Australia's Identified Mineral Resources 2023 Commodity Summaries

Page last updated:22 March 2024

On this page

- Antimony

- Bauxite

- Black Coal

- Brown Coal

- Cobalt

- Copper

- Diamond

- Fluorine

- Gold

- Graphite

- Iron Ore

- Lead and Zinc

- Lithium, Tantalum and Niobium

- Magnesite

- Manganese Ore

- Mineral Sands

- Molybdenum

- Nickel

- Phosphate

- Platinum Group Elements

- Potash

- Rare Earth Elements

- Scandium

- Silver

- Tin

- Tungsten

- Uranium

- Vanadium

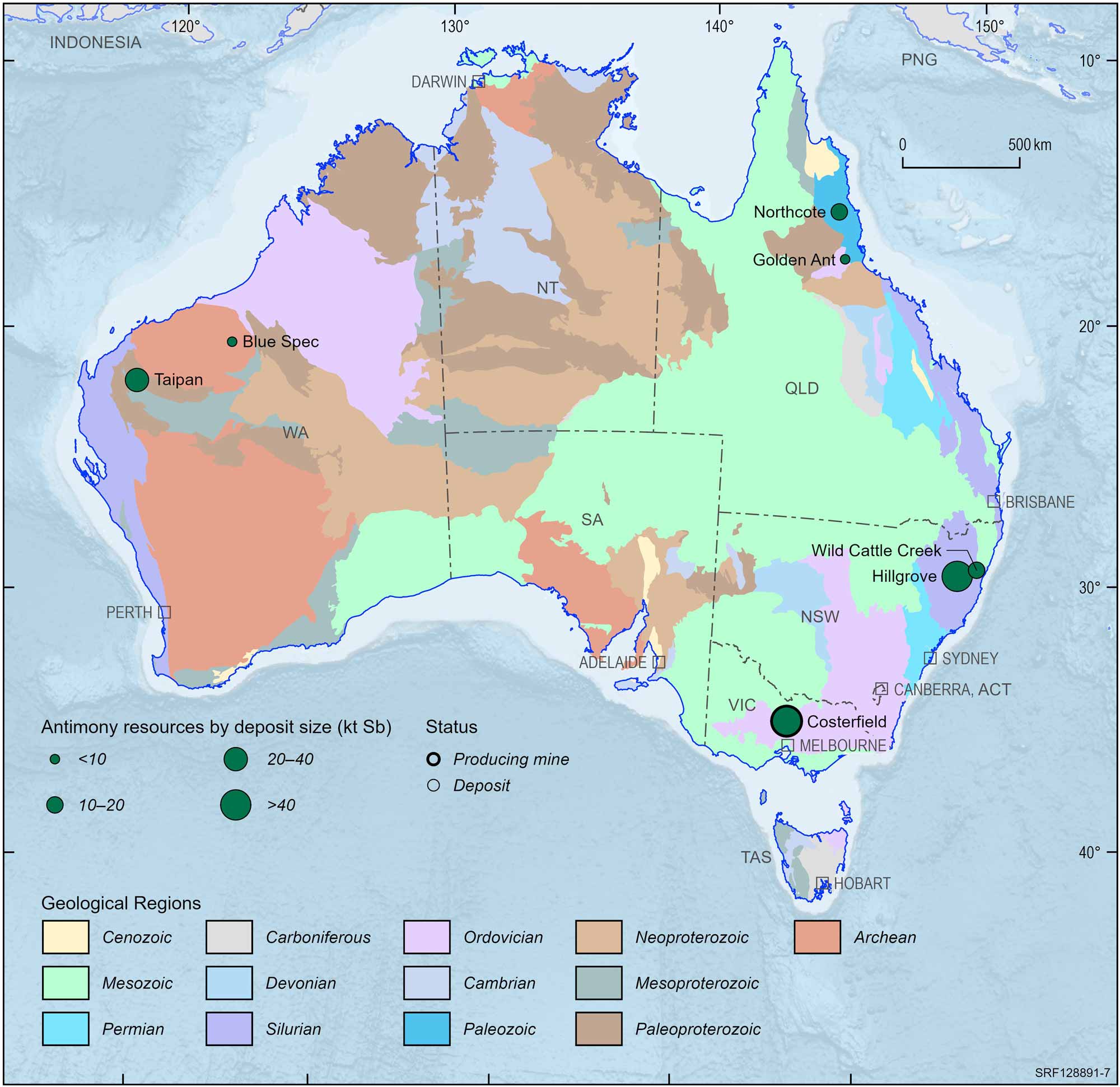

Antimony

| Critical Mineral | |

|

EDR 139.4 kt Sb ( 2%) | |

|

Ore Reserves 19.5 kt Sb ( 0%) | |

|

Operating Mines 1 | |

|

Production 2.3 kt Sb ( 32%) | |

|

Export Income n.a. |

| World Ranking | |

|

Resources 6 (7%) | |

|

Production 6 (2%) |

Major Uses:

Metal alloys, fire retardants, lead batteries, manufacturing solder, sheet and pipe metal, ammunition, bearings, castings and pewter.

Abbreviations

kt Sb – kilotonnes of antimony content; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

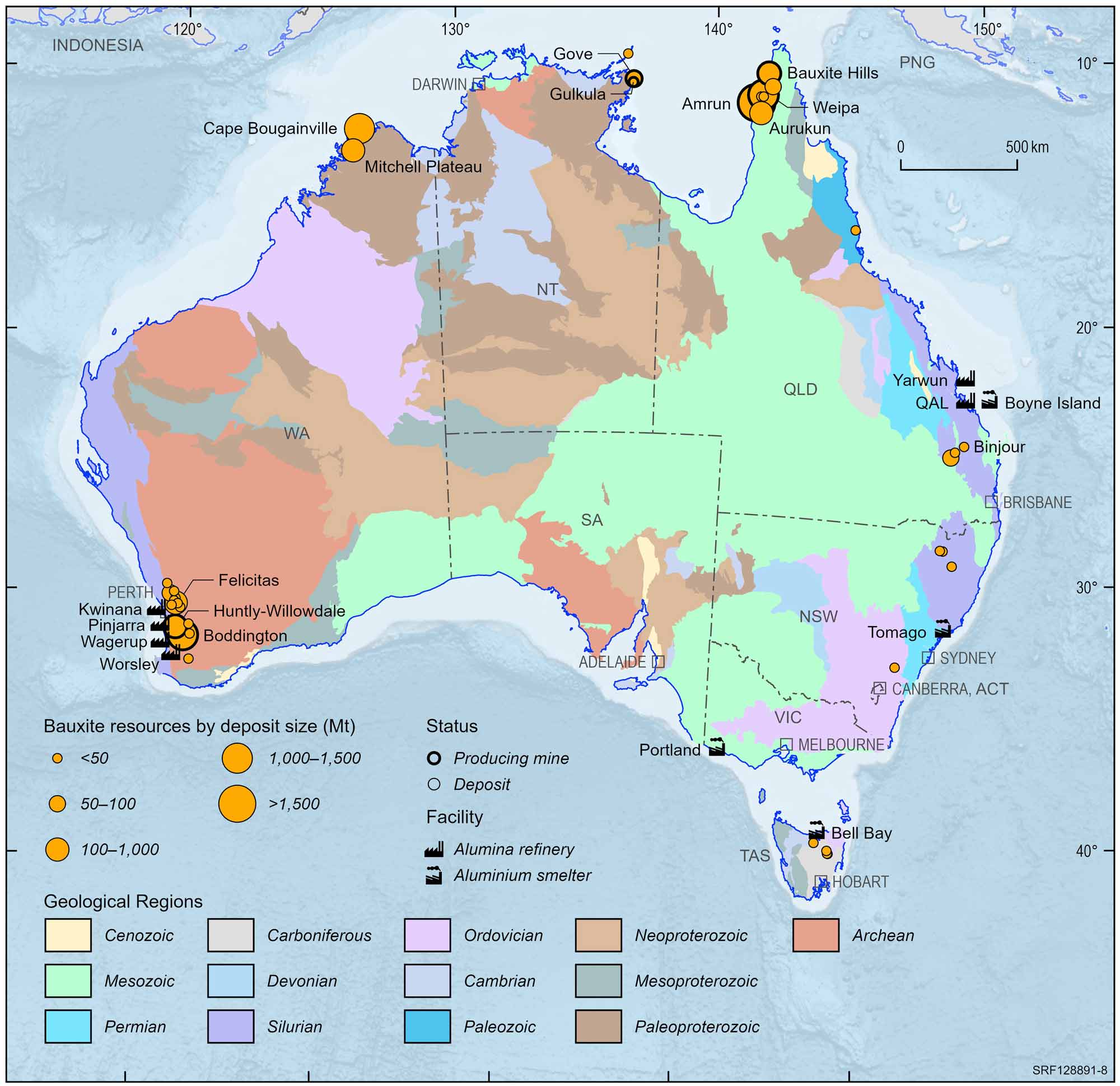

Bauxite

| Strategic Material | |

|

EDR 3,521 Mt ( 1%) | |

|

Ore Reserves 1,634 Mt ( 6%) | |

|

Operating Mines 9 | |

|

Production 102.3 Mt ( 1%) | |

|

Export Income $15,721 m ( 15%) |

| World Ranking | |

|

Resources 3 (12%) | |

|

Production 1 (27%) |

Major Uses:

Production of aluminium metal for use in buildings, aeronautics, electric vehicles, whitegoods, power lines, food storage and renewable energy technologies.

Abbreviations

Mt – million tonnes; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is the sum of bauxite, alumina and aluminum categories, sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

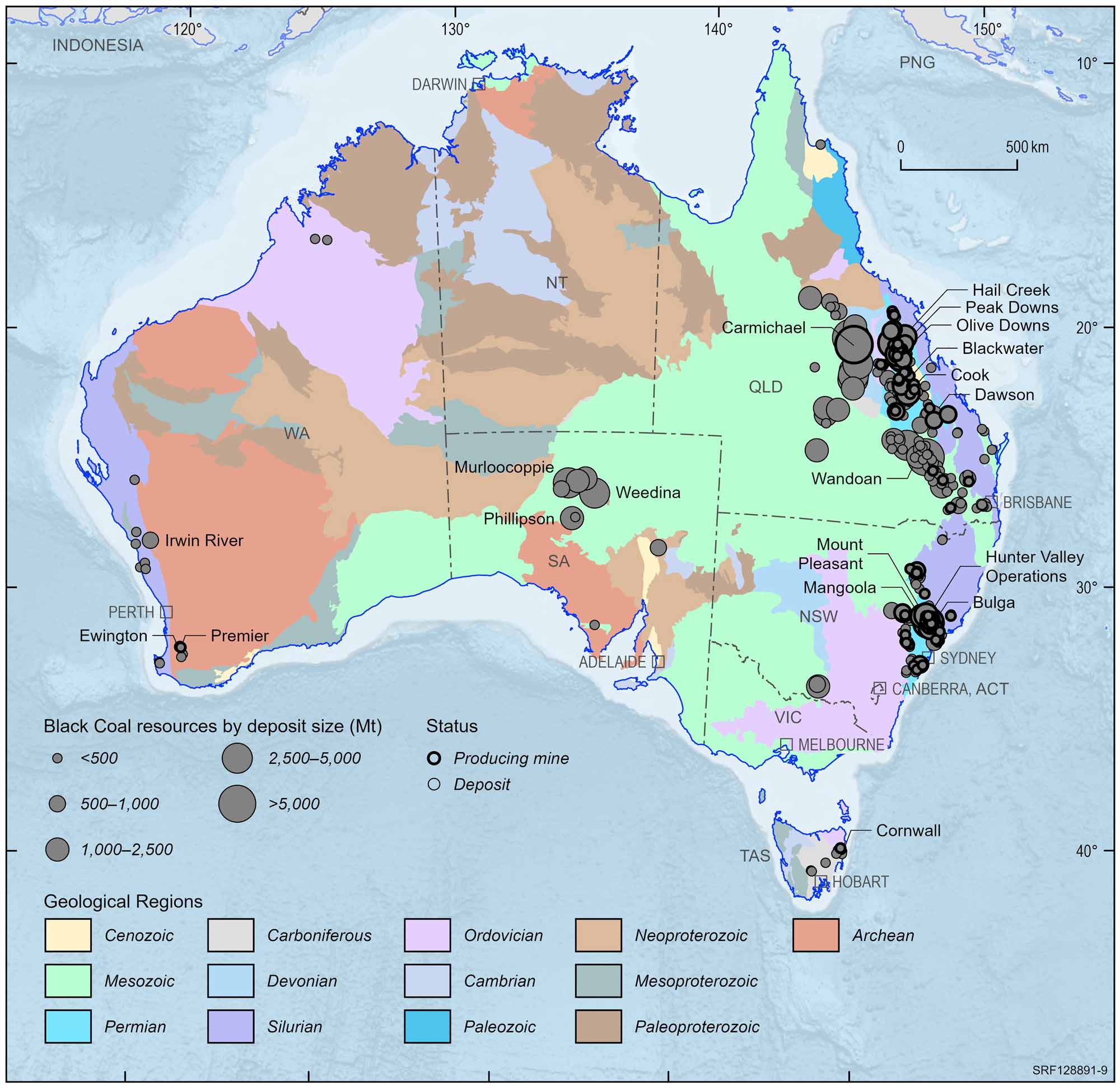

Black Coal

|

EDR 72,875 Mt ( 3%) | |

|

Ore Reserves 15,121 Mt ( 7%) |

|

Operating Mines 93 | |

|

Production 520 Mt ( 6%) | |

|

Export Income $142,345 m ( 124%) |

| World Ranking | |

|

Resources 4 (10%) | |

|

Production 5 (6%) |

Major Uses:

Electricity generation, steel making.

Abbreviations

Mt – million tonnes; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is the sum of thermal and coking coal categories, sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

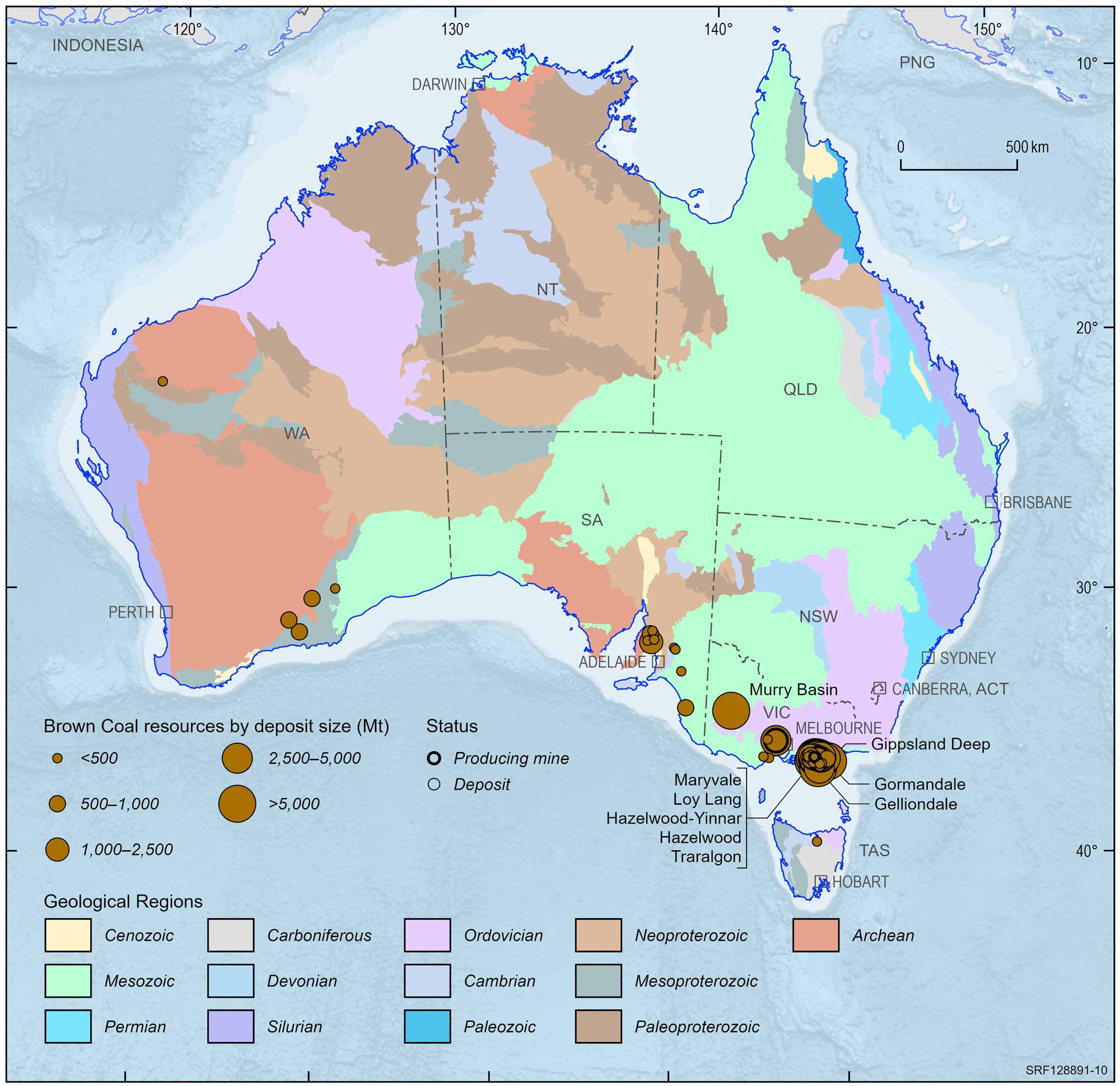

Brown Coal

|

EDR 74,039 Mt (0%) | |

|

Ore Reserves n.a. |

|

Operating Mines 3 | |

|

Production 39.1 Mt ( 9%) | |

|

Export Income $0 m (0%) |

| World Ranking | |

|

Resources 2 (23%) | |

|

Production 8 (4%) |

Major Uses:

Electricity generation, hydrogen generation.

Abbreviations

Mt – million tonnes; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

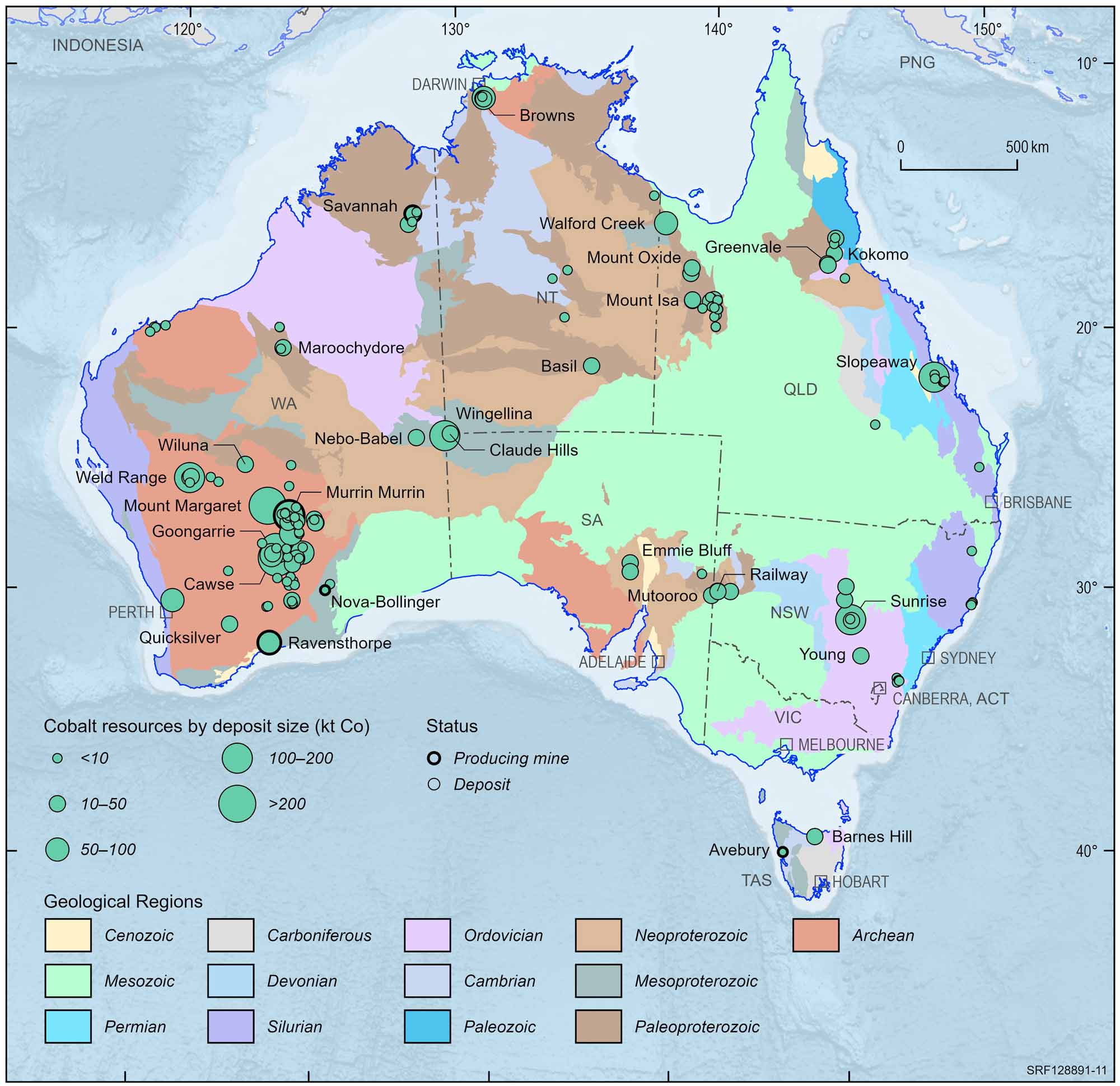

Cobalt

| Critical Mineral | |

|

EDR 1,742 kt Co ( 10%) | |

|

Ore Reserves 614 kt Co (0%) | |

|

Operating Mines 6 | |

|

Production 5.8 kt Co ( 9%) | |

|

Export Income $528 m ( 39%) |

| World Ranking | |

|

Resources 2 (19%) | |

|

Production 4 (3%) |

Major Uses:

Rechargeable battery electrodes in lithium-ion batteries, electric vehicles, superalloys, pigments, catalysts and magnets.

Abbreviations

kt Co – kilotonnes of cobalt content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income sourced from Department of Mines, Industry Regulation and Safety, Western Australian Government 2022 Major Commodities Resource Data File.

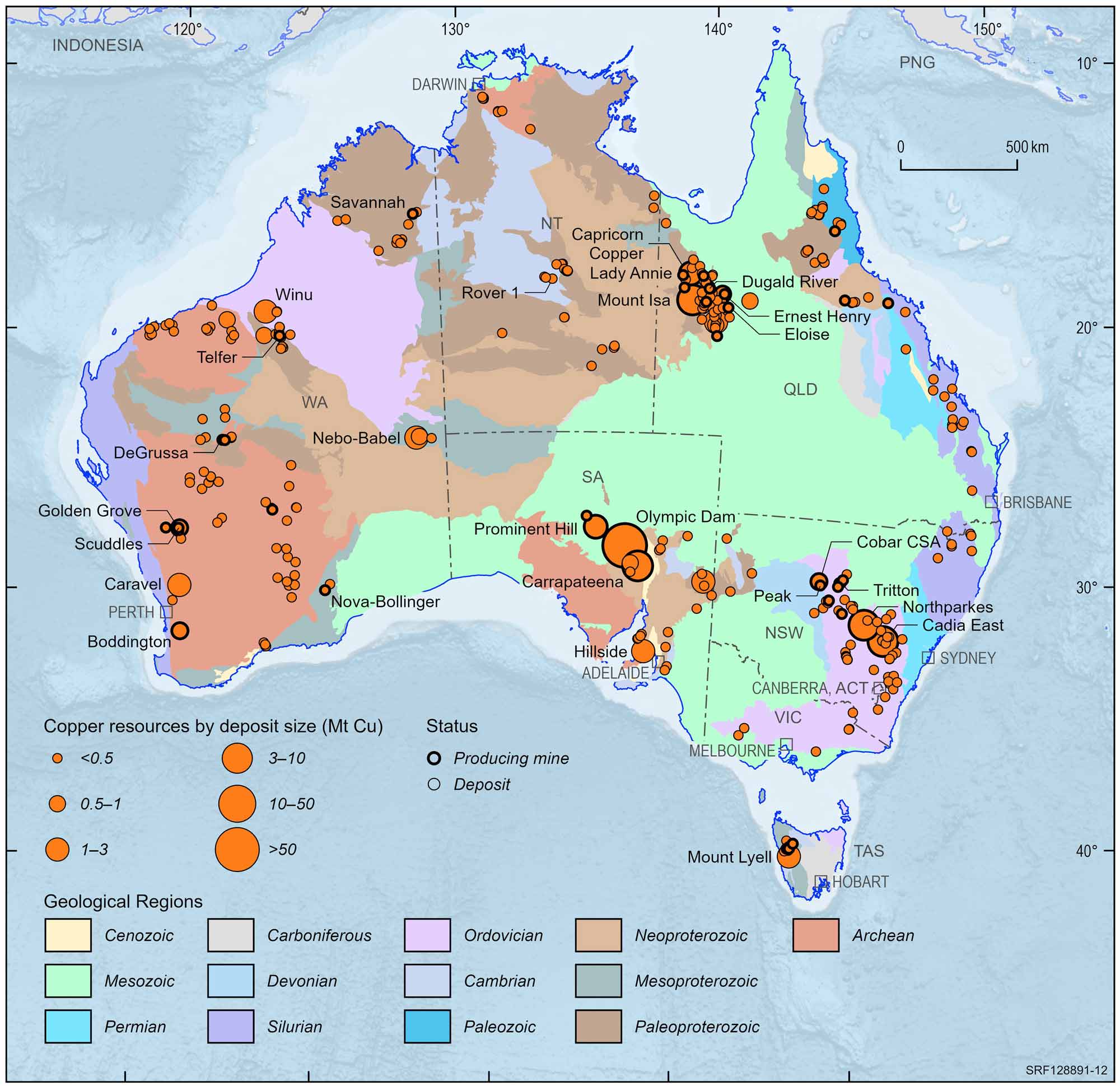

Copper

| Strategic Material | |

|

EDR 101.50 Mt Cu ( 1%) | |

|

Ore Reserves 27.43 Mt Cu ( 16%) | |

|

Operating Mines 36 | |

|

Production 0.82 Mt Cu (0%) | |

|

Export Income $12,402 m ( 14%) |

| World Ranking | |

|

Resources 2 (11%) | |

|

Production 8 (4%) |

Major Uses:

Electricity distribution, electrical equipment and devices, plumbing, industrial machinery, interior fixtures, wind turbines, solar panels, electromagnets and the transport industry including electric vehicles.

Abbreviations

Mt Cu – million tonnes of copper content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is the sum of refined and ore/concentrate categories, sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

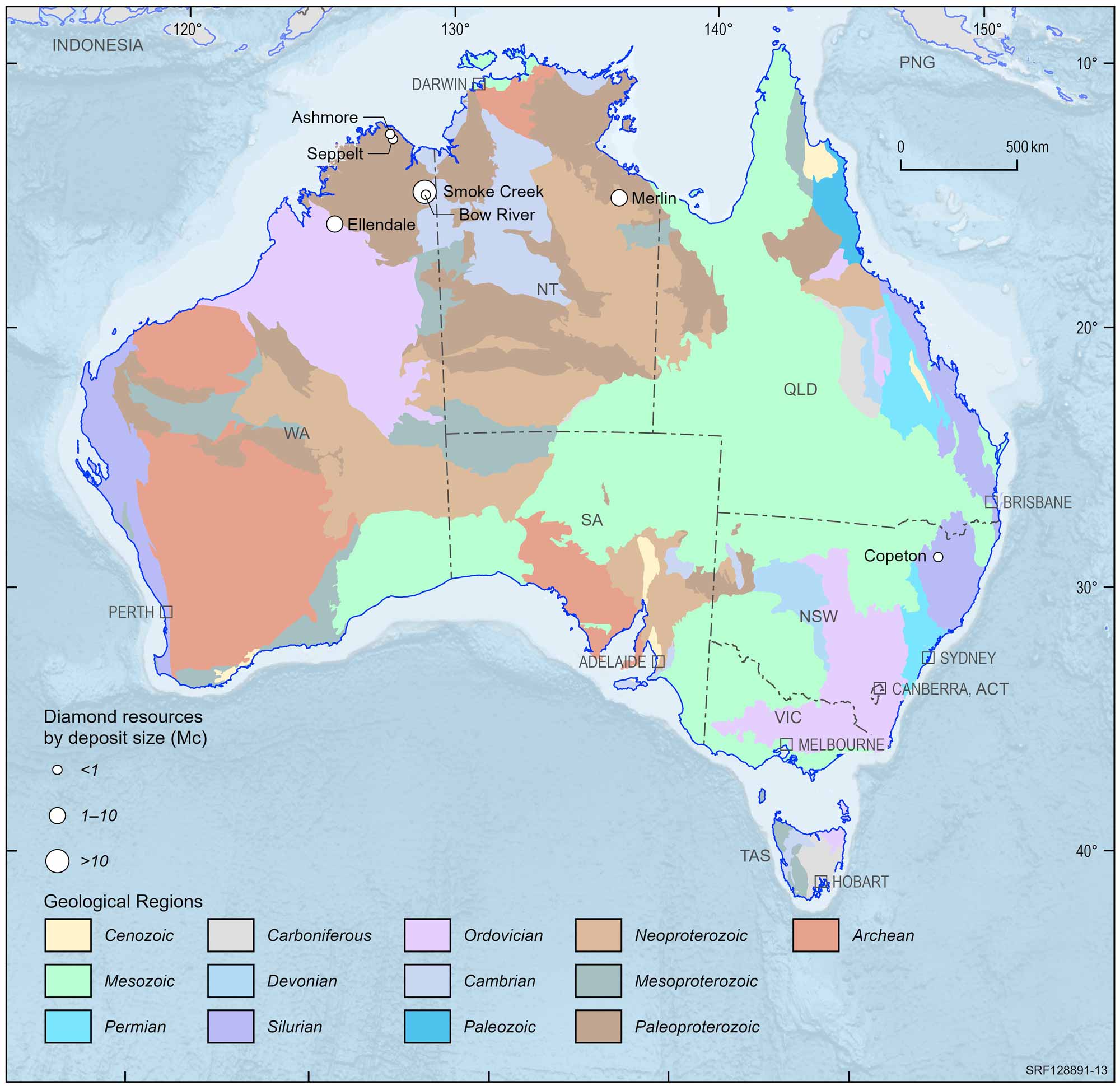

Diamond

|

EDR 1.28 Mc (0%) | |

|

Ore Reserves 0 Mc (0%) |

|

Operating Mines 0 | |

|

Production 0 Mc (0%) | |

|

Export Income $154 m ( 34%) |

| World Ranking | |

|

Resources minor | |

|

Production 0 (0%) |

Major Uses:

Jewellery, industrial cutting equipment, diamond machine tools, rock drilling bits, diamond polishing powders and compounds.

Abbreviations

Mc – million carats; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is the sum of unsorted and gem categories, sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

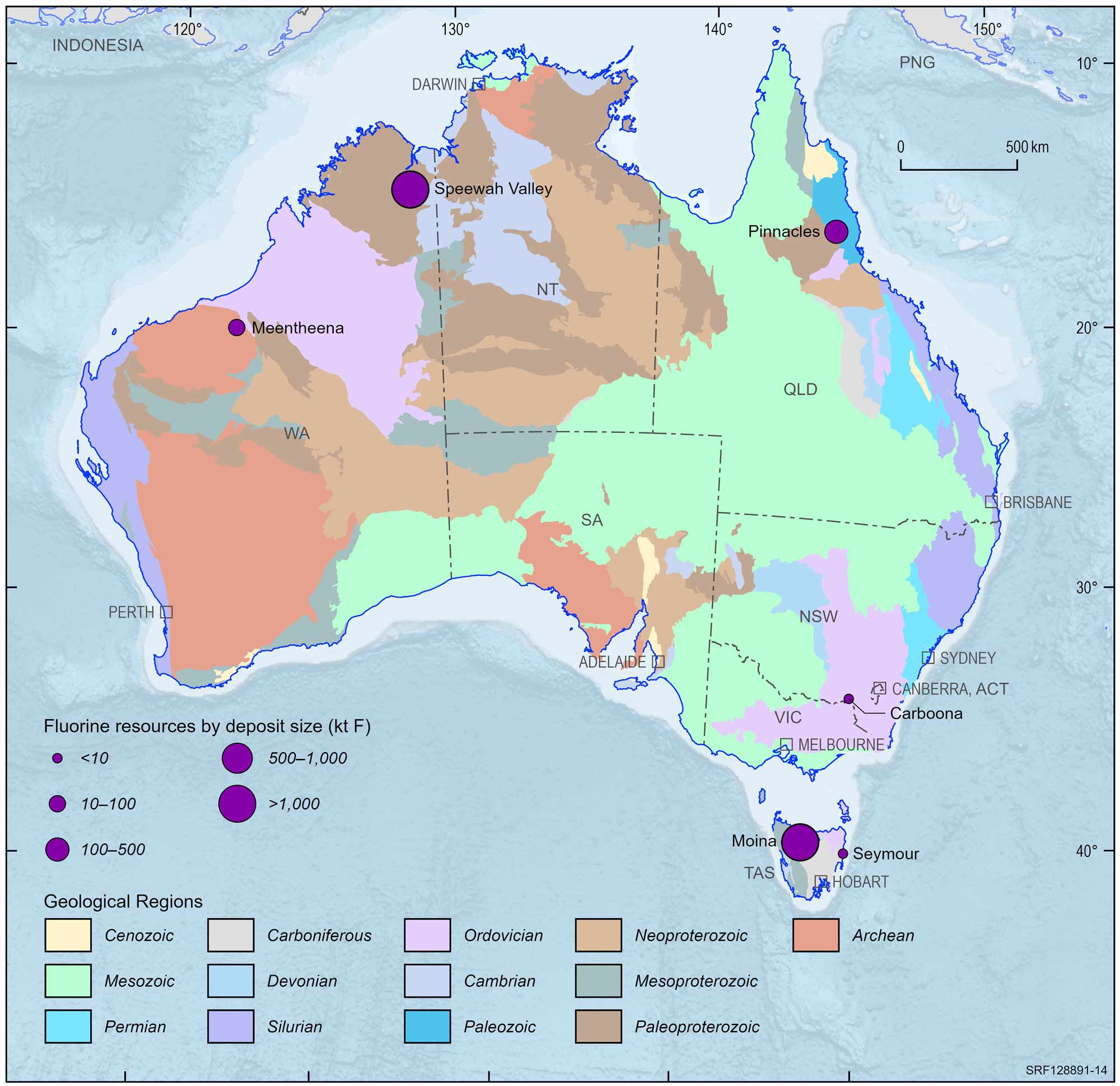

Fluorine

| Critical Mineral | |

|

EDR 343 kt F (0%) | |

|

Ore Reserves 0 kt F (0%) | |

|

Operating Mines 0 | |

|

Production 0 kt F (0%) | |

|

Export Income $0 m (0%) |

| World Ranking | |

|

Resources 9 (minor) | |

|

Production 0 (0%) |

Major Uses:

Welding, the nuclear energy industry, plastics such as Teflon, an additive to water supplies and toothpaste to prevent tooth decay. Used in semiconductor manufacture and solar photovoltaic cells.

Abbreviations

kt F – kilotonnes of Fluorine content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

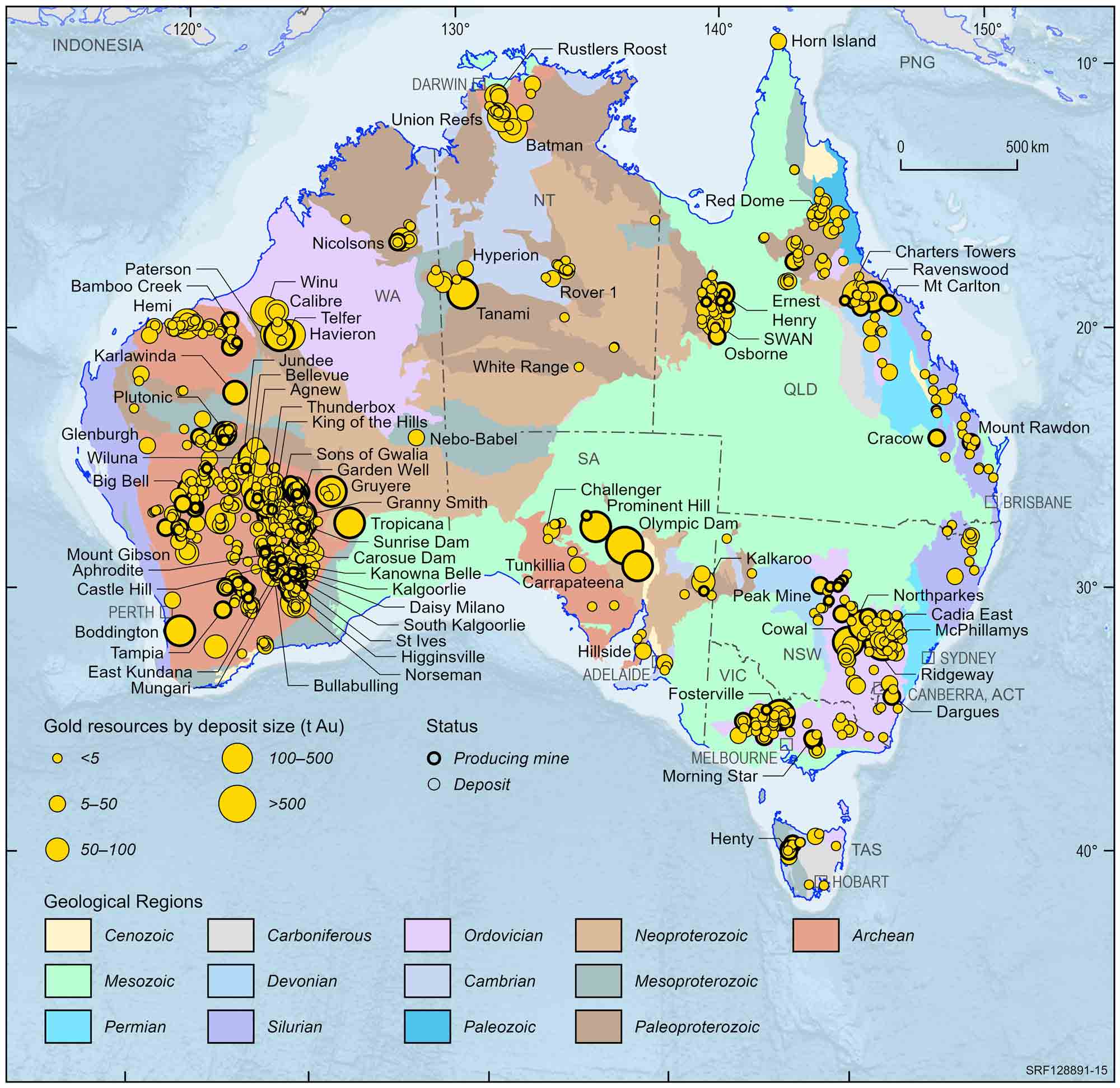

Gold

|

EDR 12,159 t Au ( 1%) | |

|

Ore Reserves 4,648 t Au ( 3%) |

|

Operating Mines 160 | |

|

Production 306 t Au (0%) | |

|

Export Income $23,508 m ( 1%) |

| World Ranking | |

|

Resources 1 (22%) | |

|

Production 3 (10%) |

Major Uses:

Jewellery, storing monetary value, personal electronic devices, computers, dentistry and aerospace industries.

Abbreviations

t Au – tonnes of gold content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

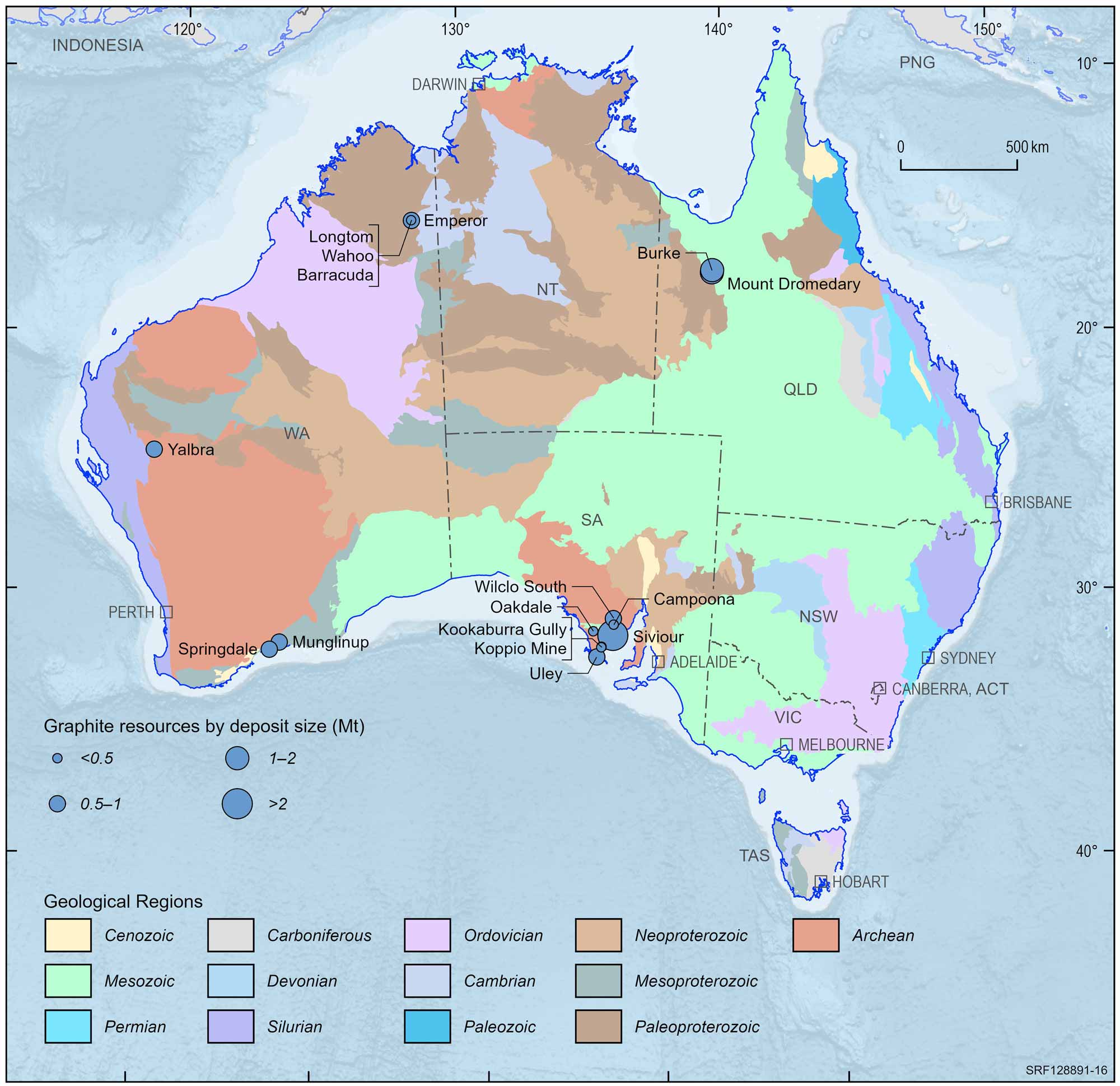

Graphite

| Critical Mineral | |

|

EDR 8.5 Mt ( 6%) | |

|

Ore Reserves 5.00 Mt (0%) | |

|

Operating Mines 0 | |

|

Production 0 Mt (0%) | |

|

Export Income $0 m (0%) |

| World Ranking | |

|

Resources 8 (3%) | |

|

Production 0 (0%) |

Major Uses:

Anode component of lithium-ion batteries, refractory materials, lubricants and pencils.

Abbreviations

Mt – million tonnes; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

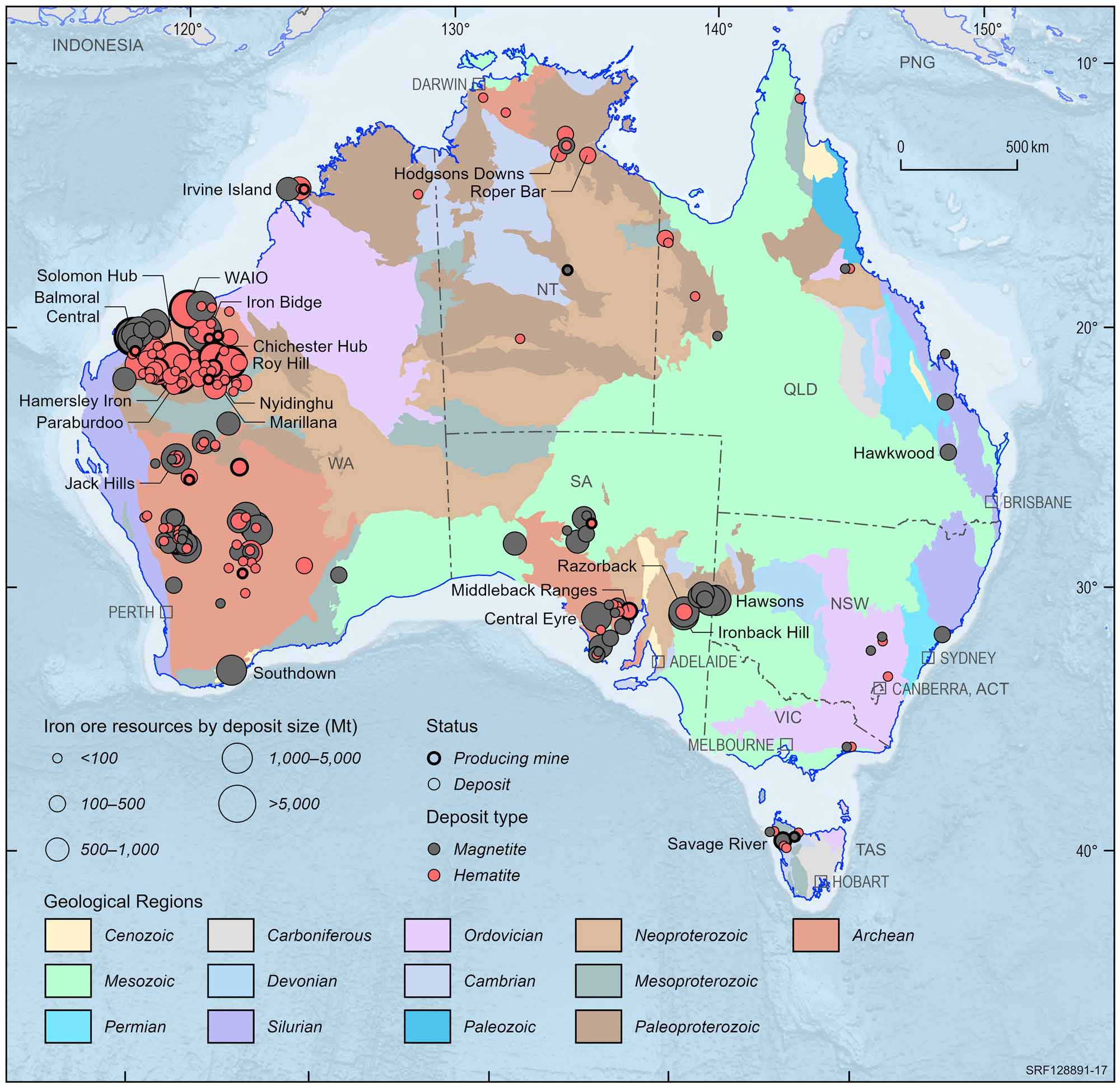

Iron Ore

|

EDR 58,286 Mt ( 3%) | |

|

Ore Reserves 22,729 Mt ( 1%) |

|

Operating Mines 41 | |

|

Production 945 Mt ( 2%) | |

|

Export Income $126,709 m ( 19%) |

| World Ranking | |

|

Resources 1 (31%) | |

|

Production 1 (35%) |

Major Uses:

Steel and stainless steel manufacture, civil engineering, transport, cast iron, magnets and alloys.

Abbreviations

Mt – million tonnes; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is the sum of ore, crude steel and scrap categories, sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

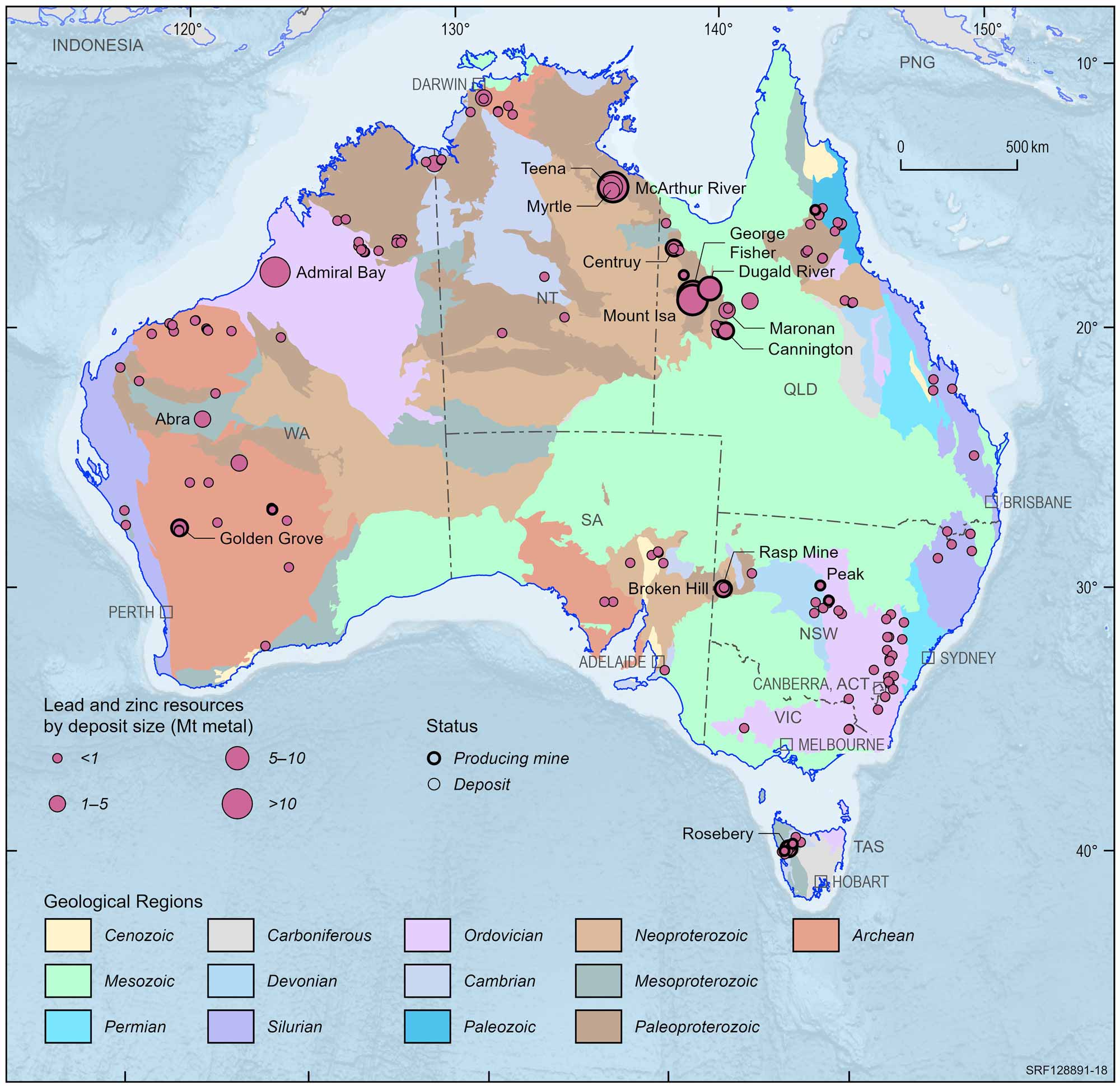

Lead and Zinc

Lead

|

EDR 34.81 Mt Pb ( 3%) | |

|

Ore Reserves 10.22 Mt Pb ( 1%) |

|

Operating Mines 15 | |

|

Production 0.44 Mt Pb ( 10%) | |

|

Export Income $1,763 m ( 9%) |

| World Ranking | |

|

Resources 1 (42%) | |

|

Production 2 (10%) |

Major Uses:

Batteries, underwater cable sheathing, solder, casting alloys, chemical compounds, weighting and radiation protection.

Abbreviations

Mt Pb – million tonnes of lead content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is the sum of bullion, refined and concentrate categories, sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

Zinc

| Strategic Material | |

|

EDR 64.30 Mt Zn ( 3%) | |

|

Ore Reserves 21.12 Mt Zn ( 10%) | |

|

Operating Mines 17 | |

|

Production 1.24 Mt Zn ( 6%) | |

|

Export Income $4,668 m ( 15%) |

| World Ranking | |

|

Resources 1 (31%) | |

|

Production 3 (10) |

Major Uses:

Galvanised steel for construction and transport industries, die-casts, brass, chemicals, cosmetics, pharmaceuticals and electrical equipment.

Abbreviations

Mt Zn – million tonnes of zinc content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is the sum of refined and ore/concentrate categories, sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

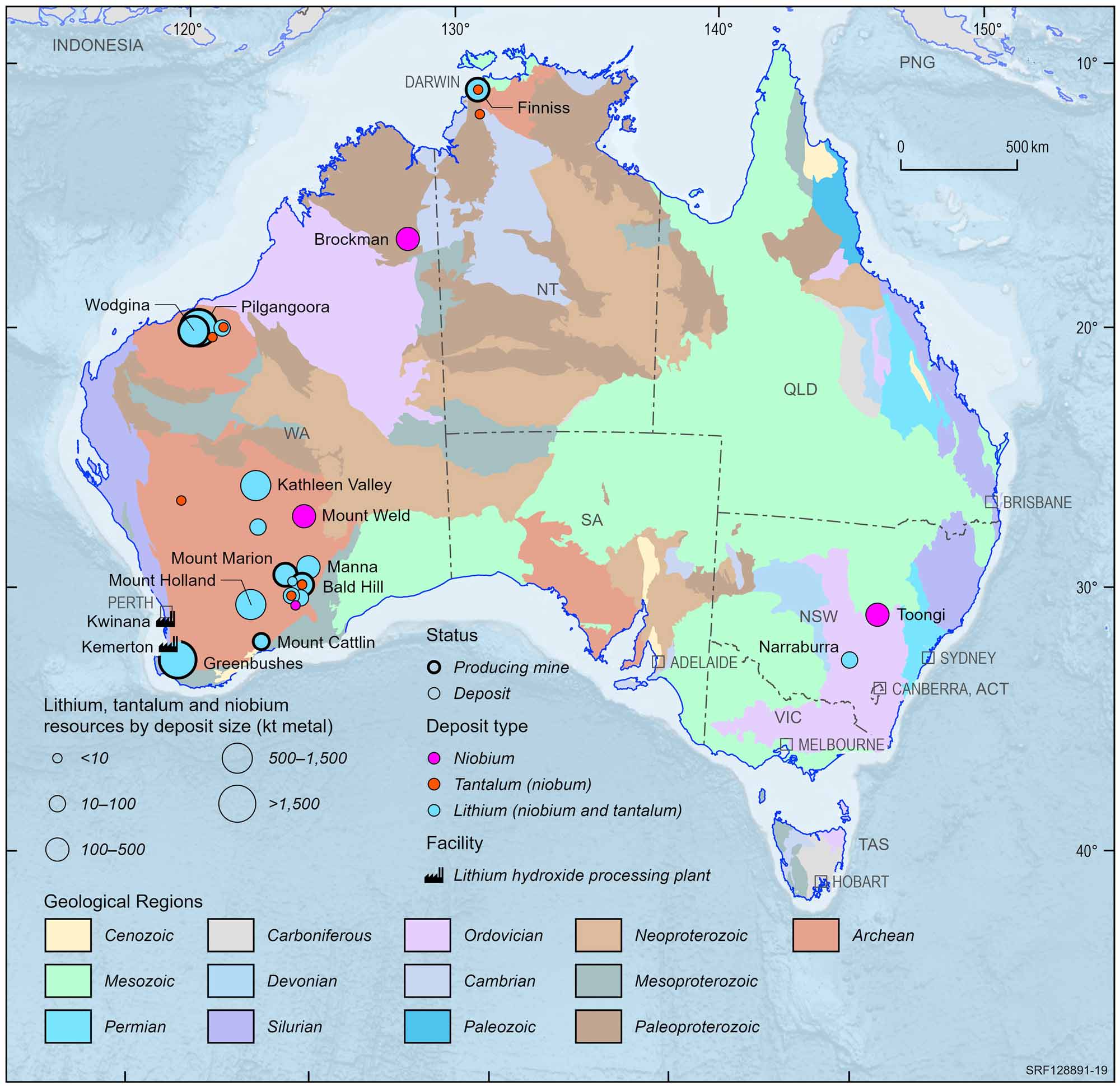

Lithium, Tantalum and Niobium

Lithium

| Critical Mineral | |

|

EDR 7,046 kt Li ( 5%) | |

|

Ore Reserves 4,794 kt Li ( 5%) | |

|

Operating Mines 7 | |

|

Production 75 kt Li ( 36%) | |

|

Export Income $12,125 m ( 642%) |

| World Ranking | |

|

Resources 2 (26%) | |

|

Production 1 (52%) |

Major Uses:

Lithium-ion batteries in electric vehicles and mobile devices, ceramics and glass.

Abbreviations

kt Li – kilotonnes of lithium content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is the sum of spodumene ore and concentrate sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

Tantalum

| Critical Mineral | |

|

EDR 110.0 kt Ta ( 5%) | |

|

Ore Reserves 28.0 kt Ta ( 44%) | |

|

Operating Mines 2 | |

|

Production 0.1 kt Ta (0%) | |

|

Export Income n.a. |

| World Ranking | |

|

Resources unknown | |

|

Production 5 (4%) |

Major Uses:

Capacitors for the electronics and telecommunications industry, resistors, semiconductors, alloys and superalloys, medical and dental applications and chemical process industries.

Abbreviations

kt Ta – kilotonnes of tantalum content; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

Niobium

| Critical Mineral | |

|

EDR 216 kt Nb (0%) | |

|

Ore Reserves 58 kt Nb (0%) | |

|

Operating Mines 0 | |

|

Production n.a. | |

|

Export Income n.a. |

| World Ranking | |

|

Resources unknown | |

|

Production unknown |

Major Uses:

Micro alloy with iron for use in the construction and automotive industries, superalloys used in aeronautics and energy industries, magnetic resonance imaging (MRI) scanners, nuclear magnetic resonance (NMR) equipment, glass, jewellery, prosthetics and medical implants.

Abbreviations

kt Nb – kilotonnes of niobium content; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

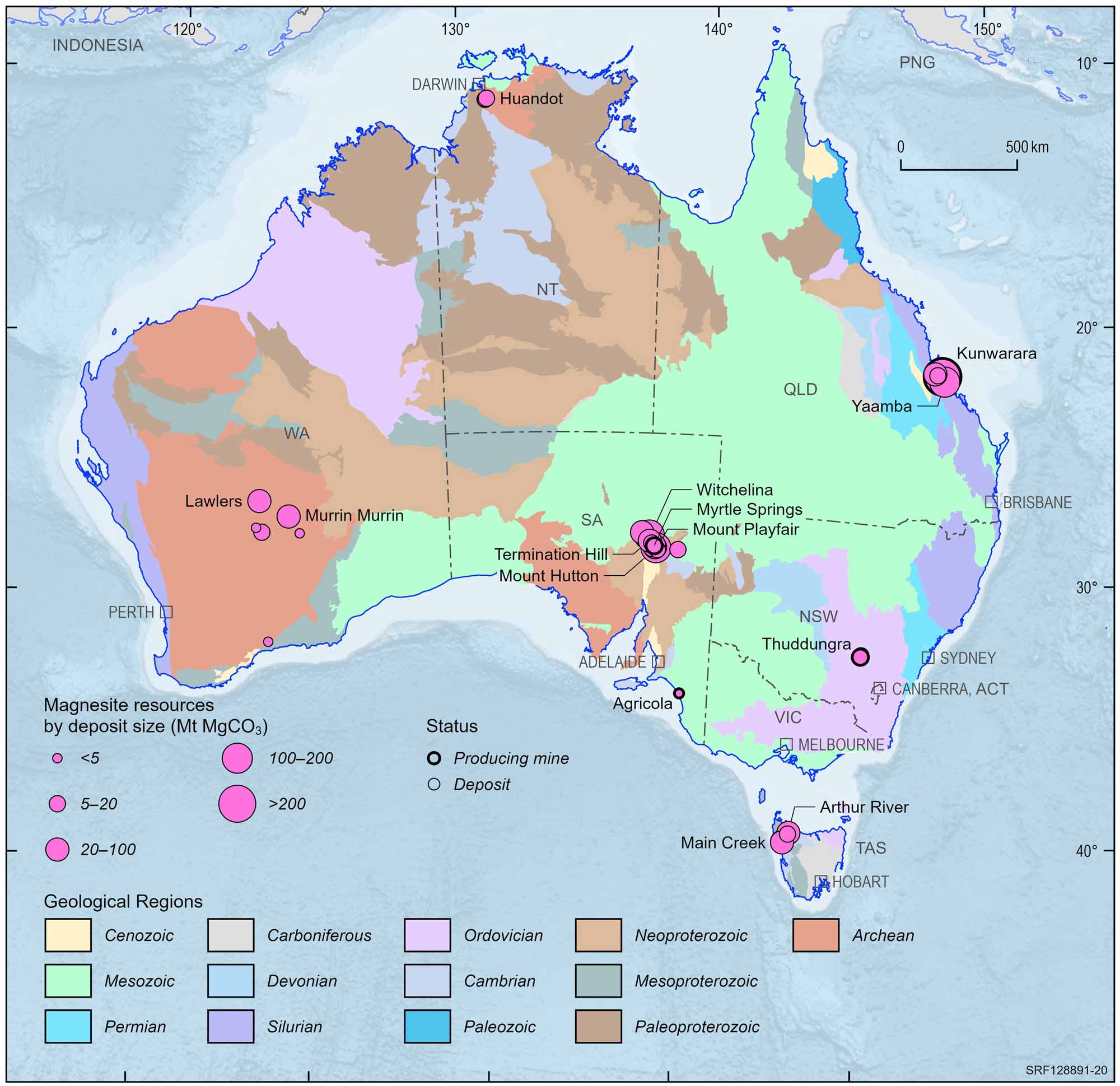

Magnesite

| Critical Mineral | |

|

EDR 284 Mt MgCO3 ( 2%) | |

|

Ore Reserves 37 Mt MgCO3 (0%) | |

|

Operating Mines 4 | |

|

Production 0.5 Mt MgCO3 ( 44%) | |

|

Export Income $44.7 m ( 25%) |

| World Ranking | |

|

Resources 4 (4%) | |

|

Production 9 (2%) |

Major Uses:

Used to produce magnesium oxide (MgO) for use as a refractory material in the steel industry, animal feeds and fertilisers, flooring compounds, flame retardants and the pharmaceutical industry.

Abbreviations

Mt MgCO3 – million tonnes of magnesium carbonate (magnesite) content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income from the South Australia Department for Energy and Mining (Report Book 2023/00034) and confidential data from the Queensland Department of Natural Resources and Mines.

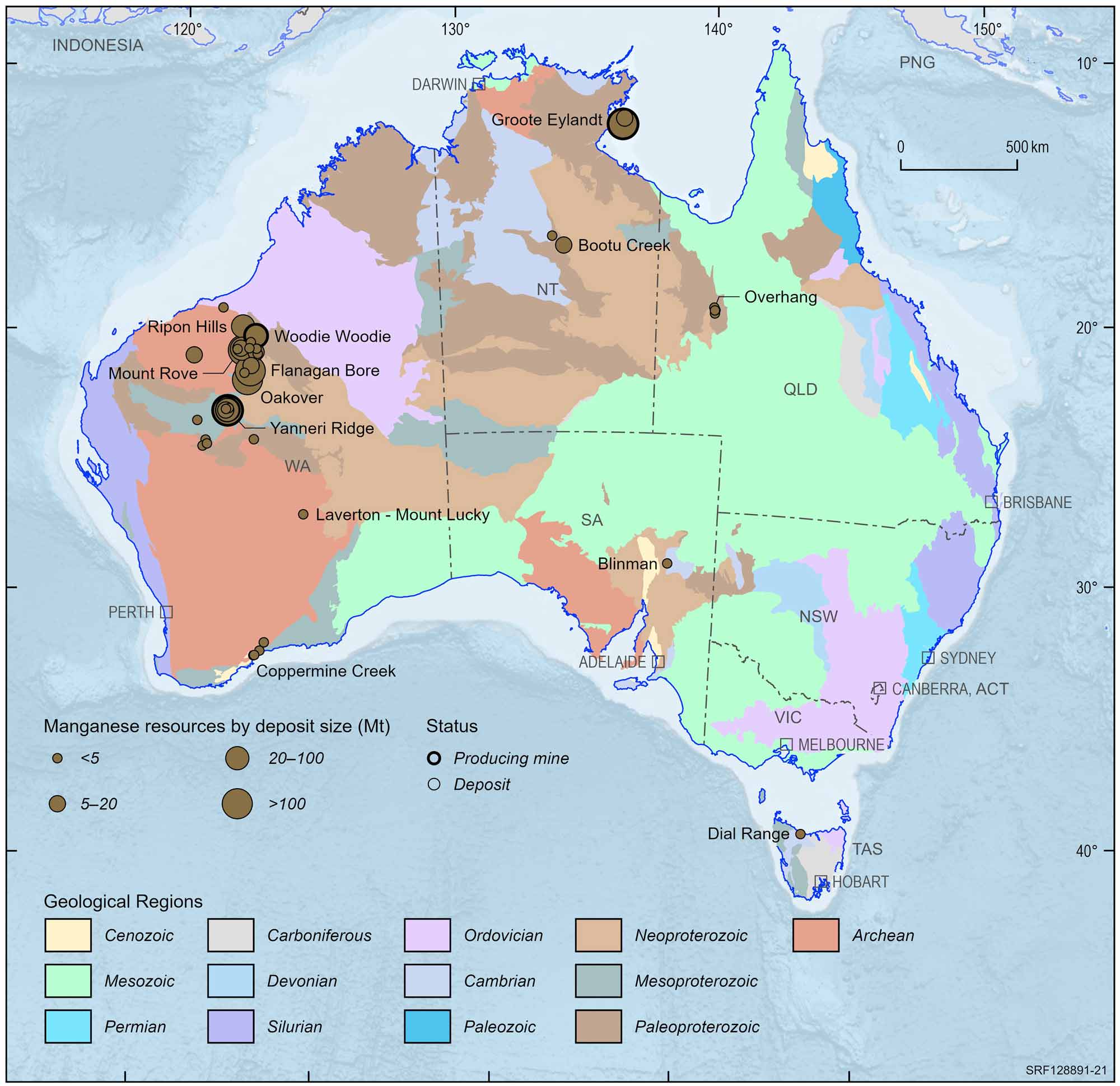

Manganese Ore

| Critical Mineral | |

|

EDR 496 Mt ( 79%) | |

|

Ore Reserves 109 Mt ( 9%) | |

|

Operating Mines 3 | |

|

Production 4.5 Mt ( 8%) | |

|

Export Income >$2,051 m ( >40%) |

| World Ranking | |

|

Resources 4 (16%) | |

|

Production 3 (10%) |

Major Uses:

Alloying agent for steel manufacture, rechargeable electric vehicle batteries, plant fertilisers, animal feeds, glass and ceramics.

Abbreviations

Mt – million tonnes; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Available export income sourced from the Department of Mines, Industry Regulation and Safety, Western Australian Government 2022 Major Commodities Resource Data File and the Northern Territory Department of Industry Tourism and Trade, 2022 Northern Territory Mining Production.

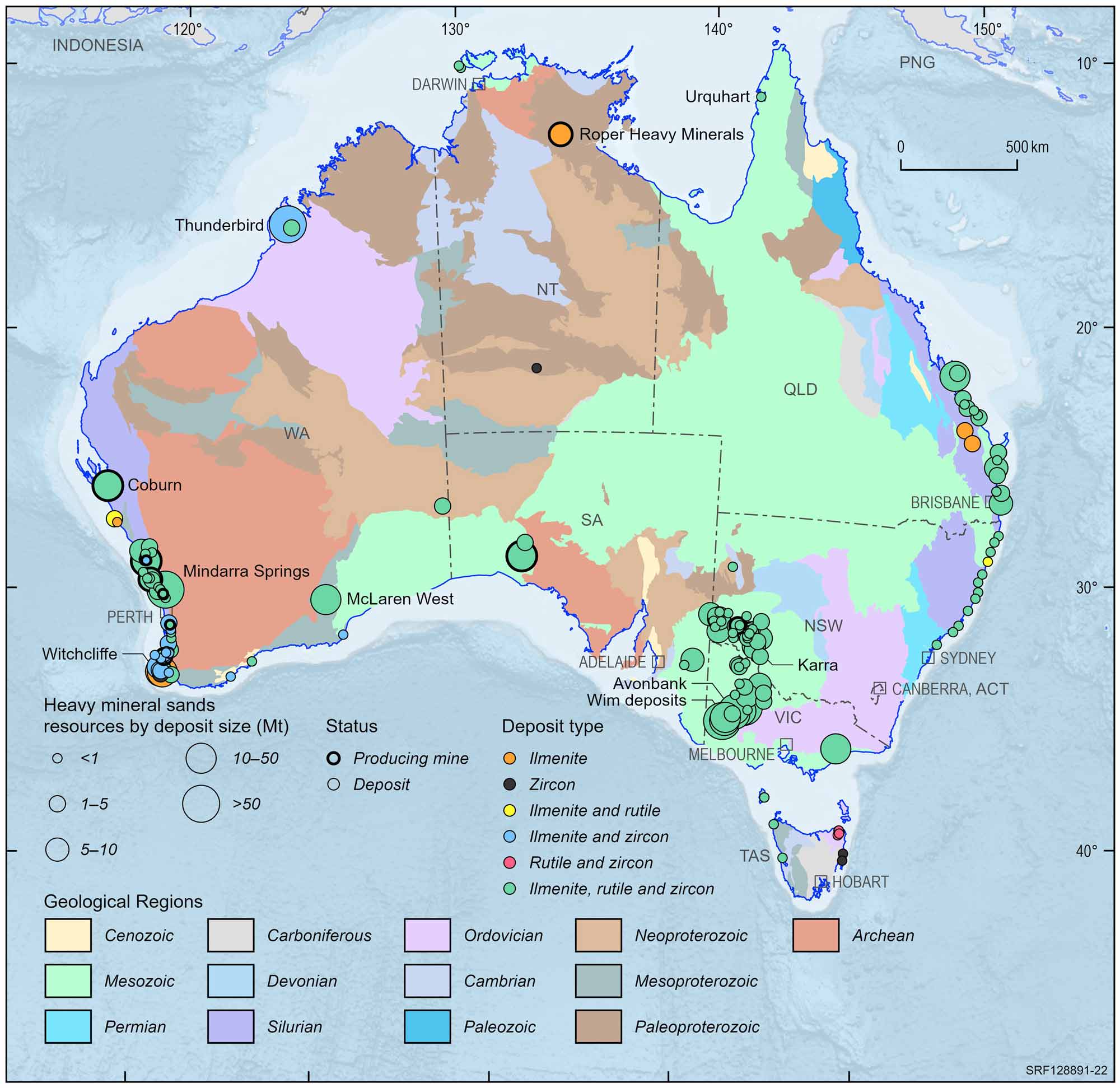

Mineral Sands

Ilmenite

| Critical Mineral | |

|

EDR 303.3 Mt ( 11%) | |

|

Ore Reserves 72.1 Mt ( 2%) | |

|

Operating Mines 11 | |

|

Production 0.7 Mt ( 34%) | |

|

Export Income n.a. |

| World Ranking | |

|

Resources 2 (27%) | |

|

Production 6 (5%) |

Major Uses:

Main source of titanium dioxide which is used in paints, plastics, fabrics, rubber, textiles, paper, sunscreen, cosmetics and as fluxing agents.

Abbreviations

Mt – million tonnes; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

Rutile

| Critical Mineral | |

|

EDR 39.0 Mt ( 15%) | |

|

Ore Reserves 12.1 Mt ( 6%) | |

|

Operating Mines 8 | |

|

Production 0.2 M ( 5%) | |

|

Export Income n.a. |

| World Ranking | |

|

Resources 1 (65%) | |

|

Production 1 (27%) |

Major Uses:

Production of titanium metals for aircraft, spacecraft, vehicles, surgical implants, sports equipment, desalination plants, and general industrial equipment.

Abbreviations

Mt – million tonnes; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

Zircon

| Critical Mineral | |

|

EDR 88.3 Mt ( 12%) | |

|

Ore Reserves 30.6 Mt ( 5%) | |

|

Operating Mines 10 | |

|

Production 0.5 Mt ( 10%) | |

|

Export Income n.a. |

| World Ranking | |

|

Resources 1 (74%) | |

|

Production 2 (25%) |

Major Uses:

Used as an opacifier for glazes on ceramic tiles, in refractories and for the foundry industry, nuclear reactors, superconducting magnets, chemical industries and cosmetics.

Abbreviations

Mt – million tonnes; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

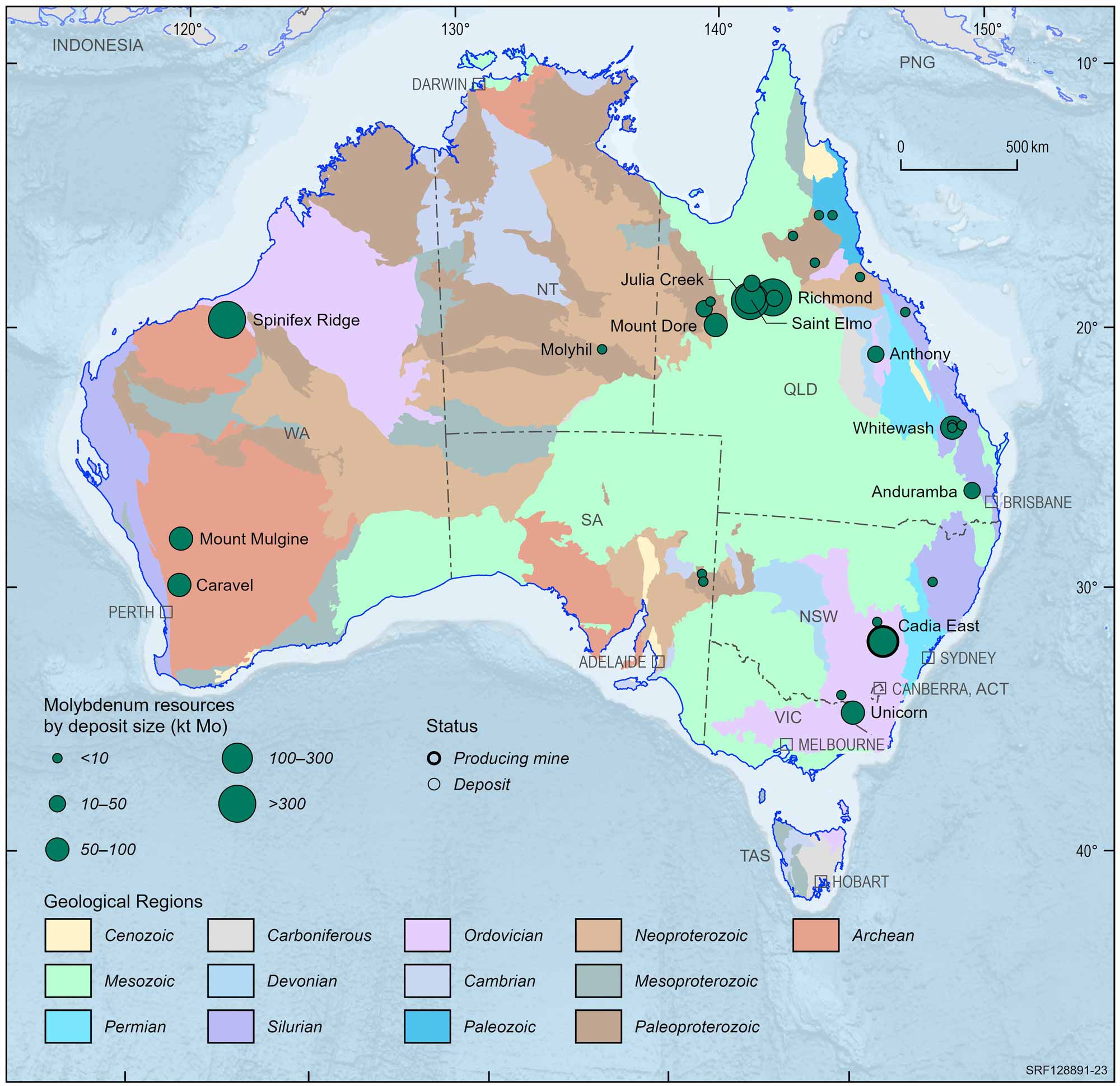

Molybdenum

| Critical Mineral | |

|

EDR 687 kt Mo ( 5%) | |

|

Ore Reserves 253 kt Mo ( 64%) | |

|

Operating Mines 1 | |

|

Production 0.277 kt Mo (n.a.) | |

|

Export Income n.a. |

| World Ranking | |

|

Resources 5 (6%) | |

|

Production minor |

Major Uses:

Drills, catalysts, lubricants, fertilisers, structural steel and steel alloys used in engine parts.

Abbreviations

kt Mo – kilotonnes of molybdenum content; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Abbreviations Notes

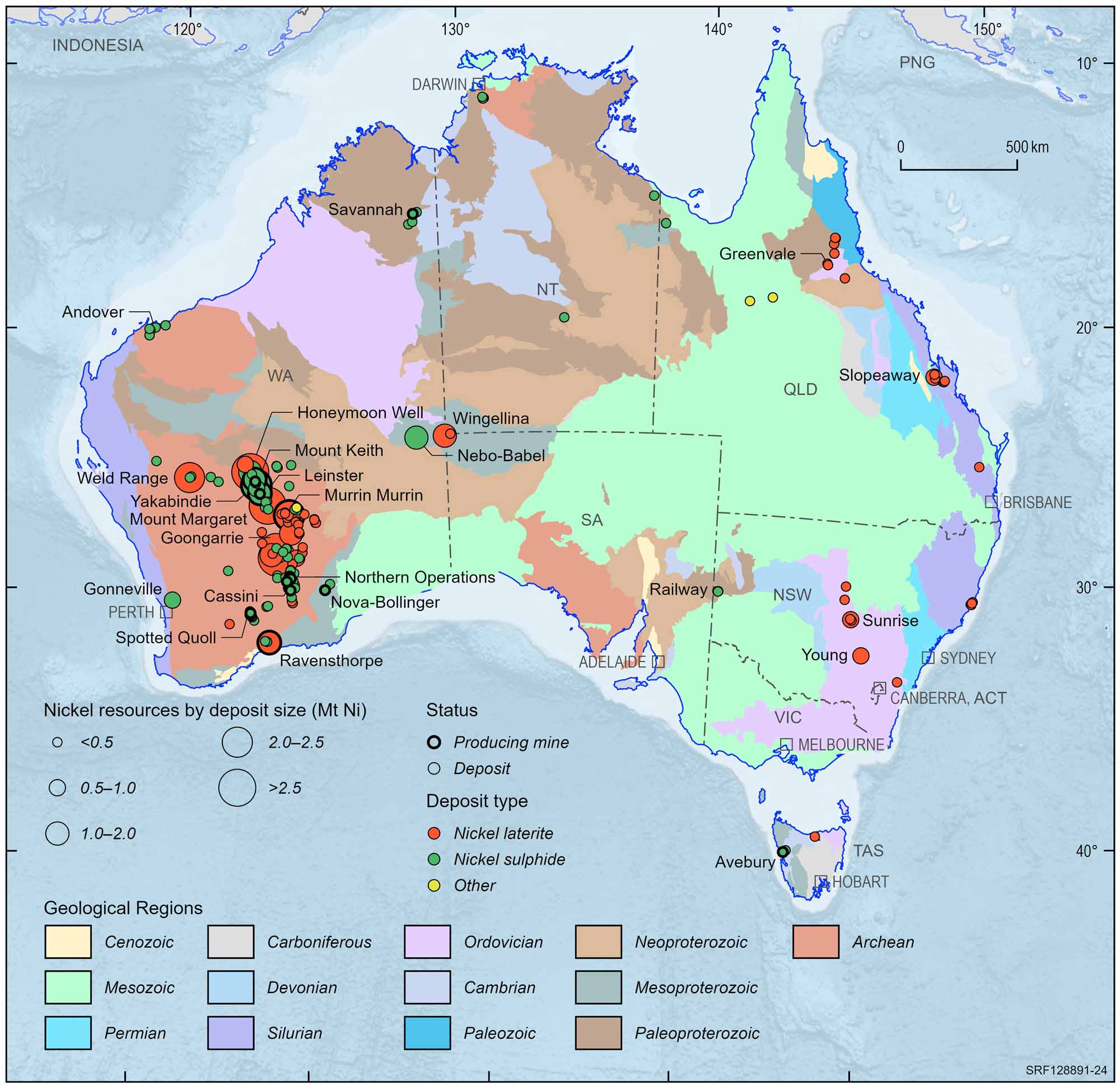

Nickel

| Critical Mineral | |

|

EDR 24.1 Mt Ni ( 11%) | |

|

Ore Reserves 8.6 Mt Ni ( 1%) | |

|

Operating Mines 16 | |

|

Production 0.16 Mt Ni ( 3%) | |

|

Export Income $4,769 m ( 35%) |

| World Ranking | |

|

Resources 1 (23%) | |

|

Production 5 (5%) |

Major Uses:

Stainless and heat-resistant steel production used in chemical industries, motor vehicles, medical applications, electronic engineering and construction. Also non-ferrous alloys, electroplating and lithium-ion batteries.

Abbreviations

Mt Ni – million tonnes of nickel content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is the sum of refined/ intermediate and ore/concentrate categories sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

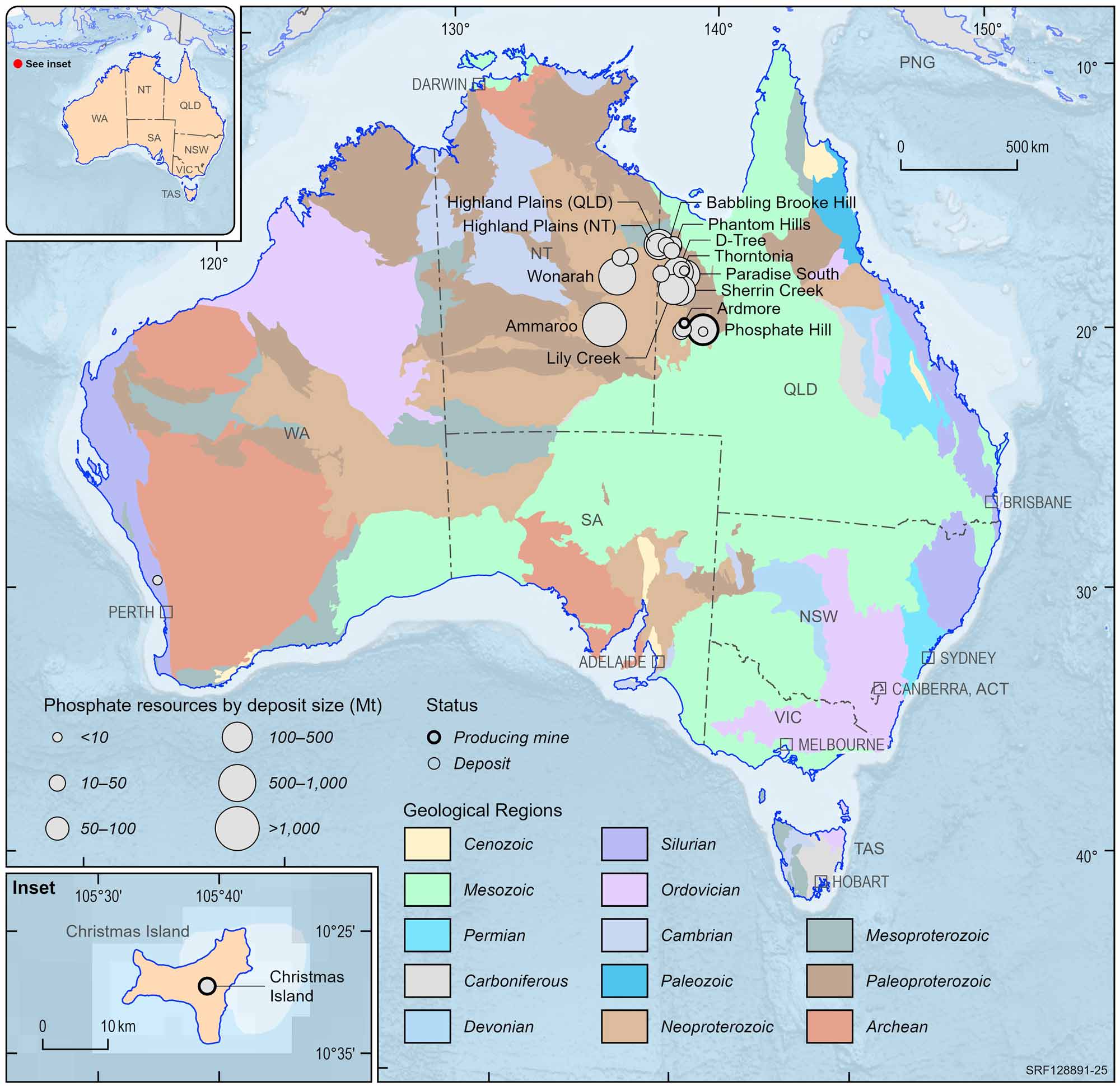

Phosphate

| Strategic Material | |

|

EDR 1,080 Mt (0%) | |

|

Ore Reserves 124 Mt (0%) | |

|

Operating Mines 3 | |

|

Production > 0.4 Mt (0%) | |

|

Export Income n.a. |

| World Ranking | |

|

Resources 9 (2%) | |

|

Production minor |

Major Uses:

Source of phosphorus, a strategic material. Phosphorous is used for fertilisers, animal feed, food additives, detergents, herbicides, electronics, asphalt, pharmaceuticals and cosmetics. There is no substitute for phosphorus in agriculture.

Abbreviations

Mt – million tonnes of phosphate rock; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

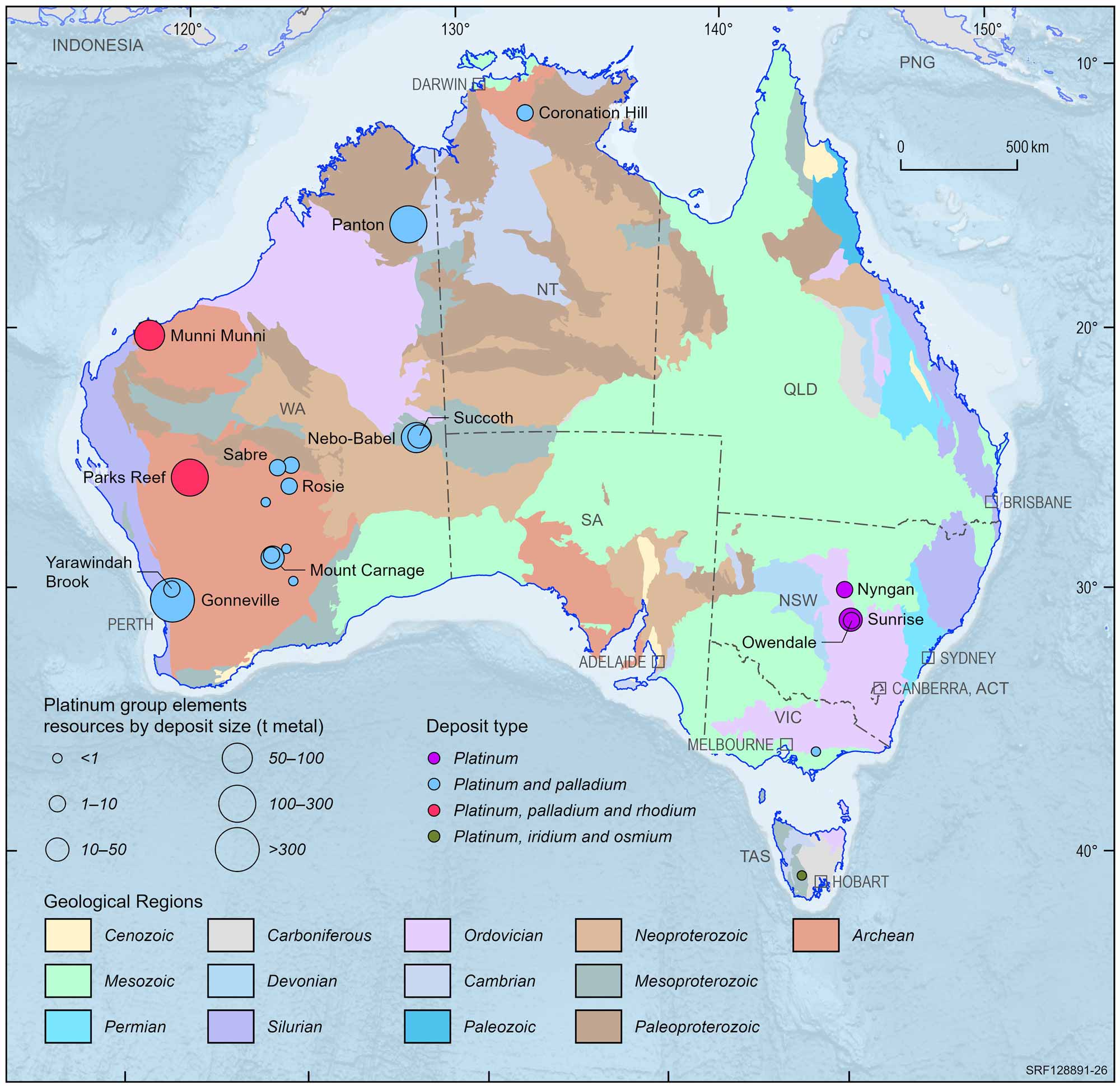

Platinum Group Elements

| Critical Mineral | |

|

EDR 359.3 t metal ( 45%) | |

|

Ore Reserves 51.3 t metal ( 1%) | |

|

Operating Mines 0 | |

|

Production 0.492 t metal ( 5%) | |

|

Export Income $40 m ( 5%) |

| World Ranking | |

|

Resources minor | |

|

Production minor |

Major Uses:

Jewellery, investment instrument, chemical industries, catalysts and catalytic converters, electronic devices, glass manufacture, industrial crucibles and surgical implants.

Abbreviations

t metal –tonnes of metal content from platinum group elements (platinum, palladium, osmium, iridium, ruthenium, rhodium); $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income from Department of Mines, Industry Regulation and Safety, Western Australian Government 2022 Major Commodities Resource Data File.

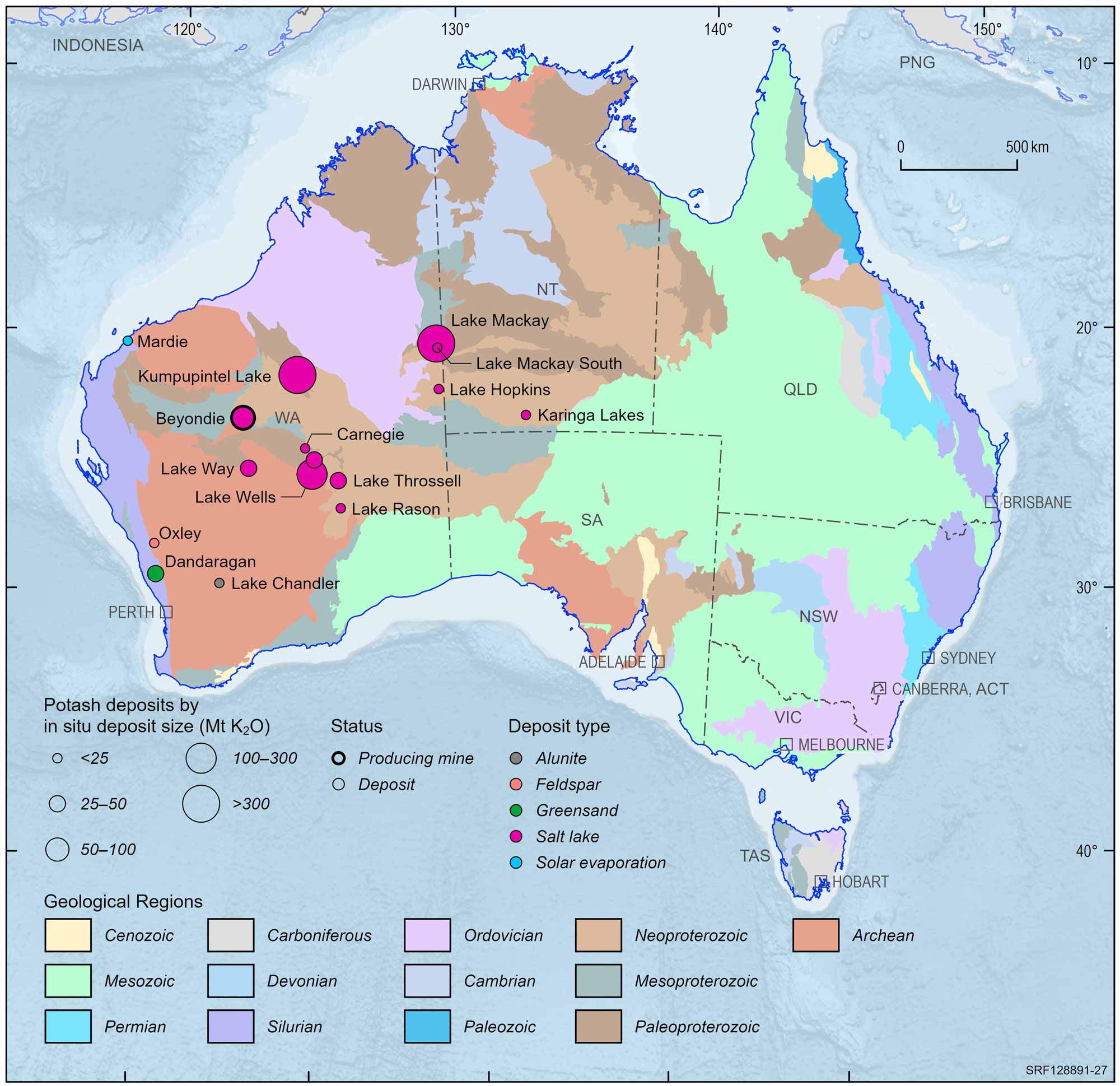

Potash

|

EDR 47.3 Mt K2O ( 7%) | |

|

Ore Reserves 18.3 Mt K2O ( 1%) |

|

Operating Mines 1 | |

|

Production < 0.1 Mt K2O | |

|

Export Income $0 m (0%) |

| World Ranking | |

|

Resources 12 (1%) | |

|

Production minor |

Major Uses:

Fertilisers, animals feeds, ceramics, detergents, pharmaceuticals, de-icing and glass manufacture.

Abbreviations

Mt K2O – million tonnes of potassium oxide content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

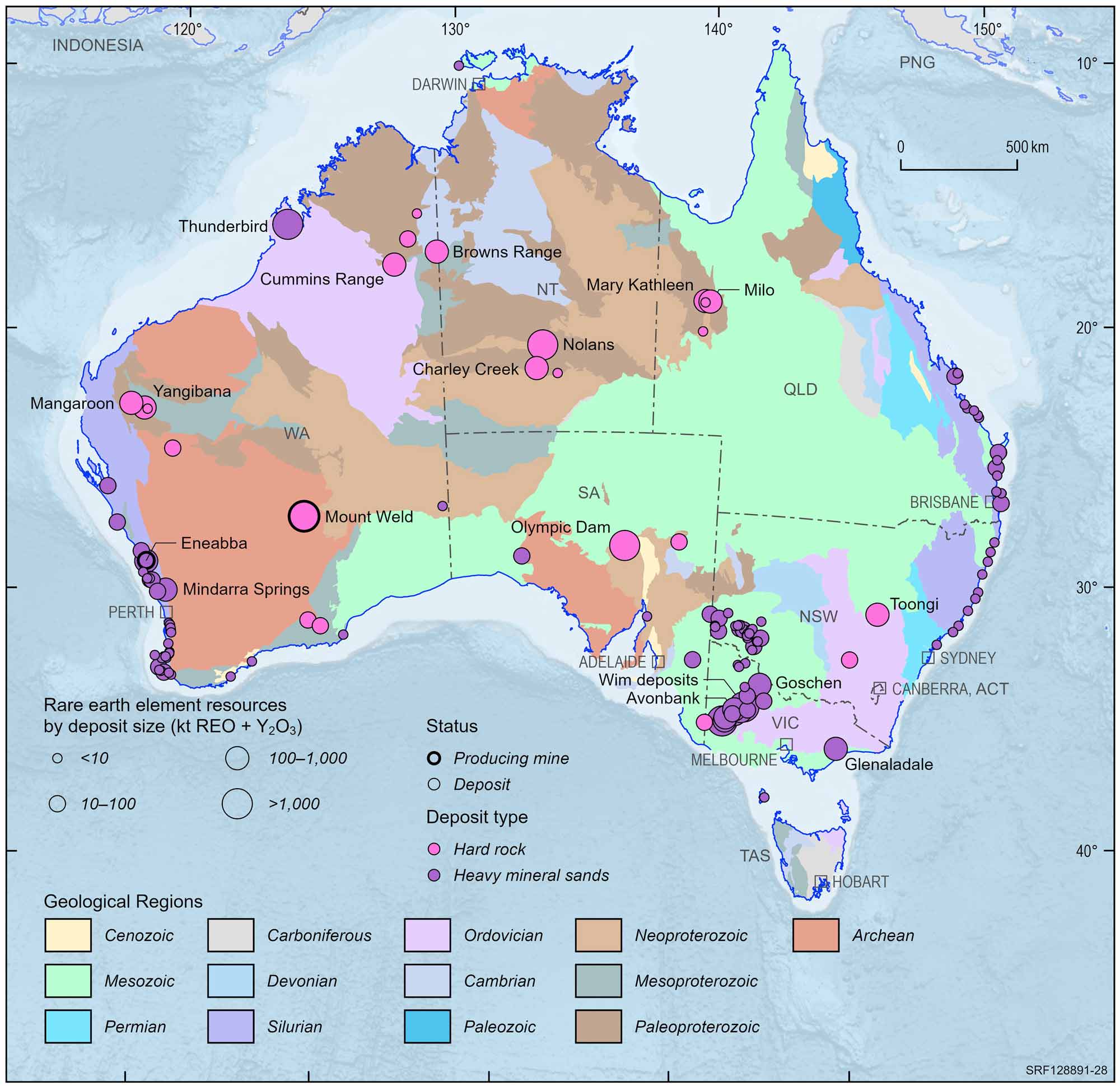

Rare Earth Elements

| Critical Mineral | |

|

EDR 5.70 Mt oxide ( 34%) | |

|

Ore Reserves 3.27 Mt oxide ( 5%) | |

|

Operating Mines 2 | |

|

Production 0.016 Mt oxide ( 30%) | |

|

Export Income > $797 m ( > 40%) |

| World Ranking | |

|

Resources 6 (4%) | |

|

Production 3 (5%) |

Major Uses:

Permanent magnets, motors, metal alloys, electronic and computing equipment, batteries, catalytic converters, petroleum refining, medical imaging, colouring agents, phosphors, lasers and special glass.

Abbreviations

Mt oxide – million tonnes of rare earth oxide plus yttrium oxide; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export data is a minimum figure as it does not include data from the Northern Territory.Available export income is sourced from Department of Mines, Industry Regulation and Safety, Western Australian Government 2022 Major Commodities Resource Data File.

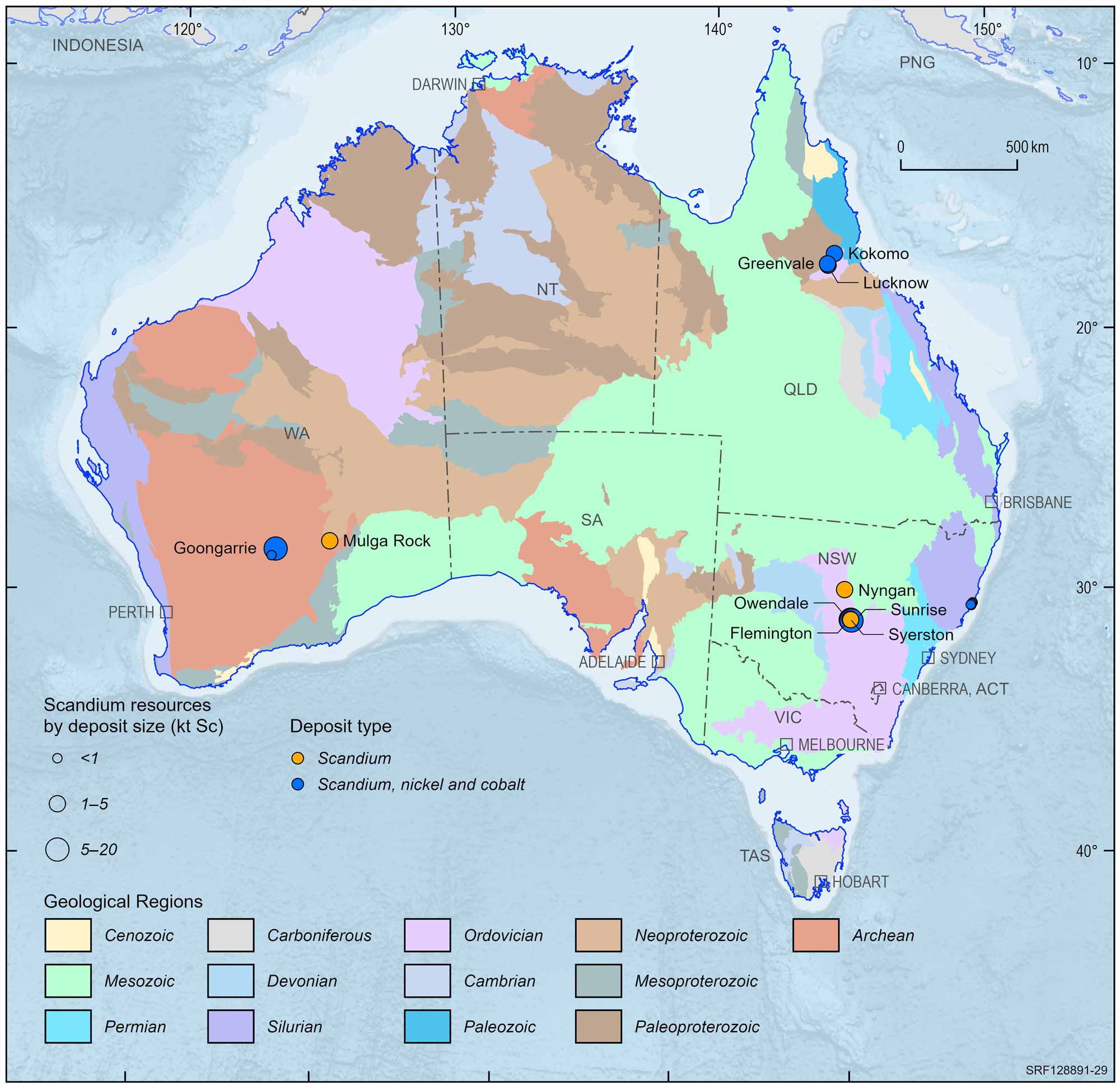

Scandium

| Critical Mineral | |

|

EDR 36.65 kt Sc (0%) | |

|

Ore Reserves 11.65 kt Sc (0%) | |

|

Operating Mines 0 | |

|

Production 0 kt Sc (0%) | |

|

Export Income $0 m (0%) |

| World Ranking | |

|

Resources unknown | |

|

Production 0 (0%) |

Major Uses:

Alloys for aerospace industries, solid oxide fuel cells, specialised lighting applications, ceramics, lasers, electronics and sporting goods.

Abbreviations

kt Sc – kilotonnes of scandium content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

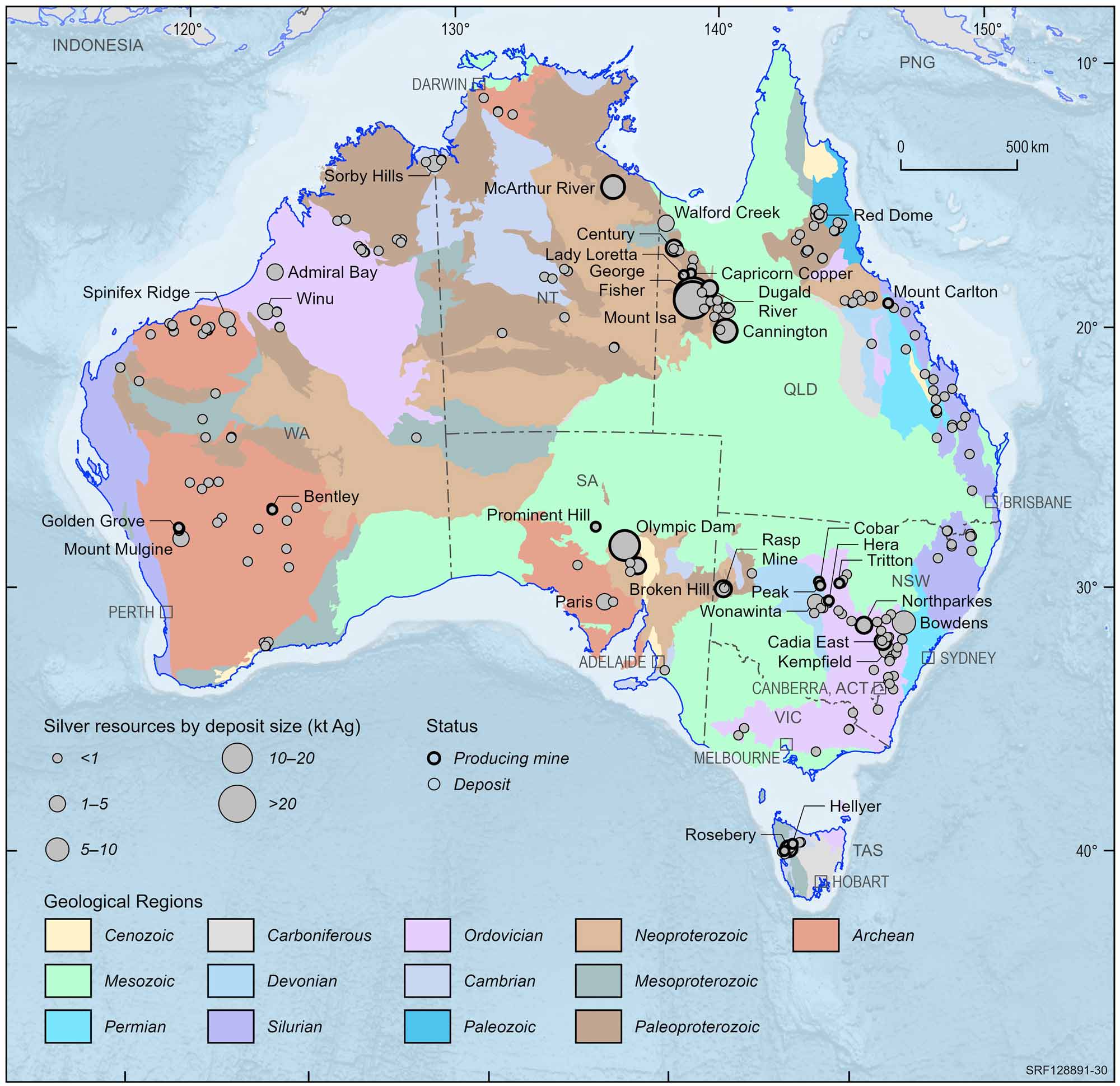

Silver

|

EDR 93.65 kt Ag ( 1%) | |

|

Ore Reserves 26.62 kt Ag ( 11%) |

|

Operating Mines 26 | |

|

Production 1.17 kt Ag ( 12%) | |

|

Export Income $105 m ( 51%) |

| World Ranking | |

|

Resources 2 (17%) | |

|

Production 8 (5%) |

Major Uses:

Jewellery, silverware, storing monetary value, photographic paper and film, mirrors, water treatment, plastics, textiles and solar panels.

Abbreviations

kt Ag – kilotonnes of silver content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

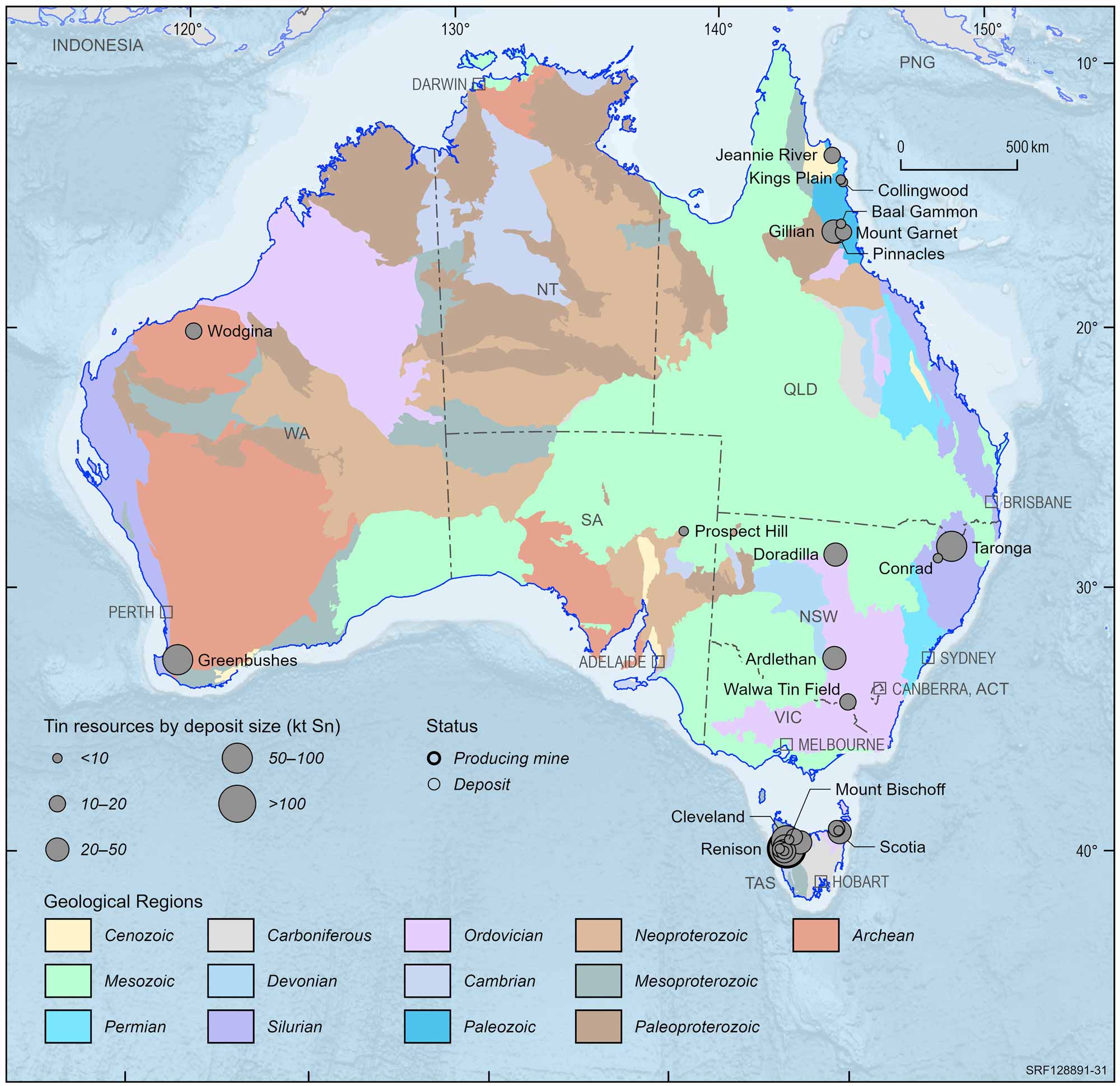

Tin

| Strategic Material | |

|

EDR 623 kt Sn ( 6%) | |

|

Ore Reserves 317 kt Sn ( 5%) | |

|

Operating Mines 1 | |

|

Production 9.0 kt Sn ( 2%) | |

|

Export Income $376 m ( 14%) |

| World Ranking | |

|

Resources 4 (13%) | |

|

Production 8 (3%) |

Major Uses:

Bronze for electrical products and sculpture, solders, steel coatings, metal alloys, electric vehicles, lead-acid batteries, lithium-ion batteries, superconducting magnets, dyes, disinfectants, perfumes, cast iron, fire retardants and pewter.

Abbreviations

kt Sn – kilotonnes of tin content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is based on tin concentrate and sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

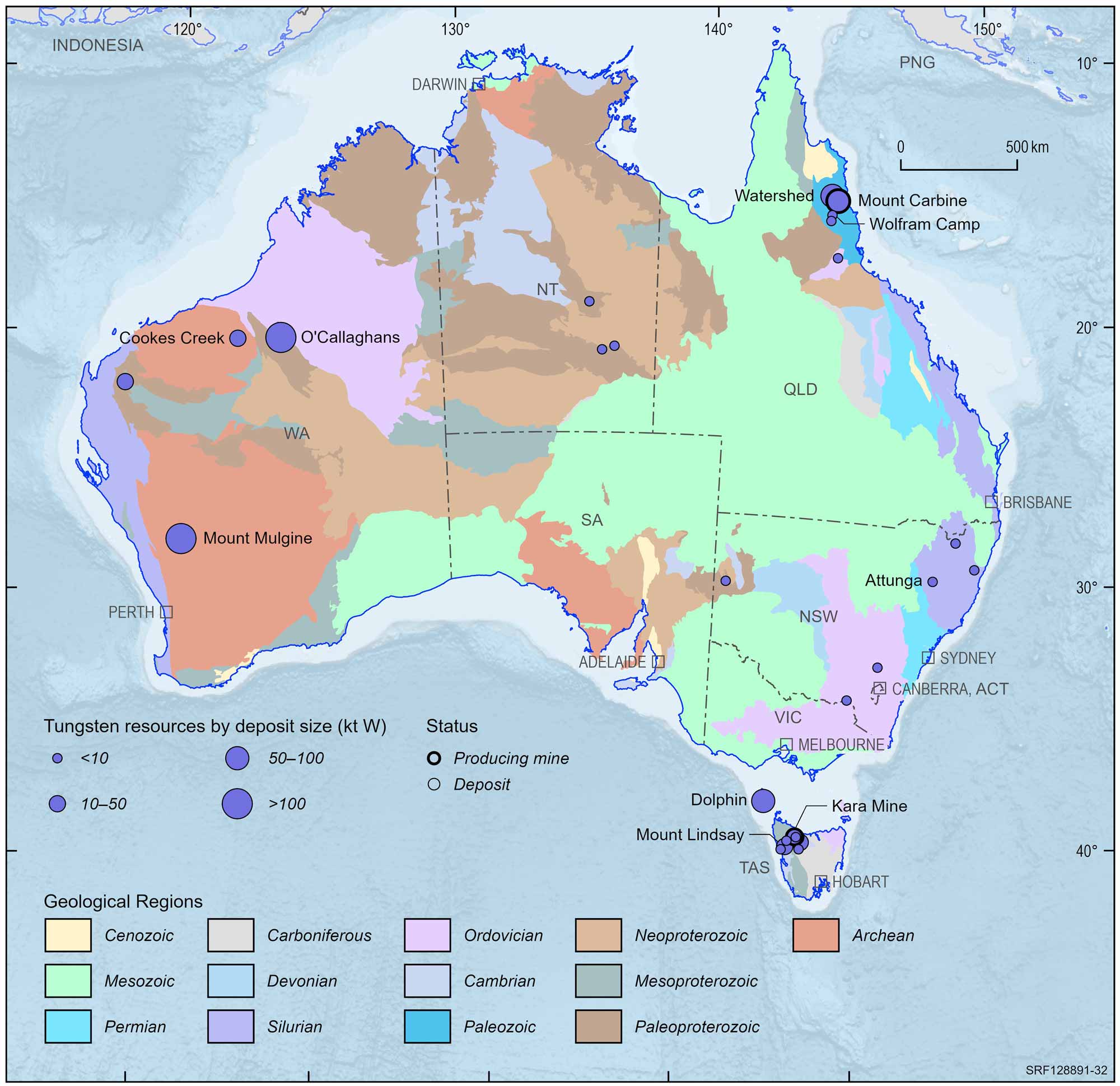

Tungsten

| Critical Mineral | |

|

EDR 568 kt W (0%) | |

|

Ore Reserves 213 kt W ( 1%) | |

|

Operating Mines 2 | |

|

Production 0.23 kt W ( 8%) | |

|

Export Income n.a. |

| World Ranking | |

|

Resources 2 (15%) | |

|

Production minor |

Major Uses:

Cemented carbides used in cutting applications and wear-resistant materials, electrodes, filaments (light bulbs), wires and components in electrical, heating, lighting and the aeronautical industry.

Abbreviations

kt W – kilotonnes of tungsten content; n.a. – not available.

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.

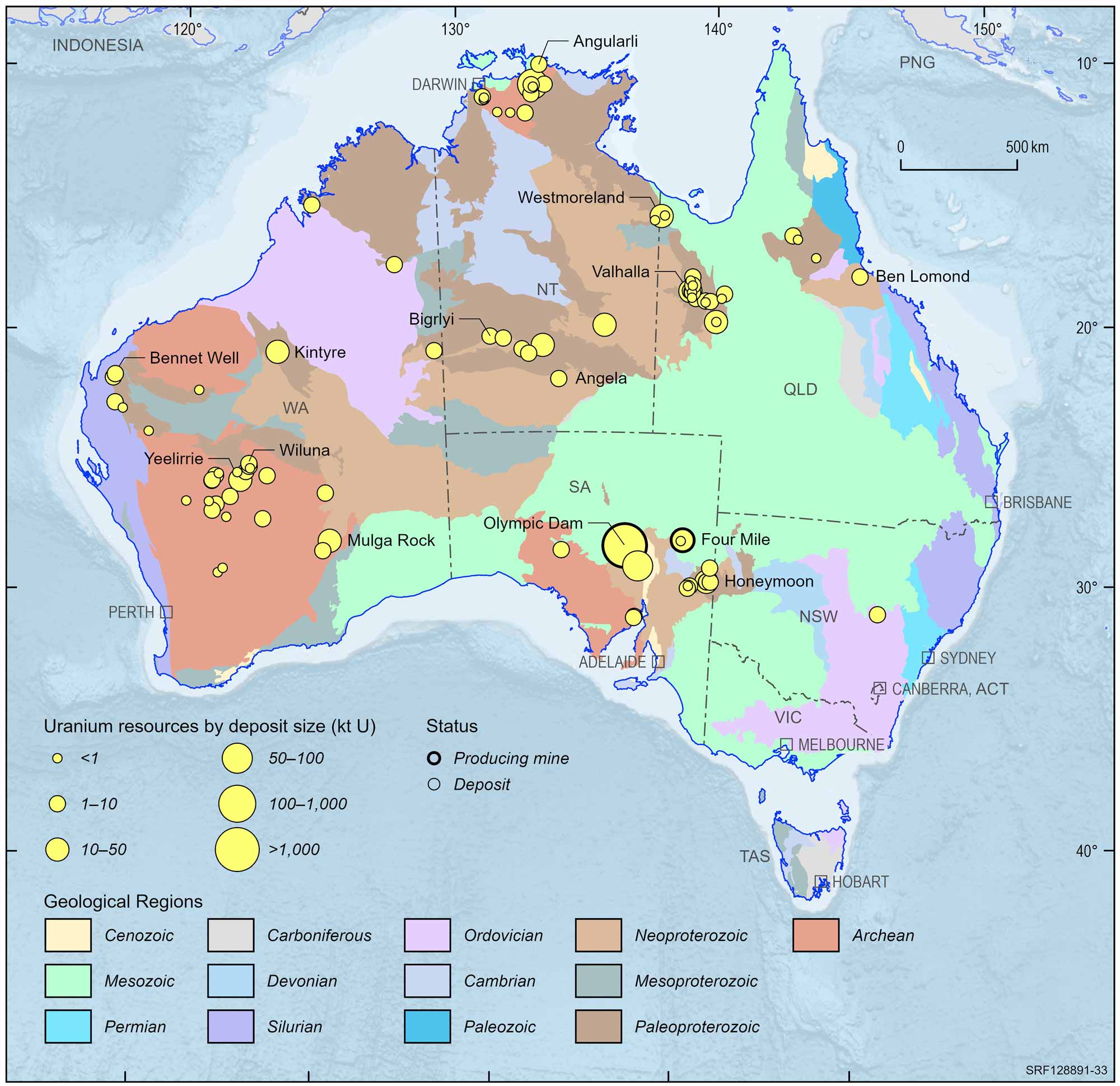

Uranium

|

EDR 1,236 kt U ( 1%) | |

|

Ore Reserves 319 kt U ( 26%) |

|

Operating Mines 2 | |

|

Production 4.555 kt U ( 20%) | |

|

Export Income $733 m ( 60%) |

| World Ranking | |

|

Resources 1 (32%) | |

|

Production 4 (9%) |

Major Uses:

Fuel for nuclear power reactors, medicine, food-processing, space and defence industry applications.

Abbreviations

kt U – kilotonnes of uranium content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets. Export income is based on uranium oxide (U3O8) and sourced from Office of the Chief Economist, Resources and Energy Quarterly, September 2023.

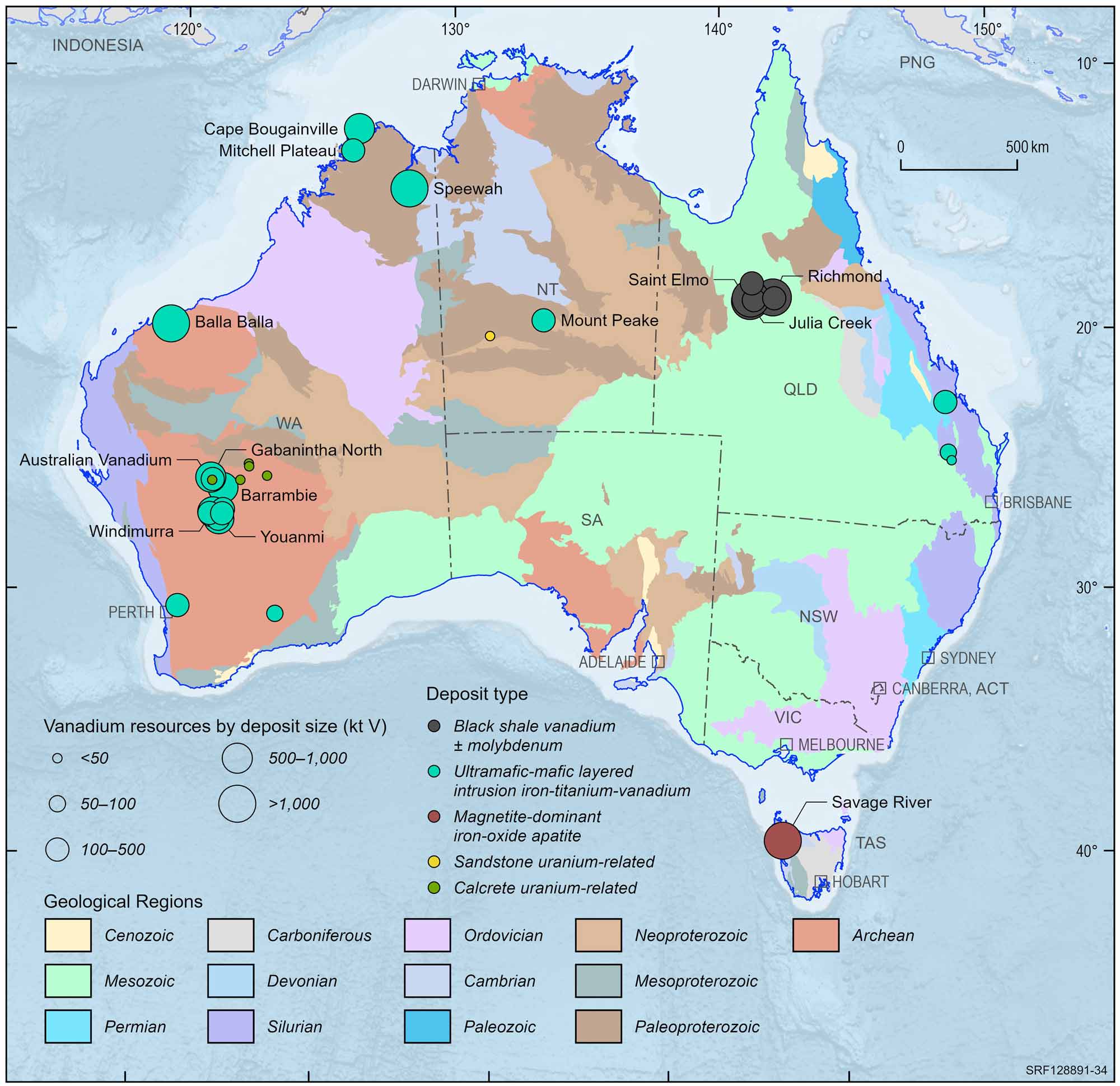

Vanadium

| Critical Mineral | |

|

EDR 8,510 kt V ( 5%) | |

|

Ore Reserves 2,971 kt V (0%) | |

|

Operating Mines 0 | |

|

Production 0 kt V (0%) | |

|

Export Income $0 m (0%) |

| World Ranking | |

|

Resources 2 (32%) | |

|

Production 0 (0%) |

Major Uses:

Alloyed with iron for high-strength steel applications, ceramics, electronics, textiles, fertilisers, synthetic rubber, batteries and alloys used in nuclear engineering and superconductors.

Abbreviations

kt V – kilotonnes of vanadium content; $m – million dollars (Australian).

Notes

Resource figures are as at 31 December 2022. Operating mines and production are for calendar year 2022. Percentage increases or decreases are in relation to 2021. World rankings are followed by percentage share in brackets.