Current global production of clean hydrogen is minor (0.6 Mt), accounting for less than 1% of all hydrogen production in 2022 (IEA, 2023b).

Current policy settings of governments around the world call for clean hydrogen production to reach 27–35 Mt in 2030, while achieving Net Zero Emissions by 2050 requires approximately 80 Mt of clean hydrogen production in 2030. In 2023, the production capacity of all announced clean hydrogen projects globally amount to 38 Mt in 2030, a year-on-year increase of 50% (IEA, 2023b). Some 3.3 Mt of additional clean hydrogen production capacity globally is currently under construction or reached Final Investment Decision (IEA, 2023b).

Demand for hydrogen in Australia is still low; however, interest in this commodity is increasing. Examples of new opportunities for hydrogen use include chemical feedstock, for which renewable hydrogen and ammonia is used to replace fossil fuel-derived hydrogen. Hydrogen has potential to become a significant tradable energy commodity with shipping of hydrogen demonstrated by the Hydrogen Energy Supply Chain (HESC) project in 2022, where 3 tonnes of liquefied hydrogen was transported via ship from Australia to Japan (Department of Climate Change, Energy, the Environment and Water [DCCEEW], 2022). Ammonia is an attractive alternative transport vector for hydrogen due to its lower energy requirement to achieve liquefaction than liquid hydrogen. Ammonia is usually shipped in liquefied petroleum gas (LPG) carriers and there are 170 ships with the capability of carrying ammonia available today (Egerer et al., 2023). The international trade of ammonia is well established with ammonia terminals existing in some 200 harbours worldwide (Egerer et al., 2023). Converting ammonia back into hydrogen is energy intensive so countries are looking into options for direct use of ammonia (IEA, 2019).

Australia’s hydrogen potential

Australia’s hydrogen potential

Being recognised for its large potential for renewable energy generation, and with abundant identified resources of natural gas and coal, and potential large-scale geological storage sites for any coproduced CO2, Australia is well placed to become a major hydrogen producer for both domestic consumption and export. Development of a domestic hydrogen industry will not only ensure Australia’s future energy security, but also enable its abundant renewable and non-renewable energy resources to be transformed into a carbon free energy source for overseas markets. There is already significant interest in Australia’s future hydrogen production. Over $200 billion is currently in the investment pipeline for hydrogen and derivatives (DCCEEW, 2022). This represents 20 % of announced global renewable hydrogen projects (IEA, 2023b). However, as of December 2023 only one project greater than 10 MW capacity had passed Final Investment Decision (FID) (DCCEEW, 2022).

- Investment from Australian state/territory and federal governments is increasing, with over $8 billion of committed hydrogen specific support and over $35 billion of hydrogen eligible support through a range of programs, including the National Reconstruction Fund (DCCEEW, 2023b).

Geoscience Australia provides open access to data sets and digital tools to assist governments and industry to assess Australia’s hydrogen potential. One of these tools is the Hydrogen Economic Fairways Tool (HEFT). Released in 2021, it helps policymakers and investors make decisions about the location of new infrastructure and the development of hydrogen hubs. The tool conducts detailed geospatial-economic analysis of future large-scale hydrogen projects and considers hydrogen produced by renewable energy and from fossil fuels with CCS. The HEFT tool was recently expanded to model the feasibility of Green Steel in Australia.

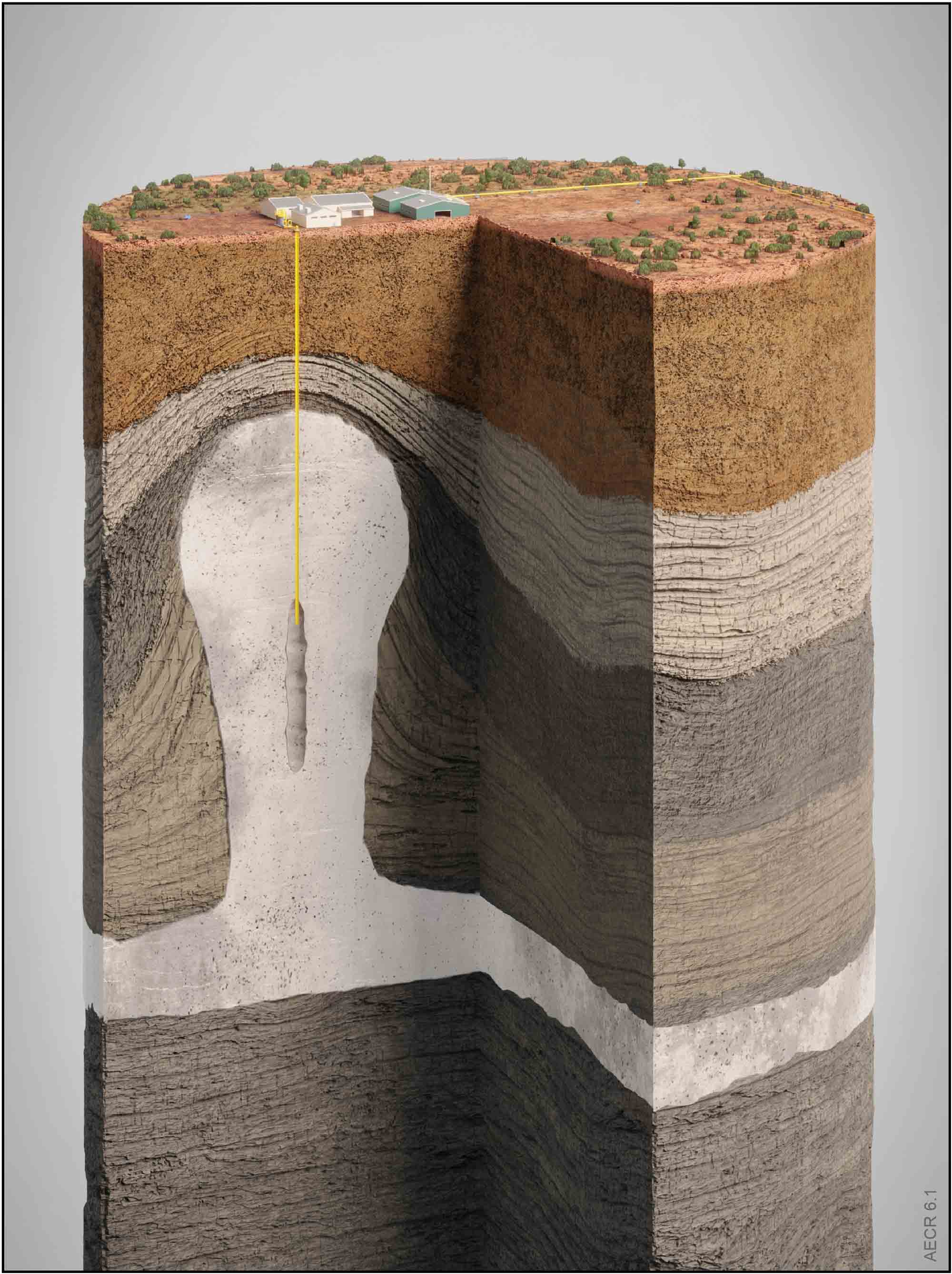

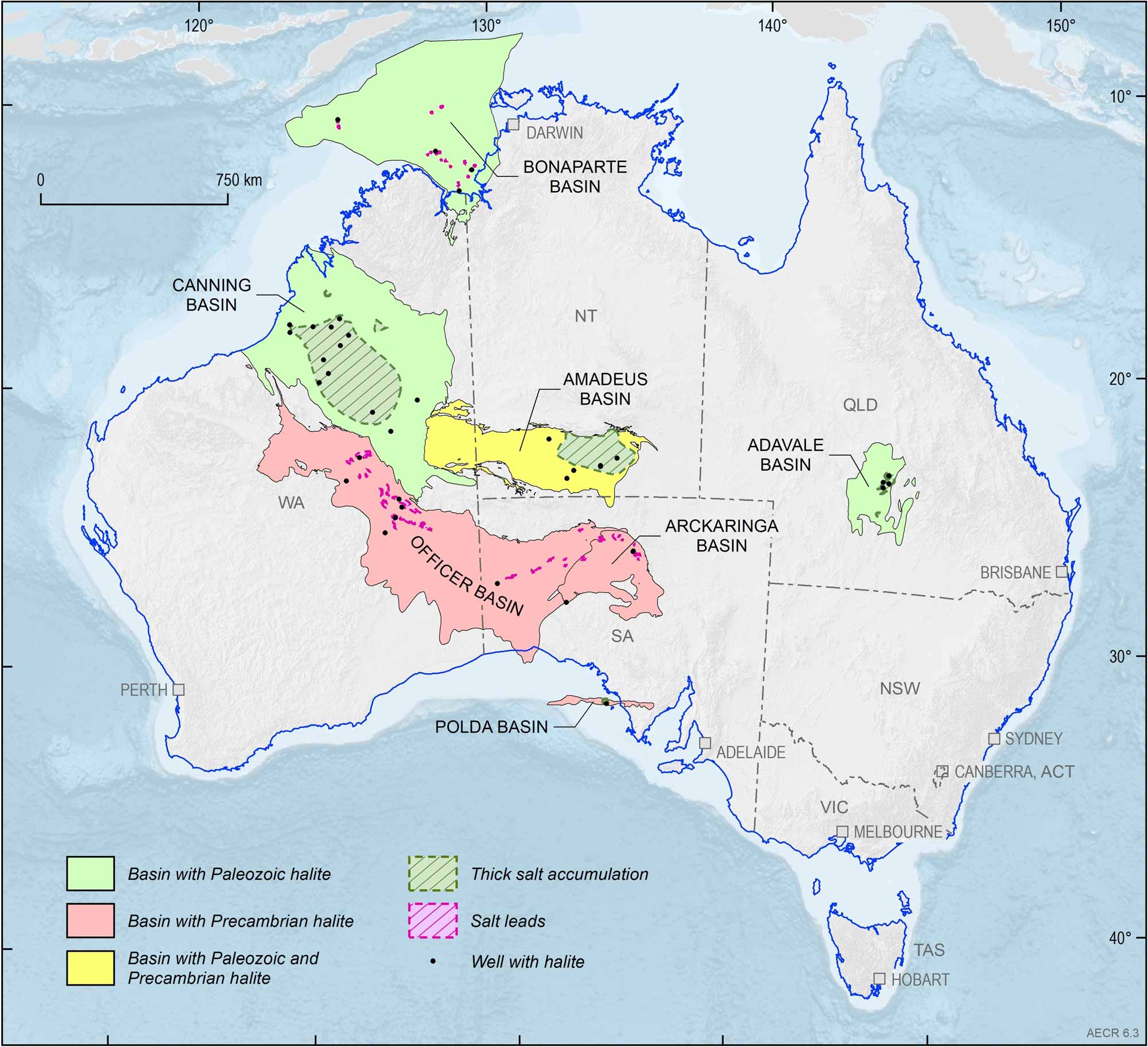

Storage of hydrogen is also an important aspect of energy production. Hydrogen can be stored in tanks on the surface, in subsurface salt caverns (Figure 6.1), or potentially depleted gas fields. Storage infrastructure is essential to enable hydrogen to be produced and stored during periods of low energy demand, then distributed to demand centres during periods of high energy consumption. Geoscience Australia recently mapped the distribution of thick underground rock salt accumulations, under its Exploring for the Future Program (Figure 6.2, Figure 6.3; Bradshaw et al., 2023). Regions with thick rock salt that may be prospective for salt cavern construction include the Adavale Basin in Queensland, Amadeus Basin in the Northern Territory, the Polda Basin offshore South Australia and Canning Basin in Western Australia. A recent feasibility study on underground hydrogen storage in a salt cavern in the Polda Basin estimated a single cavern could have an equivalent energy storage capacity of approximately 200 GWh (Rees et al., 2023). For comparison the Snowy 2.0 Project’s storage capacity will be approximately 350 GWh once operating (Snowy Hydro, 2023) and Australia’s largest operating battery storage facility, the Victorian Big Battery, has 0.45 GWh of energy capacity (AEMO, 2023).

Australia’s hydrogen projects

Australia’s hydrogen projects

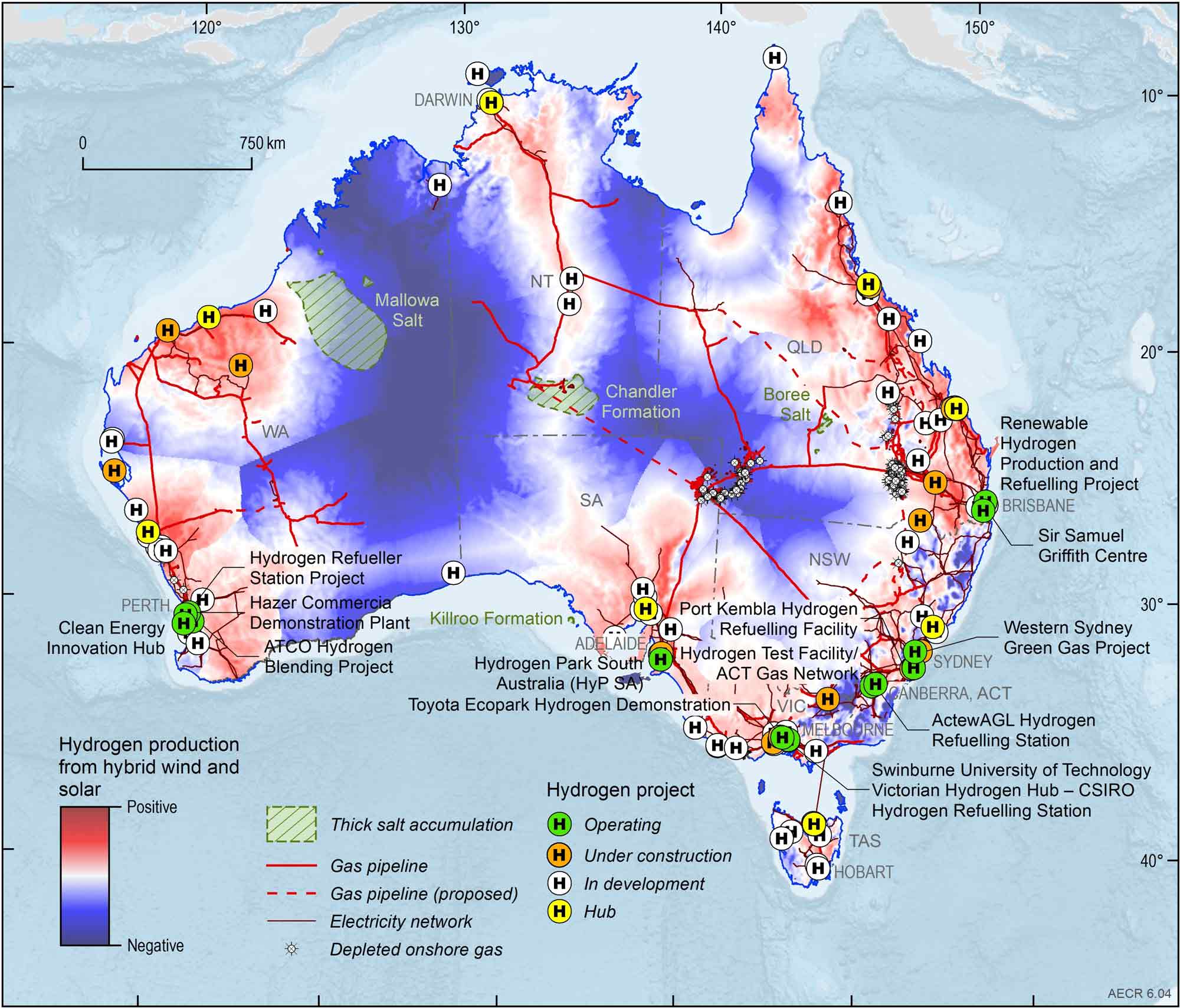

There are several pilot, demonstration and small-scale projects in various stages of operation in Australia. Figure 6.4 shows the location of current hydrogen projects in Australia compiled by CSIRO’s HyResource and the results of a mapping scenario using the HEFT tool that considers hydrogen production from electrolysis and hybrid wind and solar. In 2023, there was a decrease in the total number of hydrogen projects from 110 in 2022 to 104 in 2023 due to reclassification or rescoping of projects. However, the number of projects that are operational or under construction increased from 22 in 2022 to 31 in 2023. The combined production capacity of these projects (currently operational or under construction) is estimated as approximately 8.4 kt (1 PJ) per year (HyResource; CSIRO, 2023). Project sizes are still small with the largest operational project, Hydrogen Park South Australia (HyP SA), producing 175 tonnes per year from electrolysis using renewable energy. In terms of major projects, the total number of hydrogen projects under consideration increased from 48 in 2022 to 76 in 2023 (DISR, 2023).

Figure 6.4. Locations and status of hydrogen projects and proposed hydrogen hubs in Australia as of March 2023. Also shown are areas of high suitability for hybrid wind and solar hydrogen production in Australia, which were identified using the Hydrogen Economic Fairways Tool; and known thick salt accumulations that may provide potential hydrogen storage targets.

Natural hydrogen

Natural hydrogen

Australia is one of the most prospective countries for natural hydrogen. The extent of this geological resource is not well understood, but there are reports of high concentrations of hydrogen in gas samples in Australia (Boreham et al., 2021). Interest in natural hydrogen is increasing and some Australian state jurisdictions have started to amend their petroleum exploration licences to include natural hydrogen.

Table 6.1 Australia's reported natural hydrogen resources in 2023.

| Basin | Project | Hydrogen | Data source | |

|---|---|---|---|---|

| 2C Resources (PJ) | 2C Resources (Bcf) | |||

| Amadeus Basin | Mt Kitty | 7.9 | 22 | Central Petroleum Limited (2023) |

| Total | 8 | 22 | ||

Abbreviations

PJ= petajoules; Bcf = billion cubic feet.

References

References

AEMO (Australian Energy Market Operator), 2023. NEM Generation Information October 2023. (Last accessed June 2024)

Boreham C.J., Edwards D.S., Czado K., Rollet N., Wang L., van der Wielen S., Champion D., Blewett R., Feitz A., Henson P.A. 2021. Hydrogen in Australian natural gas: occurrences, sources and resources. The APPEA Journal 61, 163-191.

Bradshaw M., Rees S., Wang L., Szczepaniak M., Cook W., Voegeli S., Boreham C., Wainman C., Wong S., Southby C., Feitz A. 2023. Australian salt basins – options for underground hydrogen storage. The APPEA Journal 63, 285-304.

Central Petroleum Limited, 2023. Resource Estimates for Three Sub-salt Exploration Wells (Last accessed June 2024)

Commonwealth of Australia 2019. Australia’s National Hydrogen Strategy (Last accessed June 2024).

CSIRO (Commonwealth Scientific and Industrial Research Organisation), 2024. HyResource Projects spreadsheet, updates 11 May 2024. (Last accessed 17 May 2024)

DCCEEW (Department of Climate Change, Energy, the Environment and Water), 2022. State of Hydrogen, 2022 (Last accessed June 2024)

DCCEEW (Department of Climate Change, Energy, the Environment and Water), 2023a. Safeguard Mechanism. (Last accessed June 2024).

DCCEEW (Department of Climate Change, Energy, the Environment and Water), 2023b. HyResource - Funding. (Last accessed January 2024).

DISR (Department of Industry, Science and Resources), 2023. Resources and Energy Major Projects Report December 2023. (Last accessed January 2024).

Egerer, J., Grimm, V., Niazmand,K. and Runge, P. 2023. The economics of global green ammonia trade – “Shipping Australian wind and sunshine to Germany”. Applied Energy, Volume 334, 120662

HESC 2023. The world-first Hydrogen Energy Supply Chain (HESC) Project (Last accessed June 2024).

IEA (International Energy Agency) 2019. Ammonia Technology Roadmap Towards more sustainable nitrogen fertiliser production. IEA, Paris. (Last accessed June 2024)

IEA (International Energy Agency) 2023a. Energy systems overview tracking report: Hydrogen. IEA, Paris. (Last accessed June 2024)

IEA (International Energy Agency) 2023b. Global Hydrogen Review 2023. IEA, Paris. (Last accessed June 2024)

Snowy Hydro 2023. Snowy 2.0 Project Update, July 2023. Available at: https://www.snowyhydro.com.au/snowy-20/about/ (Last accessed June 2024)

Rees, S., Wang, L., Dewhurst, D., Feitz, A. 2023. Feasibility of underground hydrogen storage in a salt cavern in the Adavale Basin. Geoscience Australia, Canberra. (Last accessed June 2024)

Data download

Data download

Australia's Energy Commodity Resources Data Tables - 2022 reporting period