Bauxite

Page last updated:19 December 2023

Please note that this page is currently under review.

Resource figures are current as at 31 December 2016.

Bauxite is a natural product of weathering and occurs as a white to grey to reddish orange-brown crust at or near the Earth's surface in regions that have, or have had in the past, high rainfall. Bauxite is generally hard, heterogeneous in appearance and can be nodular, layered or massive. It has varying composition but is relatively rich in aluminium oxides along with iron and silica oxides with minor quantities of other minerals resistant to weathering, such as anatase (titanium dioxide). The principal minerals in bauxite are gibbsite (Al2O3.3H2O), boehmite (Al2O3.H2O) and diaspore, which has the same composition as boehmite but is denser and harder.

Bauxite is usually classified according to its intended commercial application, e.g., metallurgical, cement, fertiliser, abrasive, chemical or refractory. The vast majority of the bauxite mined globally is classified as metallurgical and is converted to alumina (Al2O3) for the production of aluminium metal. Some clays and other materials can also be utilised to produce alumina, however bauxite is the main raw material. In most commercial operations, alumina is extracted (refined) from bauxite by a wet chemical caustic leach process known as the Bayer process. The alumina is then smelted using the energy-intensive Hall-Heroult process to produce aluminium metal by electrolytic reduction in a molten bath of natural or synthetic cryolite (NaAlF6). Australia is the world's largest producer of bauxite, representing 31% of global production in 2016, the second largest producer of alumina (17%) and the sixth largest producer of aluminium (3%).

Australian bauxite mines are known for their high quality ore which is determined not just by the aluminium content but also by associate minerals, such as iron oxides, anatase and, in particular, the amount of reactive silica (RxSiO2). The large bauxite resources at Weipa and Amrun (>3000 Mt) in Queensland and Gove (>190 Mt) in the Northern Territory are amongst the world's highest grade deposits, averaging between 49% and 53% Al2O3. Other large deposits (each >500 Mt) are located in Western Australia in the Darling Range, the Mitchell Plateau and at Cape Bougainville, of which the latter two are undeveloped and located within the Kimberley National Park.

The Darling Range, Weipa and Gove bauxites have low reactive silica, making them relatively cheap to process. In fact, the Darling Range mines have such low reactive silica (generally 1-2%) that they are still profitable despite having the lowest grade bauxite of any commercial-scale operations in the world (around 27-30% Al2O3). Bauxite resources also occur in New South Wales and Tasmania but are relatively small (<30 Mt).

Despite the rise of independent smelters, particularly in China, Australia's aluminium industry is still a highly integrated sector of mining, refining, smelting and semi-fabrication centres. It is of major economic importance nationally and globally. In recent years, however, the industry in Australia has become less vertically integrated with increasing amounts of bauxite exported as direct shipping ore (DSO) by both small independent miners and the large producers.

In 2017, the Australian industry consisted of:

- Four long-term bauxite mines at Weipa, Gove, Huntly-Willowdale and Boddington and two new, small mines at Hey Point and Bald Hill (Figure 1).

- Six alumina refineries at Yarwun and QAL in Queensland, and Kwinana, Pinjarra; Wagerup and Worsley in Western Australia (Figure 1).

- Four primary aluminium smelters at Bell Bay in Tasmania, Portland in Victoria, Tomago in New South Wales and Boyne Island in Queensland.

- A range of extrusion mills; rolled, sheet and plate product plants; a wire manufacturer; and many aluminium fabricators located in each state and the Northern Territory.

The industry in Australia is geared to serve world demand for alumina and aluminium with more than 80% of production exported. Transport, packaging, building and construction provide much of the demand for the metal in Australia.

JORC Reserves

As at December 2016, Proved and Probable Ore Reserves of bauxite reported in compliance with the JORC Code amounted to 2319 Mt (Table 1) of which 806.5 Mt was attributable to four operating mines (Table 2). Table 2 actually lists six operating mines but the owners of Hey Point in Queensland (Green Coast Resources Pty Ltd) and Bald Hill in Tasmania (Australian Bauxite Ltd) have not published Ore Reserves for 2016. Australia produced 82 Mt of bauxite in 2016, slightly up from 2015 levels (81 Mt; Table 1). In contrast, the USGS estimates that during 2016, global bauxite production decreased 11% owing to the Malaysian ban on bauxite mining in response to environmental concerns.

Table 1. Ore Reserves of bauxite reported in compliance with the JORC Code, production and potential reserve life*, 2002-2016.

| Year | Proved and Probable Ore Reserve (Mt) | Production (Mt) | Reserve Life* (years) |

|---|---|---|---|

| 2016 | 2319 | 82.152 | 28 |

| 2015 | 2300 | 80.91 | 28 |

| 2014 | 2087 | 78.6 | 27 |

| 2013 | 2125 | 81.1 | 26 |

| 2012 | 2145 | 76.3 | 28 |

| 2011 | 1895 | 69.98 | 27 |

| 2010 | 2300 | 69 | 33 |

| 2009 | 2400 | 65 | 37 |

| 2008 | 1900 | 64 | 30 |

| 2007 | 1900 | 62 | 31 |

| 2006 | 1800 | 62 | 29 |

| 2005 | 1900 | 60 | 32 |

| 2004 | 2100 | 57 | 37 |

| 2003 | 2100 | 56 | 38 |

| 2002 | 1700 | 54 | 31 |

*Reserve life is the ratio of Ore Reserves to production and represents a snapshot in time. It assumes that future production continues at the same rate and does not take into account future resource upgrades and successful exploration for new deposits.

Table 2. Ore Reserves and Mineral Resources of bauxite (million tonnes) reported in compliance with the JORC Code at operating mines in 2016.

| No. of Operating Mines1 | Ore Reserves2 at Operating Mines | Measured and Indicated Resources3 at Operating Mines | Mine Production 20164 | Average Reserve Life (years) | Average Resource Life (years) |

|---|---|---|---|---|---|

| 6 | 806.5 | 3399 | 82.152 | 10 | 41 |

- The number of operating mines counts individual mines that operated during 2016 and thus contributed to production. Two operating mines, Hey Point and Bald Hill, do not have published reserves for 2016.

- The majority of Australian Ore Reserves and Mineral Resources are reported in compliance with the JORC Code, however there are a number of companies that report to foreign stock exchanges using other reporting codes, which are largely equivalent. In addition, Geoscience Australia may hold confidential information for some commodities. Ore Reserves are as at 31 December 2016.

- Mineral Resources are inclusive of the Ore Reserves. Mineral Resources are as at 31 December 2016.

- Source: Office of the Chief Economist (Resources and Energy Quarterly, June 2017).

Large Ore Reserves of bauxite have been published by Rio Tinto Ltd for Amrun (Table 3), formerly known as Boyd. This will be the first deposit in the South of Embley project to be developed. Amrun is expected to begin producing in 2019 and will extend the life of the Weipa operations by at least 40 years. Significant Ore Reserves also exist for Metro Mining Ltd's combined Bauxite Hills-Skardon River project and Metallica Minerals Ltd published a small Ore Reserve for Urquhart (Table 3). All these bauxite mining developments are located on the western side of the Cape York Peninsula of Queensland in the region around Weipa.

Table 3. Ore Reserves of bauxite reported in compliance with the JORC Code at operating and developing mines in Australia (as at December 2016).

| Deposit | Status | Proved Ore Reserve | Probable Ore Reserve | ||

|---|---|---|---|---|---|

| Million tonnes | %Al2O3 | Million tonnes | %Al2O3 | ||

| Queensland | |||||

| Weipa | Operating | 194 | 50.6 | 16 | 50.3 |

| Amrun | Under Development | 315 | 52.3 | 1094 | 52.4 |

| Hey Point1 | Operating | 0 | 0 | 0 | 0 |

| Bauxite Hills2 | Under Development | 41.8 | 50.7 | 6.4 | 49.3 |

| Skardon River2 | Under Development | 16.6 | 49.8 | 31.8 | 49.2 |

| Urquhart | Under Development | 3.0 | 53.7 | 3.6 | 51.9 |

| Northern Territory | |||||

| Gove | Operating | 142 | 49.2 | 5 | 49.4 |

| Western Australia | |||||

| Worsley | Operating | 256 | 28.4 | 14 | 28.1 |

| Huntly-Willowdale | Operating | 153.4 | 32.9 | 26.1 | 32.9 |

| Tasmania | |||||

| Bald Hill1 | Operating | 0 | 0 | 0 | 0 |

- The companies operating Hey Point and Bald Hill are mining from Mineral Resources reported in compliance with the JORC Code.

- Metro Mines acquired the Skardon River project in early 2017 from Gulf Alumina Ltd and combined it with the Bauxite Hills project. The combined project is now known as the Bauxite Hills Mine.

Sources: Rio Tinto Annual Report 2016 (Weipa, Amrun, Gove); South32 Annual Report 2016 (Worsley); Alcoa Corp - United States Securities and Exchange Commission Form 10-K for the period ending 31 December 2016 (Huntly); Metro Mining Annual Report 2016 (Bauxite Hills); Metro Mining ASX Announcement 7 January 2016 (Skardon River); Metallica Minerals ASX Announcement 21 December 2016 (Urquhart).

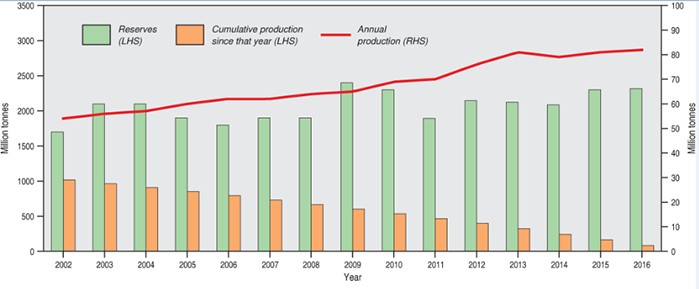

Figure 1 shows that annual production is a small fraction of the bauxite reserve (3.5% in 2016) with cumulative production over the last 15 years (1118 Mt) accounting for only 60% of the bauxite Ore Reserve from 2002 (1700 Mt). Both Ore Reserves and production have gradually risen over the last 15 years. Ore Reserves of bauxite increased from 1700 Mt in 2002 to 2319 Mt in 2016 (a 36% increase) and production increased from 50 Mt to 82 Mt (a 64% increase). However, the production to Ore Reserve ratio has only varied between 2.7% to 3.8% over this period, reflecting industry practice of delineating just enough new Ore Reserves to replace expected depletion going forward.

Figure 1. Bauxite Ore Reserves and annual production 2002-2016, as well as cumulative production since each year. LHS/RHS = refer to axis on left-hand side/right-hand side.

In addition to the Ore Reserves associated with eight deposits, Measured, Indicated or Inferred Mineral Resources reported in compliance with the JORC Code have been published for 33 bauxite deposits. Resources are also known for the Aurukun (Queensland), Marchinbar (Northern Territory), and Mitchell Plateau and Cape Bougainville (both Western Australia) deposits but these resource estimates were made pre-JORC.

Identified Resources

Economic Demonstrated Resources (EDR) of bauxite were 6005 Mt at the end of December 2016, almost unchanged from 6021 Mt in 2015 but down from 6195 Mt in 2014 and 6464 Mt in 2013 (Table 4). Queensland holds 53% of EDR, Western Australia 43% and the Northern Territory 3%. Minor EDR (<1%) also occurs in New South Wales and Tasmania.

Australia's Subeconomic (Paramarginal + Submarginal) and Inferred Resources of bauxite at the end of 2016 were largely unchanged from 2015, totalling 1573 Mt and 1942 Mt, respectively (Table 4).

Table 4. Australia's identified bauxite resources and world figures (million tonnes) for selected years from 1975-2016.

| Year | Demonstrated Resources | Inferred Resources2 | Accessible EDR3 | Australian Mine Production4 | World Economic Resources5 | World Mine Production5 | ||

|---|---|---|---|---|---|---|---|---|

| Economic (EDR)1 | Paramarginal | Submarginal | ||||||

| 2016 | 6005 | 144 | 1429 | 1942 | 6005 | 82.152 | 28 000 | 271.5 |

| 2015 | 6021 | 144 | 1429 | 1954 | 6021 | 80.91 | 27 500 | 274 |

| 2014 | 6195 | 144 | 1429 | 2036 | 6195 | 78.6 | 28 000 | 234 |

| 2013 | 6464 | 144 | 1429 | 1558 | 6464 | 81.1 | 28 000 | 263 |

| 2012 | 6281 | 144 | 1429 | 1474 | 6281 | 76.3 | 28 000 | 263 |

| 2011 | 5665 | 625 | 1430 | 1120 | 5665 | 69.98 | 29 000 | 233 |

| 2010 | 6000 | 400 | 1400 | 890 | 5500 | 69 | 28 000 | 211 |

| 2009 | 6200 | 200 | 1400 | 930 | 5400 | 65 | 27 000 | 201 |

| 2008 | 6200 | 200 | 1400 | 910 | 5400 | 64 | 27 000 | 205 |

| 2007 | 6200 | 200 | 1400 | 690 | 5400 | 62 | 25 000 | 190 |

| 2006 | 5700 | 700 | 1400 | 1100 | 5400 | 62 | 25 000 | 169 |

| 2005 | 5800 | 700 | 1400 | 1100 | 5400 | 60 | 25 000 | 165 |

| 2000 | 4400 | 2600 | 1700 | 1400 | 50 | 25 000 | 100 | |

| 1995 | 2540 | 0 | 5245 | 2134 | 42.7 | 23 000 | 109 | |

| 1990 | 5622 | 2239 | 137 | 3500 | 41.4 | 21 800 | 107 | |

| 1985 | 2889 | 2239 | 137 | 1390 | 31.8 | 22 300 | 88.59 | |

| 1980 | 2703 | 1599 | 137 | 1740 | 27 | 15 400 | 91 | |

| 1975 | 3000 | 2500 | 0 | 21 | 15 500 | 79 | ||

- EDR includes Ore Reserves and most Measured and Indicated Mineral Resources reported in compliance with the JORC Code.

- Total Inferred Resources in economic, subeconomic and undifferentiated categories.

- Accessible Economic Demonstrated Resources (AEDR) is the portion of total EDR that is accessible for mining. AEDR does not include resources that are inaccessible for mining because of environmental restrictions, government policies or military lands.

- Source: Office of the Chief Economist (Resources and Energy Quarterly).

- Source: United States Geological Survey (Mineral Commodity Summaries).

Australia's vast resources of bauxite predominantly occur at Cape York in Queensland (3188 Mt, 53% of national EDR), Gove in the Northern Territory (188 Mt, 3%) and in the Darling Range southeast of Perth in Western Australia (2588 Mt, 43%). Australia's bauxite resources (all categories) add up to a total of 9833 Mt of which Western Australia holds 55%, Queensland 42% and the Northern Territory, New South Wales and Tasmania hold 2% or less.

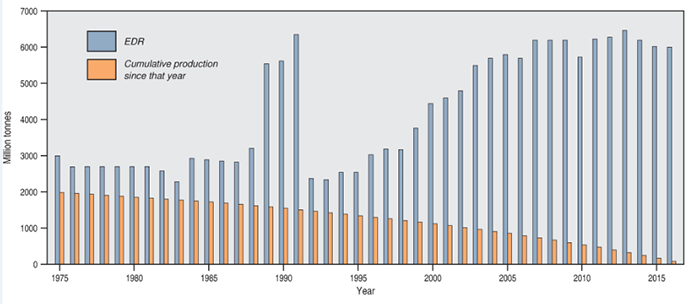

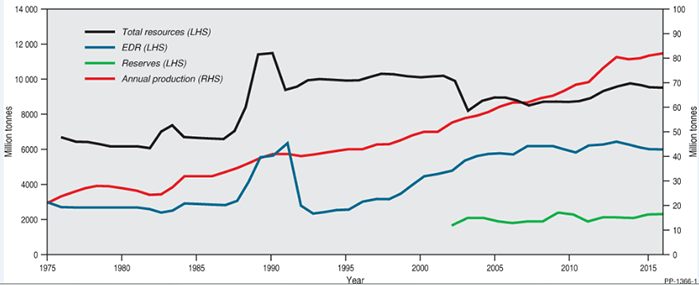

Figure 2 demonstrates the vast Australian bauxite inventory by showing that even over the last 40 years, cumulative production (1981 Mt) has only mined out 66% of the 3000 Mt of resources assessed as economic back in 1975. Despite these significant resources, Figure 6 shows that over the last 40 years, bauxite production has increased more rapidly than the bauxite inventory. In 1975, bauxite production was 21 Mt which rose to 82 Mt in 2016, a 290% increase. Bauxite EDR has increased 100% over the same time period (3000 Mt in 1975 to 6005 Mt in 2016) and total resources of bauxite (EDR + Subeconomic + Inferred) have increased from 6678 Mt in 1976 to 9520 Mt in 2016, an increase of 43%.

Figure 2. Economic Demonstrated Resources of bauxite 1975-2016, as well as cumulative production since each year.

Figure 3. Trends in total resources, Economic Demonstrated Resources, Ore Reserves and annual production of bauxite, 1975-2016. LHS/RHS = refer to axis on left-hand side/right-hand side. Note: EDR of bauxite increased in 1989 as a result of the delineation of additional resources on the Cape York Peninsula. EDR decreased in 1992 because some Cape York deposits were reclassified to comply with the requirements of the JORC Code.

Accessible EDR

All of Australia's EDR of bauxite is considered accessible. However, environmental considerations have made some areas within the Darling Range mining leases and the subeconomic bauxite deposits of the Mitchell Plateau and in Western Australia unavailable for mining. These deposits are not considered to be EDR as their status is unlikely to change in the foreseeable future.

Exploration

Data on exploration expenditure for bauxite are not available in published statistics. The bulk of drilling is associated with brownfield occurrences close to existing operations. However, smaller exploration and mining projects away from the big mines occur in the Darling Range (Western Australia), Cape York (Queensland) and in Queensland, New South Wales and Tasmania. See Industry Developments below for details.

Production

In 2016, Australia mined 82 152 kilotonnes (kt) of bauxite (Table 5) with Western Australia leading (54%) followed by Queensland (35%) and the Northern Territory (11%). Minor production came from Tasmania. Most of the bauxite (~70%) was converted into alumina at Australia's six alumina refineries in Western Australia and Queensland, with the remainder exported as DSO with earnings of $985 million (Table 5).

At 2016 levels of production, the average reserve life of operating mines is potentially 10 years and resource life could be 41 years (Table 2). If Ore Reserves at developing mines and undeveloped deposits are also considered, the reserve life of bauxite is potentially 28 years. If AEDR (Table 4) is used as an indication of long-term potential supply, then at 2016 rates of production, Australia's bauxite resources could last more than 70 years.

Australia's refineries produced 20 681 kt of alumina in 2016 (Table 5), up 3% from 20 097 kt in 2015. Australia was the world's leading alumina exporter with the bulk of alumina in 2016 (86%) being shipped overseas to destinations including North America, South America, Africa, Europe, New Zealand, China and the Middle East. The balance was converted to aluminium at the smelters in Tasmania, Victoria, New South Wales and Queensland. Australia produced 1635 kt of aluminium metal in 2016 (Table 5), slightly down from the 1646 kt produced in 2015. Of this, 1425 kt (87%) was exported for $3187 million (Table 5) mostly to South Korea and Japan. In total, Australia's aluminium industry provided almost $9 billion in export income in 2016, which is more than 6% of total mineral export earnings.

Comparing export earnings to export volume, it is clear that processed mineral commodities are worth more per unit than raw minerals. Table 5 shows that in 2016, bauxite was worth $42/t whereas alumina was worth $317/t. This is a 7-fold increase on the price of alumina; bearing in mind it takes 2-3 t of bauxite to make 1 t of alumina. It takes 2 t of alumina to make 1 t of aluminium metal, worth $2236/t in 2016, which is a further 7-fold increase on the price of alumina and a 53-fold increase on the price of bauxite. Thus any appraisal of the strength of Australia's bauxite mining industry must also consider domestic downstream refining and smelting in addition to exploration, mining and DSO exports.

Table 5. Bauxite, alumina and aluminium production and export 2016.

| Commodity | Production (kt) | Export (kt) | Export Income ($million) | Value ($/t) |

|---|---|---|---|---|

| Bauxite | 82 152 | 23 248 | 983 | 42 |

| Alumina | 20 681 | 17 864 | 5564 | 317 |

| Aluminium | 1635 | 1425 | 3187 | 2236 |

Source: Office of the Chief Economist (Resources and Energy Quarterly, June 2017).

World Ranking

World bauxite resources are estimated at approximately 28 000 Mt, with Australia holding the second largest amount after Guinea (Table 6). Brazil, Vietnam and Jamaica also hold significant resources (2000 Mt or greater) and Indonesia, China, Guyana, India and Suriname making up the remainder of the top 10 countries (Table 6).

Australia was the global leader for bauxite production (Table 7) in 2016, the second largest producer of alumina after China (Table 8) and the sixth largest producer of aluminium (Table 9).

Table 6. World economic resources of bauxite 2016.

| Rank | Country | Bauxite (Mt) | Percentage of world total |

|---|---|---|---|

| 1 | Guinea | 7400 | 27% |

| 2 | Australia | 6005 | 22% |

| 3 | Brazil | 2600 | 9% |

| 4 | Vietnam | 2100 | 8% |

| 5 | Jamaica | 2000 | 7% |

| 6 | Indonesia | 1000 | 4% |

| 7 | China | 980 | 4% |

| 8 | Guyana | 850 | 3% |

| 9 | India | 590 | 2% |

| 10 | Suriname | 580 | 2% |

| Others | 3530 | 13% | |

| Total | 27 600 |

Source: United States Geological Survey and Geoscience Australia. National figures other than Australia are rounded. Percentages are also rounded and might not add up to 100% exactly.

Table 7. World production of bauxite 2016.

| Rank | Country | Bauxite (kt) | Percentage of world total |

|---|---|---|---|

| 1 | Australia | 82 152 | 30% |

| 2 | China | 65 000 | 24% |

| 3 | Brazil | 34 400 | 12% |

| 4 | Guinea | 31 500 | 11% |

| 5 | India | 23 900 | 9% |

| 6 | Jamaica | 8540 | 3% |

| 7 | Russia | 5430 | 2% |

| 8 | Kazakhstan | 5000 | 2% |

| 9 | Saudi Arabia | 3840 | 1% |

| 10 | Greece | 1800 | 1% |

| Others | 14 320 | 5% | |

| Total | 276 000 |

Source: United States Geological Survey and the Office of the Chief Economist. National figures other than Australia are rounded. Percentages are also rounded and might not add up to 100% exactly.

Table 8. World production of alumina 2016.

| Rank | Country | Alumina (kt) | Percentage of World Total |

|---|---|---|---|

| 1 | China | 60 900 | 50% |

| 2 | Australia | 20 681 | 17% |

| 3 | Brazil | 10 900 | 9% |

| 4 | India | 6030 | 5% |

| 5 | Russia | 2680 | 2% |

| 6 | USA | 2360 | 2% |

| 7 | Ireland | 1970 | 2% |

| 8 | Germany | 1900 | 2% |

| 9 | Jamaica | 1870 | 2% |

| 10 | Spain | 1580 | 1% |

| Others | 10 191 | 8% | |

| Total | 121 000 |

Source: United States Geological Survey and the Office of the Chief Economist. National figures other than Australia are rounded. Percentages are also rounded and might not add up to 100% exactly.

Table 9. World production of aluminium 2016.

| Rank | Country | Aluminium (kt) | Percentage of world total |

|---|---|---|---|

| 1 | China | 31 900 | 54% |

| 2 | Russia | 3560 | 6% |

| 3 | Canada | 3210 | 5% |

| 4 | India | 2720 | 5% |

| 5 | UAE | 2500 | 4% |

| 6 | Australia | 1635 | 3% |

| 7 | Norway | 1220 | 2% |

| 8 | Bahrain | 971 | 2% |

| 9 | Iceland | 855 | 1% |

| 10 | USA | 841 | 1% |

| Others | 9513 | 16% | |

| Total | 58920 |

Source: United States Geological Survey and the Office of the Chief Economist. Global figures other than Australia are rounded. Percentages are also rounded and might not add up to 100% exactly.

Industry Developments

The bauxite market in Australia is undergoing structural change. Traditionally, Australia has had an integrated bauxite-alumina-aluminium industry but the rise of new alumina refineries and aluminium smelters in the Middle East and Asia, particularly China, along with export restrictions in Indonesia, has created new market opportunities for direct export of the raw commodity.

In May 2012, the Indonesian Government implemented export quotas and a 20% export tax on raw commodities, including bauxite. In January 2014, the tax rate on commodity exports rose to 50% along with a further reduction in export quotas. Prior to these export restrictions, Indonesia was the largest exporter of bauxite in the world but this position is now shared by Guinea and Australia. Recently, the Indonesian Government relaxed the ban, providing five-year export permits to companies that have either constructed refineries in Indonesia or have construction underway.

Indonesian bauxite was predominantly supplied to Chinese low-temperature refineries and, with the potential reduction in supply, many expected that Australian and African bauxite producers (and emerging producers) would fill any shortfall, along with supplying new capacity. In 2015, Malaysia unexpectedly emerged as a significant bauxite exporter but doubts exist about the country's capability for long-term sustainable bauxite supply as most deposits are small. Owing to environmental and corruption concerns, the Malaysian Government imposed a ban on bauxite mining in January 2016. The ban was still in place by the end of 2017, but the government did permit exports of stockpiled bauxite. These issues aside, Malaysia does have the advantage of proximity to Chinese refineries, and bauxite exploration is also active in other Southeast Asian countries such as Vietnam, Laos and the Philippines.

China accounts for over 95% of Australia's bauxite exports. Rio Tinto ships to the Chinese markets from both its Weipa operation at Cape York and its Gove operation in the Northern Territory. In addition, its new Amrun (South of Embley) development will supply an increased amount of bauxite in the coming decades. Meanwhile, Alcoa announced in December 2016 that it had secured its first third-party contract to supply 400 kt of bone-dry bauxite from its Huntly mine in Western Australia to customers in China. The company has approval from the Western Australian Government to export up to 2.5 Mt per annum for five years. Alcoa has also stated that it is focussed on building its third-party bauxite business and that its Australian bauxite mines are well located to meet growing demand from alumina refineries in China and the Middle East. Nonetheless, the Office of the Chief Economist is predicting a moderate decrease in bauxite exports to China in coming years as a result of the Chinese Government's crackdown on air pollution which has restricted alumina production.

A number of Australian juniors have also been positioning themselves to supply the Chinese low-temperature refineries. In Western Australia, Bauxite Resources Ltd was part of two individual Joint Ventures with different Chinese companies (both state-owned enterprises) to supply Darling Range bauxite. Both projects have been largely inactive in recent years with the most advanced of the joint ventures bought out by its Chinese partner in 2016. On the east coast, Australian Bauxite Ltd has projects in Queensland, New South Wales and Tasmania, with shipments from the Bald Hill mine in Tasmania underway since January 2016. In the Cape York region of Queensland, Metro Mining Ltd, Metallica Minerals Ltd and Queensland Bauxite Ltd are all seeking to supply DSO to the foreign markets with Racle Resources Pty Ltd succeeding in October 2016 with its first shipment from the Hey Point mine. As a product, DSO is generally lower-quality but cheaper, as it is essentially raw bauxite loaded onto a barge. However, it has the advantage of not requiring beneficiation (upgrading by screening and washing) and the extra operating and capital costs associated with this process. In addition, the environmental footprint of the mining operation is reduced as tailings dams are not needed.

While the market for bauxite is looking positive, Australia lost some of its alumina capacity with the closure of Rio Tinto's Gove refinery in the Northern Territory in 2014. Gove had a nameplate capacity of 3800 kt per annum (ktpa). Other refineries have, however, expanded capacity in recent years and nameplate capacity for Australia's alumina refineries currently totals 20 729 ktpa. The largest refinery is South32's Worsley refinery in Western Australia at 4600 ktpa. South32 plans to expand the refinery to 5100 ktpa with a planned extension to the mine underpinning increased production. Nameplate capacity at the other Western Australian refineries comprises Yarwun (3200 ktpa), Kwinana (2190 ktpa) and Wagerup (2555 ktpa). The Queensland refineries at QAL and Yarwun also have significant capacity at 3950 ktpa and 3200 ktpa, respectively.

Meanwhile, aluminium production in Australia has undergone significant upheavals. The Kurri Kurri smelter in the Hunter Valley of New South Wales ceased aluminium production in October 2012, removing 180 ktpa of aluminium capacity from Australia. In August 2014, the aging and high-cost Point Henry aluminium smelter at Geelong, Victoria, also closed, removing another 185 ktpa of capacity. This is part of a global trend of permanently closing older, less efficient aluminium smelters and building new, more efficient, smelters in countries with low power costs. Australia's remaining aluminium smelters are Bell Bay in Tasmania (195 ktpa capacity), Tomago in New South Wales (590 ktpa), Portland in Victoria (358 ktpa) and Boyne Island (584 ktpa) in Queensland.

Weipa: Weipa, on the western side of Cape York Peninsula in northern Queensland, is owned by Rio Tinto Ltd. As at December 2016, the Weipa operations have a Proved Reserve of 194 Mt of bauxite and a Probable Reserve of 16 Mt. In addition, there is a Measured Resource of 29 Mt, an Indicated Resource of 604 Mt and an Inferred Resource of 451 Mt. Weipa bauxites generally grade between 49% and 53% Al2O3. In 2016, Weipa produced a record 29 427 kt of bauxite, up from 27 663 kt in 2015 and 26 266 kt in 2014.

Bauxite is mainly shipped to the Yarwun and Queensland Alumina Ltd (QAL) refineries at Gladstone with a smaller amount sent to China. In 2016, Yarwun produced 3176 kt of alumina and QAL produced 3848 kt, with both refineries recording increases on 2015 and 2014 production.

South of Embley: The South of Embley operation is one of Rio Tinto Ltd's flagship projects with the Amrun (formerly Boyd) deposit the first to be developed. Amrun is located approximately 45 km southwest of Weipa and will extend the company's Weipa operations by approximately 40 years. Government and environmental approvals were obtained in 2012 and 2013 and, in late 2015, the board of Rio Tinto approved the project including capital expenditure of US$1.9 billion. Construction at Amrun commenced in 2016 with the 40 km main access road completed. Construction also involves processing and port facilities as well as the mine, with the majority (70%) of capital expenditure planned for 2017 and 2018.

Amrun is expected to start producing in the first half of 2019 ramping up to a planned output of 22.8 Mt per annum. It will partly replace depleted production from the East Weipa mine (now more than 50 years old) as well as adding some 10 Mt per annum in new capacity. Rio Tinto has described Amrun as a long-life, low-cost, expandable asset that is strategically placed to satisfy increasing demand for seaborne bauxite in China and the Middle East, as well as the company's own refineries in Australia.

As at December 2016, South of Embley has a Proved Reserve of 315 Mt of bauxite and a Probable Reserve of 1094 Mt. This is in addition to a Measured Resource of 41 Mt and an Indicated Resource of 402 Mt.

Aurukun: The Aurukun bauxite deposit is one of the largest undeveloped bauxite deposits in Australia. It lies on western Cape York, approximately 70 km south of Weipa. The area spans about 85 km from north to south and about 20 to 30 km from east to west.

In November 2012, the Queensland Government announced it was seeking expressions of interest for the development of the Aurukun deposit and, in August 2014, announced that Glencore plc was its Preferred Proponent. Some controversy surrounds the decision with rival contender Aurukun Bauxite Development Pty Ltd filing a challenge in the Queensland Supreme Court, which was dismissed in December 2016. In addition, lawyers for the local Aboriginal corporation holding the native title interests of the Wik and Wik Waya people commenced proceedings in the High Court, but changes to legislation in March 2016 saw the discontinuation of these proceedings. Thirdly, there was an objection by the Cape York Land Council. This was dismissed by the National Native Title Tribunal in June 2016, with a subsequent appeal dismissed by the Federal Court in March 2017. Additionally, in late 2015, the Senate of the Parliament of Australia referred the matter of the development of bauxite resources near Aurukun in Cape York to the Senate Economics References Committee. An interim report was published in March 2016 with a final report expected in June 2016. However, with the dissolution of Parliament in May 2016, the inquiry lapsed and, in October 2016, the new Senate agreed not to re-refer this inquiry to the Parliament.

The Aurukun deposit has a historical (i.e., not compliant with the JORC Code) resource of 439 Mt in the North Watson and South Watson areas. Glencore are currently engaged in community consultation and technical studies with the view to assessing the viability of mining, initially producing up to 6 Mt per annum of bauxite over 20 years.

South Johnstone: In December 2014, Queensland Bauxite Ltd released an Indicated Resource of 1.9 Mt at 29.7% available Al2O3 and 3.2% RxSiO2 at its South Johnston project near Innisfail, northern Queensland. The company also released a scoping study based on this resource in which the bauxite will be mined at 800 000 tonnes per annum and shipped as DSO via Mourilyan Harbour. The company has continued with its drilling programs to further upgrade and expand the resource and is awaiting a Minerals Development Licence from the Queensland Government.

Urquhart: In May 2015, Metallica Minerals Ltd released a maiden resource for the Urquhart bauxite project near Weipa in Cape York, north Queensland. The project is a Joint Venture with private Chinese investor Ozore Resources Pty Ltd. Metallica announced an Inferred Resource of 7.5 Mt at 51% Al2O3 over two separate, but nearby, areas on the southern side of the Embley River. A portion of the Inferred Resource is estimated at 4 Mt at 53.3% Al2O3 and 4.9% RxSiO2. The JV has applied to the Queensland Government for a Mining Lease and plans to mine the bauxite at a rate of 1.5-2 Mt per annum and ship it as DSO.

In April 2016, Metallica announced a Heads of Agreement with the operators of the Hey Point bauxite project, some 15 km to the east, which will enable the Urquhart bauxite to be shipped out using the Hey Point load-out facility. In May 2016, Metallica through its subsidiary, Oresome Bauxite Pty Ltd, applied to the Commonwealth for environmental approval which confirmed that no Environmental Impact Statement (EIS) was required. Subsequently, the company began a new 198-hole drilling program to prove up the resource, resulting in a Measured Resource of 3.0 Mt at 53.3% Al2O3 (5.0% RxSiO2), an Indicated Resource of 3.9 Mt at 53.3% Al2O3 (5.2% RxSiO2) and an Inferred Resource of 2.6 Mt at 50.3% Al2O3 (5.9% RxSiO2). These estimates were used in the company's pre-feasibility study, released in December 2016, which reported a Proved Reserve of 2.964 Mt at 53.7% Al2O3 (5.4% RxSiO2) and a Probable Reserve of 3.568 Mt at 51.9% Al2O3 (5.9% RxSiO2).

In January 2018, the company announced that it had been granted a Mining Lease for the Urquhart project and is now awaiting approval to construct the haul road. The company must also negotiate with a number of outside parties, including Rio Tinto, as the planned route traverses surrounding leases.

Hey Point: Hey Point is located on the Embley River about 10 km south of Weipa on Cape York, northern Queensland. In January 2016, Metro Mining announced the completion of its sale of the Hey Point bauxite deposit to Green Coast Resources Pty Ltd, a subsidiary of Racle Resources Pty Ltd. The company plans to produce 3.55 Mt of bauxite over approximately three years at a rate of 1.6 Mt per annum. The last publically available resource estimate is for a beneficiated Inferred Resource of 2.5 Mt at 55.3% Al2O3. Green Coast has commenced mining bauxite at Hey Point and loaded its maiden shipment in October 2016 from a stockpile greater than 100 kt.

Skardon River: The Skardon River project covers an area over 70 km2 some 100 km north of Weipa on Cape York, northern Queensland, and is adjacent to the Bauxite Hills project. The Skardon River project was owned by private company Gulf Alumina Ltd until Metro Mining Ltd, the owner of the neighbouring Bauxite Hills project, took control in December 2016 with the takeover completed in February 2017.

In November 2015, Gulf Alumina submitted an EIS in which it proposed mining approximately 50 Mt of bauxite as DSO over 10 years producing 3-5 Mt per annum. By late 2016, the project had gained both Commonwealth environmental approval and approval from the Queensland Department of Environment and Heritage Protection. However, with the takeover by Metro Mining, a supplementary EIS was submitted in December 2016 in which the Skardon River activities are incorporated with those at Bauxite Hills.

Skardon River has an Inferred Resource of 14.6 Mt at 49.4% Al2O3, an Indicated Resource of 32.3 Mt at 49.4% Al2O3 and a Measured Resource of 16.6 Mt at 50.2% Al2O3. This resource also includes a total Proved and Probable Ore Reserve of 48.3 Mt at 49.4% Al2O3 with 40.3% available Al2O3 and 6.3% RxSiO2.

In January 2017, Metro Mining announced that it was combining Skardon River with Bauxite Hills and naming the combined entity the Bauxite Hills Mine.

Bauxite Hills: The Bauxite Hills project is situated 95 km north of Weipa on the western side of the Cape York Peninsula in north Queensland. It comprises a number of bauxite plateaux scattered over some 1200 km2. In February 2015, Metro Mining Ltd completed a prefeasibility study and subsequent geological modelling resulted in an upgraded resource announced in June 2015. The June resource announcement was based on the BH1 and BH6 deposits, which are near each other on the south side of the Skardon River. The company announced a Measured Resource of 41.8 Mt at 51.0% Al2O3, an Indicated Resource of 8.3 Mt at 49.3% Al2O3 and an Inferred resource of 3.4 Mt at 48.4% Al2O3. This resource estimate includes a Proved Ore Reserve of 41.8 Mt at 50.7% Al2O3 and a Probable Reserve of 6.4 Mt at 49.3% Al2O3. Reactive silica ranges from 6.1% to 7.2%.

In August 2015, Metro signed a non-binding Memorandum of Understanding with Xinfa Group securing an offtake agreement of 1.0-1.2 Mt per annum over five years. In November 2015, the company released a definitive feasibility study that indicated a mining scenario of 1.95 Mt of DSO bauxite produced over 25+ years would be economic. In December 2015, Metro released another resource upgrade, this time for the BH2 deposit which now has an Indicated Resource of 11.7 Mt at 49.1% Al2O3 with 6.7% RxSiO2.

In April 2016, the company submitted its Environmental Impact Statement to the Queensland Government outlining mine production of up to 5 Mt per annum for a mine life of 12 years at maximum production. (Bauxite Hills is classified as a Project of Regional Significance by the Queensland Government.) In October 2016, the company signed a binding offtake agreement with China's Xinfa Group for 7 Mt of bauxite to be delivered over the initial four years of mining. By December 2016, the company was in control of Gulf Alumina Ltd and its adjacent Skardon River project and had submitted a supplementary EIS for Bauxite Hills that incorporated mining and infrastructure at Skardon River.

In January 2017, Metro Mining announced that it was combining Skardon River with Bauxite Hills and naming the combined entity the Bauxite Hills Mine. In March 2017, the company reported a Measured Resource of 54.7 Mt at 50.0% Al2O3, an Indicated Resource of 66.4 Mt at 49.2% Al2O3 and an Inferred Resource of 23.7 Mt at 47.4% Al2O3. The Measured and Indicated Resources include a Proved Reserve of 48.3 Mt at 49.8% Al2O3 and a Probable Reserve of 43.9 Mt at 49.0% Al2O3. The company also released the results of a positive Bankable Feasibility Study in which the mine would produce 2 Mtpa bauxite ramping up to 6 Mtpa for an initial mine life of 17 years. In May 2017, the company announced that development of the mine had started, with production expected to commence in 2018. Environmental approvals are, however, still pending.

In August 2017, Metro Mining announced that it had received three mining leases for the Bauxite Hills project from the Queensland Government. The company then awarded a mining contract to SAB Mining Services Pty Ltd and, in November 2017, announced that its barge loading and marine offloading facilities were complete. To date, Metro Mining has offtake agreements in place with a number of Chinese customers.

Binjour: The Binjour bauxite deposit is located near Gayndah, 100 km southwest of Bundaberg. In June 2012, Australian Bauxite Ltd announced an Indicated Resource of 15.5 Mt with a 62% yield when sieved at 0.26 mm and an Inferred Resource of 9 Mt (in situ) with a yield of 59%. Alumina content for the total resource averages 44.1% and reactive silica is 3.0%. The company describes it as the highest quality bauxite in its portfolio and plans to produce both metallurgical and cement-grade bauxite and export it through the Bundaberg Port. In its reports, Australian Bauxite states that it is working with Indian company, Rawmin Mining and Industries Pvt Ltd, on developing and marketing the Binjour deposit in Queensland.

Toondoon: The Toondoon deposit is located about 40 km southwest of the Binjour tenements near Mundubbera. In December 2012, Australian Bauxite announced that the deposit has an Inferred Resource of 3.5 Mt (in situ) with a 67% yield when sieved a 0.26 mm. The beneficiated resource averages 40.2% Al2O3 and 5.2% RxSiO2.

In September 2015, Australian Bauxite announced the discovery of the Brovinia bauxite plateau. The company had been exploring about 13 km south of Toondoon and described its findings as a large, new plateau capped with bauxite. Initial results suggest that it may be of similar quality to the Binjour bauxite.

Monogorilby: The Monogorilby bauxite project is located in central Queensland, about 100 km northwest of Kingaroy. In July 2016, Iron Ridge Resources Ltd announced a maiden Inferred bauxite resource of 54.9 Mt at 37.5% Al2O3 (28% available alumina) with relatively high reactive silica at 7.9%. In addition, titanium is also relatively high at 3.8-5% and the company is investigating the potential for producing a titanium product. Beneficiation would be required to produce a saleable product suitable for alumina refining. Preliminary metallurgical testwork indicates that beneficiation could produce a DSO product with 1-3% RxSiO2 and 35-40% available alumina. The bauxite predominantly occurs as gibbsitic layers with an average thickness of 7-14 m across the Monogorilby plateau. The highest grade bauxite intersections occur as valley-fill mineralisation along the edges of the plateau.

In November 2017, the company announced that it had discovered a new high-grade bauxite target, Koko, 25 km to the northwest of Monogorilby.

Taralga: The Taralga-Mount Rae bauxite deposits are located about 45 km north of Goulburn. In May 2012, Australian Bauxite announced an Indicated Resource (20.4 Mt) and an Inferred Resource (17.5 Mt), totalling 37.9 Mt of in situ bauxite with a 63% yield when sieved at 0.26 mm. The beneficiated bauxite has a total alumina grade of 38.9% with 1.6% RxSiO2. The company regards the bauxite as suitable for DSO.

The Penrose Pine Plantation deposit is located 45 km to the northeast of Goulburn and is described by Australian Bauxite in February 2017 as a new discovery of high-quality, refractory-grade bauxite. Refractory-grade bauxite is used for heat containment and abrasives and is usually more expensive than metallurgical bauxite. The company describes the Penrose Pine Plantation bauxite as forming the lowermost layer in a thick three-layered bauxite profile.

Guyra: The Guyra deposit occurs just outside of the town of Guyra in northern New South Wales. It has an Indicated Resource of 3.8 Mt (in situ) with a yield of 61% when sieved at 0.26 mm and an Inferred Resource of 2.3 Mt (in situ) with a yield of 56%. Alumina content ranges from 41.4% to 43.1% and RxSiO2 is 2% to 2.8%. Australian Bauxite describes the bauxite as low-silica and gibbsite-rich with much of it suitable for use as a "sweetener" in alumina refineries.

Inverell: The Inverell bauxite deposit is situated about 13 km north of the town of Inverell in northern New South Wales. It has an Indicated Resource of 20.5 Mt (in situ) with a yield of 60% when sieved at 0.26 mm and an Inferred Resource of 17.5 Mt (in situ) with a yield of 61%. Alumina content ranges from 39.8% to 40.6% and RxSiO2 is 4% to 4.2%. Australian Bauxite describes the bauxite as medium-quality, low-silica and gibbsite-rich that is suitable for low-temperature alumina refineries.

Nullamanna: The Nullamanna bauxite deposit is located about 15 km northeast of the town of Inverell. In 2008, privately held company Volcan Australia Corporation Pty Ltd was granted the exploration licence for Nullamanna and in 2009 entered into a joint venture with Plateau Bauxite Ltd, a public unlisted company. In October 2013, private investment firm First State Pty Ltd acquired Volcan's 50% interest in the tenement, which it then sold to Queensland Bauxite Ltd in July 2014. In March 2016, Queensland Bauxite announced that it had bought a further strategic stake from Plateau Bauxite and now owns 81% of the project.

In June 2011, Plateau reported an Inferred Resource estimate for the deposit of 29 Mt at 32% available Al2O3 and 5% RxSiO2, compliant with the 2004 JORC Code. Some of this report was published by Queensland Bauxite in July 2014. The bauxite is present as a capping on a northwest-trending ridge some 7 km long. The resource estimate is based on an estimated bauxite thickness of 1 m for the central area and a measured thickness of 2.8 m to 4 m for the northwest and southeast areas. Queensland Bauxite considers the 2011 report to be reliable.

Gove: The Gove bauxite mine is located by the Arafura Sea in northeast Arnhem Land, some 650 km east of Darwin. The mine is owned by Rio Tinto Ltd and, before the closure of the associated alumina refinery, was the largest private employer in the Northern Territory with some 1400 staff. Rio Tinto closed the refinery in 2014 but has continued to operate the mine with a workforce of around 300 people.

As at December 2016, the mine has a Proved Reserve of 142 Mt at 49.2% Al2O3 and a Probable Reserve of 5 Mt at 49.4% Al2O3. In addition, there is a Measured Resource of 16 Mt at 49.2% Al2O3, an Indicated Resource of 25 Mt at 49.6% Al2O3 and an Inferred Resource of 3 Mt at 50.2% Al2O3. In 2016, the Gove mine produced a record 9091 kt of bauxite, up from 7497 kt in 2015 and 6528 kt in 2014.

Dhupuma: The Dhupuma bauxite deposit is adjacent to the Gove deposit, approximately 30 km south of the Nhulunbuy township. The bauxite profile on the Dhupuma plateau ranges from 3-11 m thick with little overburden. The main bauxite component is gibbsite with minor boehmite and the reactive silica component is low. The mine was officially opened in December 2017. It is operated by the Gulkula Mining Company Pty Ltd and is Australia's first 100%-aboriginal owned and operated mine. Rio Tinto has committed to purchasing all bauxite produced from the mine and has provided access to its Gove operations 14 km away, where the Dhupuma bauxite will be crushed, loaded and shipped. The company has not released a JORC-compliant resource estimate for the Dhupuma deposit but states that the reserves are approximately 8-12 Mt. The company plans to produce 0.1 Mt of bauxite in the first year ramping up to 0.5 Mt over the first four years of operation with a total mine life of 15 years.

Bald Hill: The Bald Hill bauxite deposit is located in the Campbell Town area of northeast Tasmania, about 110 km northeast of Hobart and 60 km southwest of Launceston. The bauxite occurs on sparsely vegetated ridge tops on weathered Lower Tertiary volcanic tuffs. In March 2015, Australian Bauxite published an initial Indicated Resource of 1.18 Mt at 37.2% Al2O3 and Inferred Resource of 0.42 Mt at 37.2% Al2O3. However, Australian Bauxite actually began operations in late 2014, resulting in Bald Hill becoming the first new Australian bauxite mine in 35 years.

To date, Bald Hill has supplied bauxite for use by the cement and fertiliser industries, shipped from the Bell Bay Port, 100 km away on Tasmania's north coast. The company sold 42 kt of cement-grade bauxite and 1.9 kt of bauxite for fertiliser in 2016. (Bauxite can be used to coat superphosphate granules thus reducing the leaching of phosphate from the soil.) The company sold a further 30.7 kt of cement-grade bauxite and 2.4 kt of bauxite for fertiliser in 2017. As at December 2017, the company had 65.6 kt of grade-controlled bauxite stockpiles and a similar tonnage of unprocessed material and had already remediated two pit areas at Bald Hill and returned the land to graziers.

As part of its operations, Australian Bauxite is developing a proprietary technology called TasTech that will enable the company to easily separate its bauxite stockpiles into three products: high-grade, metallurgical bauxite (>45% Al2O3); cement-grade bauxite; and bauxite for fertiliser and other products. The company is also investigating the feasibility of branching out into aluminium fluoride production with the possibility of developing plants in Tasmania and/or Queensland.

Fingal Rail: The Fingal Rail deposit is located 11 km northeast of Campbell Town and comprises cement-grade bauxite occurring on a remnant plateau. In March 2015, Australian Bauxite published an unbeneficiated maiden resource totalling 1.18 Mt at 37.8% Al2O3. In August 2016, the company published a resource upgrade for its cement-grade bauxite that amounted to 2.84 Mt at 31.1% Al2O3 Indicated and 1.75 Mt at 30.9% Al2O3 Inferred. In addition, the company published resources for cement-grade iron ore at Fingal Rail amounting to 1.02 Mt Indicated (46.5% Fe2O3) and 0.69 Mt Inferred (46.1% Fe2O3). The bauxite layer averages 3.6 m thick beneath approximately 2 m of overburden. The company states that Fingal Rail will most likely be their second mine, operating as part of the Campbell Town production centre.

Nile Road: The Nile Road bauxite deposit is located 25 km north of Campbell Town, averaging 3.8 m thick beneath approximately 2 m of overburden on a remnant plateau. In March 2015, Australian Bauxite published an unbeneficiated maiden Inferred Resource of 0.73 Mt at 34.4% Al2O3.

DL130 and Rubble Flat: In November 2012, Australian Bauxite published a maiden resource for the DL130/Rubble Flat area, located about 30 km west of Launceston. The Inferred Resource is estimated at 5.7 Mt (in situ) with a beneficiated grade (55% yield) of 44.1% Al2O3. The main deposits occur within plantation forests as clustered remnant ridges about one to two kilometres in length. The bauxite averages 3.8 m thickness beneath soil ranging from 0.5 m to 2 m thick. The company states that approximately half the deposit is suitable for DSO; this resource amounts to 3 Mt at 40.5% Al2O3.

Athena and Ceres: The Athena and Ceres bauxite deposits are located in the eastern Darling Range and owned by the Bauxite Resources Ltd and HD Mining & Investments Pty Ltd Joint Venture (BR-HDM JV). HD Mining & Investments is a wholly-owned subsidiary of the Shandong Bureau No. 1 Institute for Prospecting of Geology & Minerals. Athena is located about 100 km southeast of Perth between the towns of Wandering and Pingelly. Ceres is located approximately 25 km south of Athena and 20 km north of Williams.

Both deposits comprise low-temperature bauxite with reactive silica around 3%. Athena consists of four zones each with a number of what the company describes as "mineralised lodes". At Athena, the bauxite has formed over granitic basement and is similar in style to other Darling Range bauxite deposits. It averages 3 m thickness but can be up to 13 m thick. The Ceres deposit is up to 8 m thick and lies beneath 0.5-2 m of loose overburden. Athena has an Inferred Resource of 36.2 Mt and Ceres has an Inferred Resource of 14.8 Mt.

In early 2017, the company carried out limited reconnaissance drilling to extend the Ceres deposit, with encouraging results for further target generation.

Dionysus: The northern Darling Range hosts the Dionysus bauxite deposit, located approximately 100 km northeast of Perth between the towns of Bindoon and Calingiri. Bauxite suitable for low-temperature refining has formed over granitic basement and is up to 8.5 m (average 3 m) thick with thin overburden (<2 m). The deposit is owned by the BR-HDM JV and has an Inferred Resource of 20.3 Mt at 42.1% Al2O3 with 3.4% reactive silica.

In early 2017, the company carried out limited reconnaissance drilling to extend the Dionysus deposit, with encouraging results for further target generation.

Cardea 1 and 2: These deposits are located approximately 60 km northeast of Perth in the vicinity of the Cardea 3, Felicitas, Minerva, Vallonia, Juturna, Aurora and Fortuna deposits. Cardea 1 and 2 are owned by the BR-HDM JV and have a combined Inferred Resource of 6.4 Mt at 41.8% Al2O3 with 4.3% reactive silica.

Cardea 3: Located in the Darling Range about 100 km northeast of Perth and 20 km northwest of Toodyay, this deposit has split ownership. The BR-HDM JV portion of the deposit has an Indicated Resource of 1.5 Mt and an Inferred Resource of 8.4 Mt. The other portion was originally owned by a joint venture between Bauxite Resources Ltd and Yankuang Resources Ltd (BAJV) but, in 2016, Bauxite Resources sold its interest to Yankuang. The Yankuang portion of the deposit has an Indicated Resource of 4.7 Mt and an Inferred Resource of 9.5 Mt. Average alumina values range between 40.3% and 42.8% and reactive silica averages in the range of 3.2% to 4.4%. The deposit is up to 11.5 m thick covered by loose overburden, typically between 0.5-2 m thick.

Felicitas and Fortuna: The Felicitas and Fortuna deposits are located in the north Darling Range about 60 km northwest of Perth and 15 km southwest of Toodyay. They essentially form one laterised region crossing tenement boundaries and were previously reported in the mid-1970s as part of the Chittering deposits by CSR Ltd (Pacminex).

Felicitas has a Measured Resource of 122.7 Mt, an Indicated Resource of 77.1 Mt and an Inferred Resource of 28.2 Mt. Fortuna has an Indicated Resource of 6.3 Mt and an Inferred Resource of 33.9 Mt. Both deposits have low reactive silica ranging 1.7-2.3%.

Felicitas is low-temperature bauxite, suitable for DSO with available alumina of 39.7%. It is the single largest bauxite deposit in Australia with a JORC-compliant resource outside those of the major producers. The bauxite has formed over a granite-greenstone basement averaging 4 m thickness but up to 16 m thick. The Fortuna bauxite has formed over granitic basement and is covered by shallow, loose overburden (0.5-2 m thick) with 32% available alumina.

Felicitas had been part of the BAJV, whereas Fortuna was solely owned by Bauxite Resources. In early 2016, Bauxite Resources completed the sale of its interest in the Felicitas and Fortuna deposits to Yankuang, retaining a 0.9% royalty on the first 100 Mt of bauxite mined from these tenements.

The deposits are now owned by Yankuang Bauxite Resources Pty Ltd. In February 2016, Yankuang announced that current economic circumstances were unfavourable thus delaying further development work until conditions improve.

Aurora: This deposit was formerly known as Bindoon. The bauxite has formed over predominantly granitic basements in two main pods that are up to 11 m thick. The mineralisation is flat-lying and covered by gravelly overburden that ranges in average thickness from 0.5 m in the north to 0.9 m in the south. In January 2014, the BAJV released an Indicated Resource of 12 Mt and an Inferred Resource of 3.9 Mt but this was downgraded in 2015 to an Indicated Resource of 7.6 Mt and an Inferred Resource of 1.8 Mt as the company ceased reporting on a small northern pod (6.5 Mt). Bauxite Resources sold its interest in Aurora to Yankuang in 2016.

Juturna: This deposit is located 65 km east of Perth and approximately 20 km southwest of Northam in the Bakers Hill region of the Darling Range. Bauxite mineralisation occurs in three main, flat-lying pods that range in thickness from 0.2 m to 11.2 m. The pods are near surface and overlain by an average 0.7 m thickness of gravel. Juturna has an Inferred Resource of 8.2 Mt with 40.2% Al2O3 (29.9% available at low-temperature refining) and 3.9% reactive silica. It was part of the BAJV but is now owned by Yankuang.

Rusina: The northern Darling Range hosts the Rusina bauxite deposit, located approximately 125 km north-northeast of Perth between the towns of New Norcia and Moora. Bauxite mineralisation occurs in four separate pods averaging 1.7 m thickness but up to 5 m thick. The pods are flat-lying with an average overburden of 0.75 m thickness. Rusina has an Inferred Resource of 3.7 Mt with 40.3% Al2O3 (29.1% available at low-temperature refining) and 5.3% reactive silica. The Rusina deposit was also part to the package of bauxite interests sold by Bauxite Resources to Yankuang in 2016.

Minerva: Minerva is located approximately 13 km southwest of Toodyay and was previously reported in the mid-1970s as part of the Chittering deposits by CSR Ltd (Pacminex) when it was known as Areas 3 and 18. The most recent resource estimate compliant with the JORC Code dates to 2011 and is an Inferred Resource of 2.2 Mt at 38.7% Al2O3 with 3.9% reactive silica. Of this, the available alumina grades 28.9% at standard low-temperature Bayer Process refining. Minerva was part of the BAJV but is now owned by Yankuang.

Cronus: Cronus is located in the southern Darling Range, approximately 15 km east of the town of Boyup Brook and 220 km southeast of Perth. Drilling and modelling resulted in the identification of eight individual lodes of moderate-grade bauxite with a lateral extent of 3.3 km from north to south and 3.5 km from east to west. It has an Inferred Resource of 2.8 Mt at 39.3% Al2O3 with 2.8% RxSiO2, which includes a 16 m-thick interval. Cronus was originally part of the BAJV but is now owned by Yankuang.

Vallonia: The deposit is located about 40 km northwest of Perth in the north Darling Range and was reported as the Avon deposit in the past. Bauxite mineralisation occurs in two main flat-lying, near surface zones ranging between 0.8 m and 6 m thick beneath an average 0.6 m of gravelly overburden. In 2011, Bauxite Resources Ltd released an Inferred Resource for Vallonia of 1.5 Mt but subsequently surrendered the tenement in 2014.

Mitchell Plateau and Cape Bougainville: These two undeveloped deposits are located in the Kimberly region of northern Western Australia. Neither has a resource estimate that is compliant with the JORC Code. However, the Mitchell Plateau has a historical resource of 637 Mt and Cape Bougainville has a historical resource of 1040 Mt. In 2011, the Australian Heritage Register added the West Kimberly to the National Heritage List and, in 2015, the Western Australian Government announced its intention to create Australia's largest national park. As the new Kimberly National Park precludes all mining, Rio Tinto Ltd and Alcoa Inc agreed to give up the 45-year state agreement that gave them the rights to mine and refine, respectively.

Wandoo: The Wandoo bauxite deposit is located about 85 km northeast of Perth and 30 km southwest of New Norcia. Alpha Bauxite Pty Ltd, a private Chinese company, is the current owner of the Wandoo bauxite project. The previous owner, Iron Mountain Ltd, released a resource estimate of 89.3 Mt Inferred in March 2012.

Huntly and Willowdale: These two mines are located in the Darling Range of Western Australia, 73 km and 100 km southeast of Perth, respectively. Alcoa of Australia Ltd is the Australian operator for Alcoa Worldwide Alumina and Chemicals (AWAC) which is a joint venture between Alcoa Inc (60%) and Alumina Ltd (40%). AWAC owns Huntly, the largest bauxite mine in the world, which provides bauxite to the alumina refineries at Kwinana and Pinjarra, as well as the smaller Willowdale mine, which supplies the Wagerup refinery. Average bauxite production for the Huntly mine is 23 Mt per annum and for the Willowdale mine it is 10 Mt per annum. Actual alumina production was not reported by the company but the Kwinana refinery has a nameplate capacity of 2190 kt, Pinjarra has 4234 kt and Wagerup has 2555 kt. Alcoa also has a 55% interest in the Portland aluminium smelter, located some 300 km west of Melbourne along the Victorian coastline, which has a nameplate capacity of 358 kt. The other owners are CITIC Group Corp Ltd (22.5%) and Marubeni Corp (22.5%).

As at 31 December 2016, Alcoa reported a combined Proved Reserve of 153.4 Mt and a Probable Reserve of 26.1 Mt for its Darling Range operations. Alcoa does not report Mineral Resources to the public.

Worsley (Boddington): The Worsley bauxite is mined near Boddington, 130 km southeast of Perth and transported some 50 km to the alumina refinery near Collie via one of the world's longest conveyor belts. In May 2015, BHP Billiton Ltd spun off its aluminium, coal, manganese, nickel, silver, lead and zinc assets to form South32 Ltd. The new company owns 86% of the integrated Worsley bauxite mine and alumina refinery, with Japan Alumina Associates (Australia) Pty Ltd (10%) and Sojitz Alumina Pty Ltd (4%) holding the remainder. The Worsley refinery produced 4544 kt of alumina in 2016 and 4438 Kt in 2017. This alumina was then exported via the Port of Bunbury to aluminium smelters around the world, including South32's Hillside and Mozal smelters in southern Africa. The company forecasts that its alumina refinery will achieve nameplate capacity of 4600 kt per annum across the 2017-18 financial year.

In 2017, the company released plans for mining an area known as the Hotham Extension, adjacent to the primary mining envelope at Boddington. Mining at the Hotham extension would increase the current mine capacity of 18 Mt per annum to 21 Mt per annum, underpinning the planned expansion of the Worsley refinery. Nameplate capacity for alumina production at the refinery is currently 4.7 Mt per annum with the company wishing to increase this to 5.1 Mt per annum.

As at 30 June 2016, the Worsley mine had a Measured Resource of 337 Mt, an Indicated Resource also of 337 Mt and an Inferred Resource of 408 Mt. Inclusive of these resources were a Proved Reserve of 256 Mt and a Probable Reserve of 14 Mt.

Citation

Bibliographical reference: Britt, A. F., 2018. Australian Resource Reviews: Bauxite 2017. Geoscience Australia, Canberra. http://dx.doi.org/10.11636/9781925297720